Gross profit margin is declining year by year

Recently, Boleyton Technology Co., Ltd. (hereinafter referred to as “Boleyton”) submitted a prospectus to the Hong Kong Stock Exchange to be listed on the Hong Kong Main Board. CICC and CMB International are co-sponsors.

Glonghui learned that Boleyton was founded in 2016 and is headquartered in Shanghai. It is a clean energy solutions provider in China, focusing on the design, development and commercialization of construction machinery powered by new energy sources.

According to Insight Consulting's data, based on 2023 shipments, Brereton ranked third and fourth among all new energy loader and new energy wide-body dump truck manufacturers in China, with market shares of 11.2% and 8.3% respectively.

According to Insight Consulting's data, based on 2023 shipments, Brereton ranked third and fourth among all new energy loader and new energy wide-body dump truck manufacturers in China, with market shares of 11.2% and 8.3% respectively.

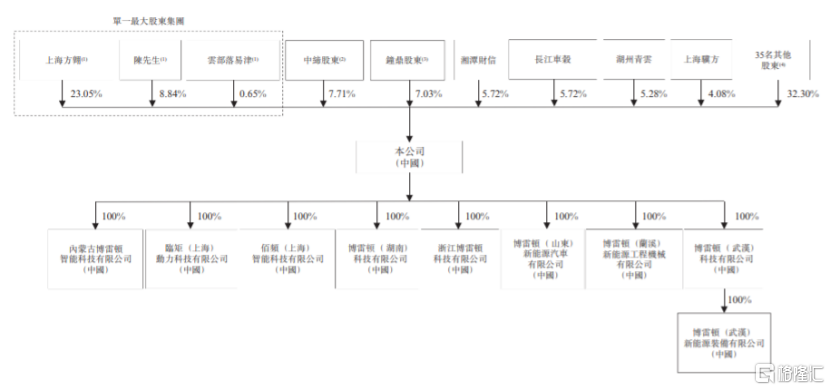

In terms of the shareholding structure, the prospectus shows that before this offering, Chen Fangming was able to exercise a total of 32.18% of Boleyton's voting rights. At the same time, Xiangtan Caixin, Changjiang Chegu, and Huzhou Qingyun all held more than 5% of their shares.

Pre-issuance share structure chart, image source: prospectus

Chen Fangming, the founder of Boleyton, is 42 years old. He obtained a bachelor's degree in engineering mechanics from South China University of Technology in July 2004. He served as the chairman of the board of directors and general manager in Yijin, Shanghai, and became the executive director of Boleyton in November 2016. Today, Chen Fangming is the executive director, chairman of the board of directors and general manager of Boleyton.

With this listing application, Brayton plans to raise capital to invest in technological progress and develop new products and services; establish manufacturing plants and purchase necessary machinery; expand sales and service networks; seek strategic cooperation, investment or acquisition that complement the company's business and are in line with its strategy; working capital and general corporate use.

1

Losses exceed 500 million yuan in three years

Borreton is a manufacturer of new energy construction machinery. The company's exploration in the field of new energy began with the development of customized power system kits for first-generation new energy tractors, and now it has further expanded its technical capabilities to the field of construction machinery.

The company first launched the BRT951EV five-ton electric loader model in December 2019, then launched the 90-ton electric wide-body dump truck model BRT90E in May 2020. Currently, the company's product line mainly features electric models, including electric loaders with a payload of 3 to 7 tons, and electric wide-body dump trucks with a tonnage between 90 and 105 tons. At the same time, Boreton also designs and develops power system kits for new energy tractors, and cooperates with manufacturers to launch these vehicles on the market.

The company's key development milestones, image source: prospectus

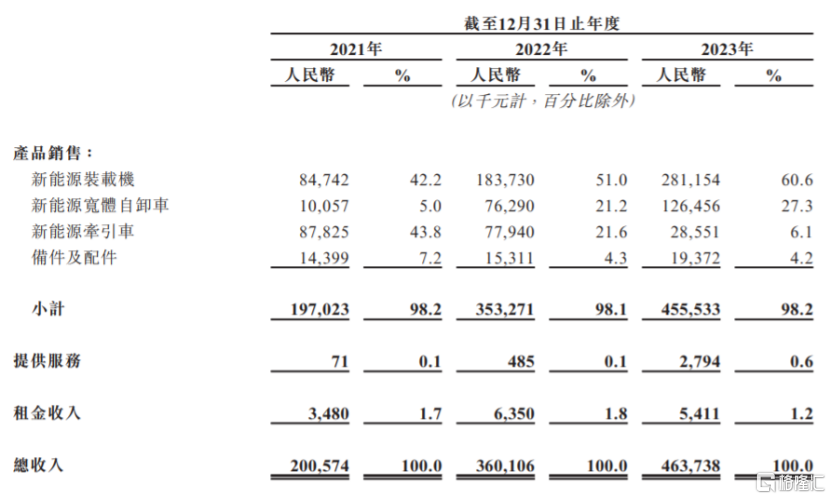

During the track record period, Boreton's revenue mainly came from the sale of new energy loaders, the sale of new energy wide-body dump trucks, the sale of new energy tractors, and the sale of spare parts and accessories. At the same time, the company also obtained rental income by renting loaders, wide-body dump trucks and tractors, and provided customers with repair and maintenance services.

Specifically, from 2021 to 2023, Boreton's revenue share of NEV loaders was on the rise, and was over 40%, accounting for a relatively large share; at the same time, sales of NEV tractors declined sharply.

Revenue breakdown by business line, image source: Prospectus

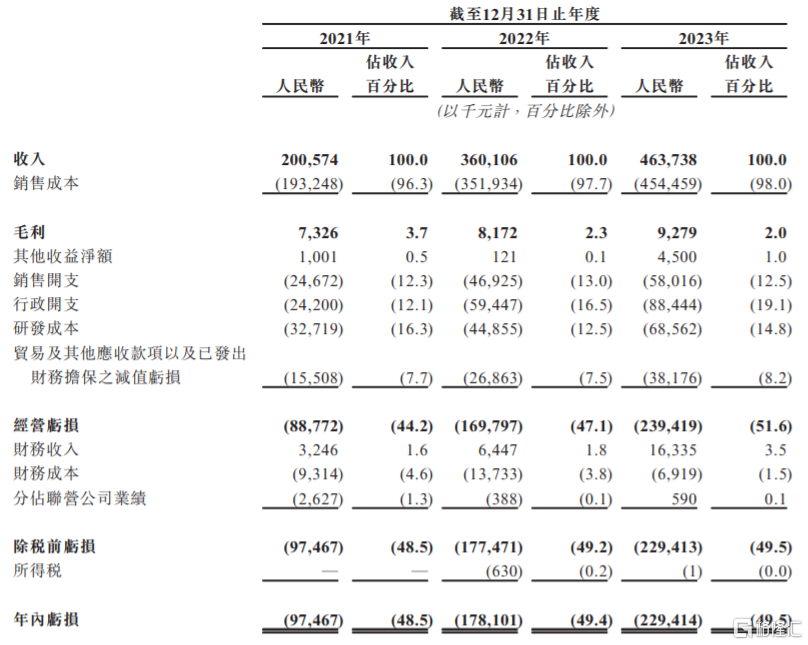

In terms of performance, in 2021, 2022, and 2023, Brayton's revenue was about 201 million yuan, 360 million yuan, and 464 million yuan respectively; corresponding net losses were about 97 million yuan, 178 million yuan, and 229 million yuan, respectively, with a cumulative loss of over 500 million yuan over three years. In the same period, the company's adjusted net losses were approximately RMB 93 million, RMB 143 million and RMB 190 million respectively.

According to the prospectus, in 2021, 2022, and 2023, Bratton's gross margins were 3.7%, 2.3%, and 2%, respectively, showing a downward trend year by year.

Since the company is still in the early stages of production and development to achieve economies of scale, although Brayton's revenue has been growing in recent years, sales expenses, administrative expenses, and R&D costs all have to be spent. This is probably an important reason for the company's loss in performance.

Summary of the comprehensive income statement, image source: prospectus

As performance continued to lose, the company's cash flow from operating activities also became tight. In 2021, 2022, and 2023, Boleyton's net cash used for operating activities was approximately $271 million, $290 million, and $194 million respectively. The company expects net loss and net cash outflow from operating activities to continue in the short term.

2

High concentration of suppliers

Brereton's new energy construction machinery and tractor industry is fiercely competitive. On the one hand, traditional construction machinery and tractor manufacturers can expand into the new energy sector. On the other hand, the company is also facing competition with existing pure new energy construction machinery and tractor manufacturers, and potential new market entrants may also increase competition in the industry.

The company is in an industry where technology iterates rapidly. If the company is unable to keep up with the advancement of new energy technology or compete with other construction machinery or tractor manufacturers that use alternative energy, it may affect the competitiveness of the company's products. After all, the advent of alternative energy technologies such as advanced diesel, hydrogen, ethanol, fuel cells, or compressed natural gas, as well as improvements in fuel efficiency for internal combustion engines and fluctuations in gasoline costs, may affect Borreton's business and development prospects.

Boleyton needs to purchase motors, batteries, controllers, transmissions, thermal management components, etc. from suppliers. From 2021 to 2023, the company's purchases from the top five suppliers all accounted for more than 60% of the total procurement volume for each year. Of these, purchases made to the largest suppliers accounted for 20.9%, 35.4%, and 39.4% of the total procurement volume for each year, respectively. If the cooperative relationship between the company and major suppliers changes, it may affect the company's production and operation.

The company distributes products through various channels such as dealers. In 2021, 2022 and 2023, Brayton's revenue through dealer sales accounted for 32.9%, 55.6%, and 40.3% of total product sales revenue, respectively. If the company and existing dealers are unable to sign an agreement after the contract expires, or if they are unable to establish a cooperative relationship with the new dealer, it may affect the sales of the company's products.

3

epilogue

In recent years, Borreton's revenue has been growing, but net profit has continued to lose money, and gross margin has been declining year by year. Although the company ranks high among domestic manufacturers of new energy loaders and new energy wide-body dump trucks, if it wants to be recognized by the capital market, it may still have to improve its “self-hematopoietic” ability in the future.

据灼识咨询的资料,按2023年出货量来算,博雷顿在中国所有新能源装载机及新能源宽体自卸车制造商中分别排名第三、第四,市场份额分别为11.2%、8.3%。

据灼识咨询的资料,按2023年出货量来算,博雷顿在中国所有新能源装载机及新能源宽体自卸车制造商中分别排名第三、第四,市场份额分别为11.2%、8.3%。