Exploring Three Swedish Growth Companies With High Insider Ownership On The Swedish Exchange

As global markets show signs of resilience, with indices like the S&P 500 nearing record highs, Sweden's market landscape presents a unique opportunity for investors interested in growth companies with high insider ownership. Such stocks often indicate a strong alignment between company management and shareholder interests, potentially offering stability and confidence during fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

BioArctic (OM:BIOA B) | 35.1% | 48.2% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Yubico (OM:YUBICO) | 37.5% | 42% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 91.9% |

SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Calliditas Therapeutics

Simply Wall St Growth Rating: ★★★★★★

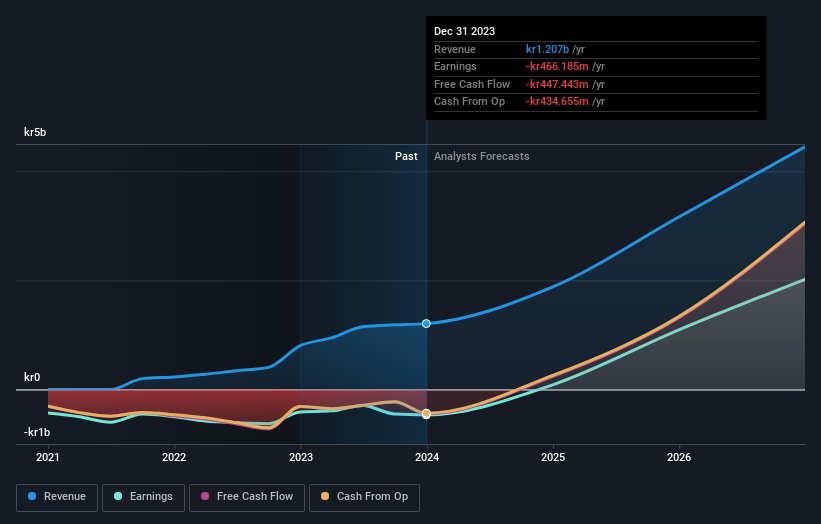

Overview: Calliditas Therapeutics is a commercial-stage biopharmaceutical company specializing in novel treatments for orphan renal and hepatic diseases, operating primarily in the United States, Europe, and Asia with a market capitalization of approximately SEK 6.59 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling SEK 1.21 billion.

Insider Ownership: 11.6%

Calliditas Therapeutics, a Swedish biopharmaceutical company, is on track to become profitable within the next three years, with expected revenue growth at 28.9% per year—significantly outpacing the Swedish market. The company's stock is currently trading at a substantial discount, approximately 97.5% below estimated fair value. Recent successful Phase 2 trials of setanaxib have shown promising results in treating squamous cell carcinoma of the head and neck, potentially boosting future revenues and profitability forecasts. Moreover, Calliditas maintains a very high forecasted Return on Equity at 87.4%, signaling strong potential for efficient capital management as it approaches profitability.

Lime Technologies

Simply Wall St Growth Rating: ★★★★★☆

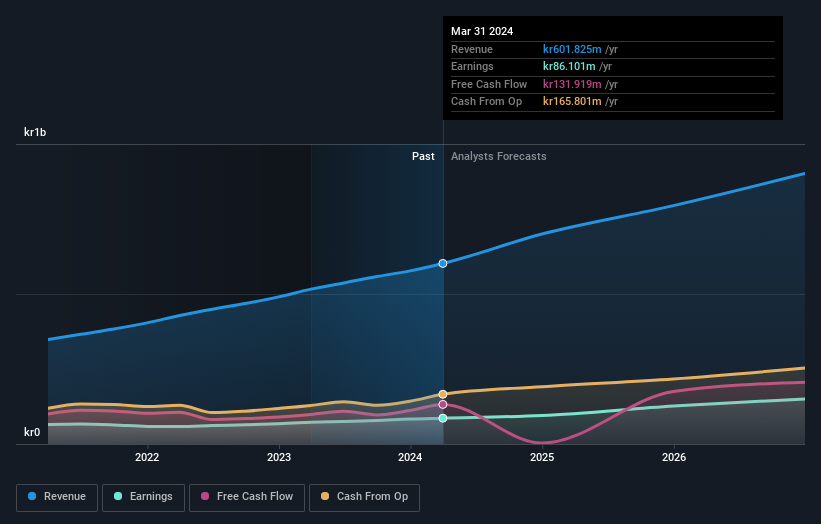

Overview: Lime Technologies AB operates as a provider of software-as-a-service (SaaS) based customer relationship management (CRM) solutions in the Nordic region, with a market capitalization of approximately SEK 4.89 billion.

Operations: Lime Technologies generates revenue primarily through the sale and implementation of CRM systems, totaling SEK 601.83 million.

Insider Ownership: 12%

Lime Technologies, a Swedish software company, demonstrates robust growth with revenue and earnings expected to increase by 14.4% and 20.85% per year respectively, outpacing the broader Swedish market. Despite trading at a 6% discount to its fair value and maintaining high insider ownership with more buying than selling activity recently, concerns linger due to its high debt levels. The company posted a strong first-quarter performance in 2024, with significant increases in sales and net income compared to the previous year.

Yubico

Simply Wall St Growth Rating: ★★★★★★

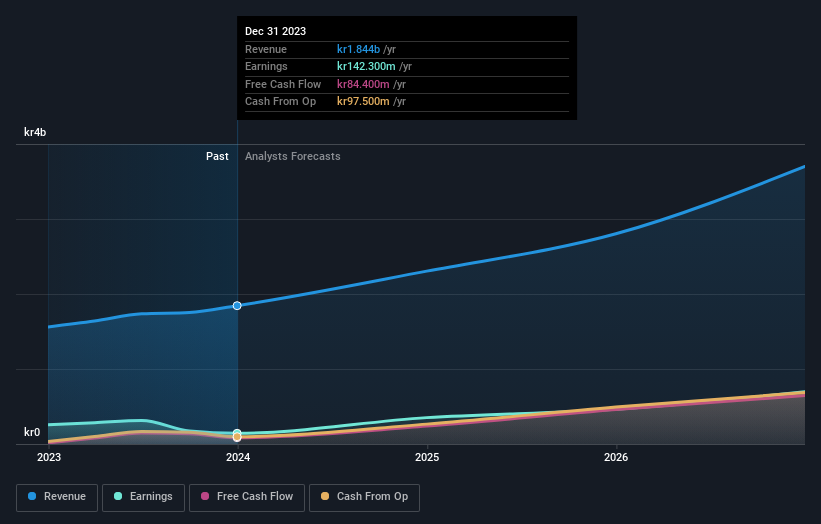

Overview: Yubico AB specializes in authentication solutions for computers, networks, and online services, with a market capitalization of SEK 18.26 billion.

Operations: The company generates SEK 1.84 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Yubico, a Swedish growth company, has displayed strong financial performance with an 18.1% increase in revenue over the past year. Despite a decline in profit margins from 16.4% to 7.7%, its earnings are projected to grow by 42% annually, significantly outpacing the Swedish market forecast of 13.9%. The firm's revenue growth also exceeds market expectations at 21.7% per year. However, Yubico faces challenges such as high share price volatility and substantial shareholder dilution over the past year. Additionally, recent product updates and executive changes highlight its focus on enhancing enterprise security solutions.

Turning Ideas Into Actions

Gain an insight into the universe of 81 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:CALTXOM:LIME and OM:YUBICO

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance