Whales with a lot of money to spend have taken a noticeably bearish stance on American Tower.

Looking at options history for American Tower (NYSE:AMT) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 60% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $252,881 and 5, calls, for a total amount of $296,218.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $190.0 to $200.0 for American Tower during the past quarter.

Volume & Open Interest Development

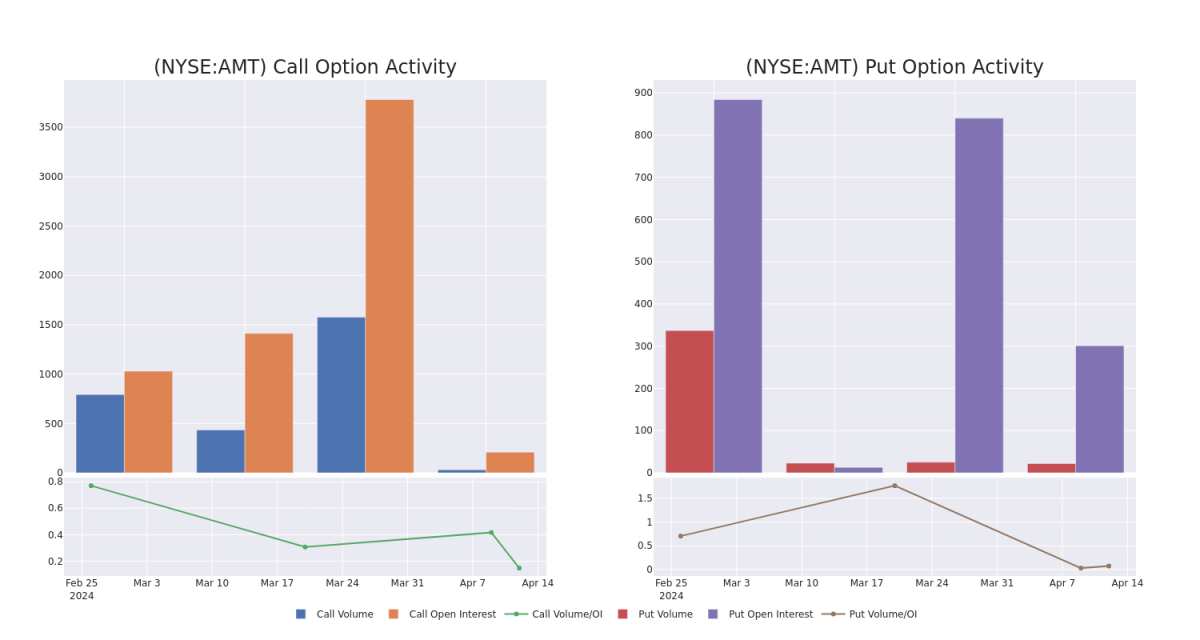

In today's trading context, the average open interest for options of American Tower stands at 946.0, with a total volume reaching 2,249.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in American Tower, situated within the strike price corridor from $190.0 to $200.0, throughout the last 30 days.

American Tower Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMT | CALL | SWEEP | BEARISH | 07/19/24 | $4.7 | $4.5 | $4.5 | $200.00 | $90.0K | 582 | 335 |

| AMT | PUT | SWEEP | BEARISH | 05/17/24 | $2.4 | $1.8 | $2.35 | $195.00 | $80.1K | 0 | 357 |

| AMT | CALL | SWEEP | BULLISH | 06/21/24 | $4.5 | $4.3 | $4.4 | $195.00 | $76.5K | 1.3K | 212 |

| AMT | PUT | SWEEP | BEARISH | 07/19/24 | $5.4 | $5.2 | $5.4 | $190.00 | $58.8K | 291 | 117 |

| AMT | CALL | SWEEP | NEUTRAL | 07/19/24 | $4.7 | $4.5 | $4.5 | $200.00 | $51.9K | 582 | 135 |

About American Tower

American Tower owns and operates more than 220,000 cell towers throughout the us, Asia, Latin America, Europe, and Africa. It also owns and/or operates 28 data centers in 10 us markets after acquiring CoreSite. On its towers, the company has a very concentrated customer base, with most revenue in each market being generated by just the top few mobile carriers. The company operates more than 40,000 towers in the us, which accounted for almost half of the company's total revenue in 2023. Outside the us, American Tower operates over 75,000 towers in India, almost 50,000 towers in Latin America (dominated by Brazil), 30,000 towers in Europe, and nearly 25,000 towers in Africa. American Tower operates as an REIT.

After a thorough review of the options trading surrounding American Tower, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is American Tower Standing Right Now?

- Trading volume stands at 1,394,632, with AMT's price up by 3.32%, positioned at $193.17.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 71 days.

What Analysts Are Saying About American Tower

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $230.33333333333334.

- An analyst from Scotiabank has decided to maintain their Sector Outperform rating on American Tower, which currently sits at a price target of $223.

- An analyst from BMO Capital persists with their Outperform rating on American Tower, maintaining a target price of $220.

- Showing optimism, an analyst from Raymond James upgrades its rating to Strong Buy with a revised price target of $248.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.