3 Tech Acquisitions YTD Likely to Reshape Sector Dynamics

In a concerted effort to thwart the growing menace of cyberattacks and strengthen cyber resiliency, technology companies are increasingly investing in a comprehensive suite of modernized cloud security and compliance solutions. These solutions are specifically designed to assist enterprises in mitigating risk and safeguarding their data across hybrid, multi-cloud environments and workloads.

Leveraging artificial intelligence, machine learning and automation techniques, these solutions bring together human expertise and advanced technologies for faster response, efficiency and transparency through a holistic approach to secure hybrid cloud environments. Moreover, a higher demand for data computing at the edge, triggered by the rapid deployment of 5G and the proliferation of IoT devices, has forced tech firms to ensure their resiliency, performance, security and compliance standards.

In addition to organic growth, technology firms are gradually leaning toward the inorganic route to bolster their cybersecurity domain. The merger and acquisition (M&A) strategy heralds a new era of innovation in AI-driven cybersecurity solutions. As the companies join forces, their complementary strengths are poised to reshape the industry landscape, delivering enhanced value to customers and stakeholders alike.

Let us delve a little deep for a brief analysis of three such notable transactions in 2024 to get an essence of the sector developments.

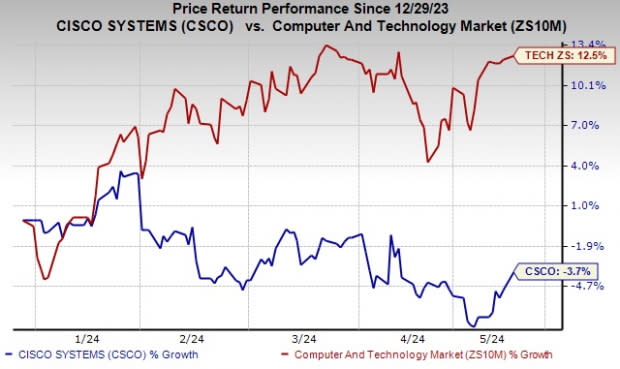

Cisco Systems Inc. CSCO acquired Splunk Inc. in March in a transaction valued at $28 billion. Splunk's expertise in advanced AI-powered solutions stands to greatly enhance Cisco's AI-driven service offerings. By leveraging Splunk's capabilities, Cisco aims to accelerate the development of next-generation solutions, optimizing data value and reinforcing security analytics.

This strategic alignment reflects industry trends, where the convergence of cybersecurity and AI is increasingly paramount. As organizations navigate complex digital ecosystems, the demand for AI-driven security solutions continues to surge. By integrating Splunk's cutting-edge technologies, Cisco strengthens its position as a formidable player in this evolving landscape, poised to deliver innovative solutions tailored to meet evolving customer needs.

From Splunk's perspective, the merger represents a significant win-win scenario. It provides access to Cisco's robust resources and global reach, facilitating accelerated research and development initiatives. Moreover, the collaboration positions Splunk at the forefront of AI innovation, enabling the creation of synergistic solutions that address the evolving cybersecurity challenges faced by enterprises worldwide.

Image Source: Zacks Investment Research

In April, International Business Machines Corporation IBM inked an agreement to acquire HashiCorp Inc. HCP. Based in California, HashiCorp is a software company that enables organizations to efficiently automate multi-cloud and hybrid environments with its Infrastructure Lifecycle Management and Security Lifecycle Management solutions.

With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which, in turn, has led firms to undertake a cloud-agnostic and highly interoperable approach to highly secure multi-cloud management. IBM’s acquisition of HCP is a probable ploy to address these issues.

Representing an enterprise value of $6.4 billion, the deal will significantly augment IBM’s capabilities to assist enterprises in managing complex cloud environments. Moreover, HashiCorp’s tool sets will likely complement IBM RedHat’s portfolio, bringing additional functionalities for cloud infrastructure management. The integration of HCP’s cloud software capabilities will bolster IBM’s hybrid multi-cloud approach.

Image Source: Zacks Investment Research

Earlier, in January, Hewlett Packard Enterprise HPE inked a definitive agreement to acquire Juniper Networks, Inc. JNPR in an all-cash transaction for $40.00 per share, representing an equity value of approximately $14 billion.

Juniper offers an extensive array of routing, switching and network security solutions. The company specializes in developing products that facilitate building network infrastructure used for services and applications based on a single Internet protocol network worldwide. Juniper also boasts a solid AI portfolio. Juniper AIOps (AI for IT Operations) leverages machine learning capabilities in conjunction with data science to streamline enterprise operations across wireless access, wired access and security domains.

HPE stands as a key player in the server and hardware storage sectors and a prominent cloud service provider. The company is actively seeking to diversify its revenue sources and views AI as the next major market. Hewlett Packard is strategically focusing on expanding its generative AI offerings to tap the growing opportunities in this domain. The acquisition of Juniper is a significant stride in that direction.

Integration of Juniper’s AI and cloud portfolio will serve as a valuable enhancement to HPE’s portfolio. The acquisition is likely to double HPE’s networking business with a comprehensive product bouquet. The combined entity will amplify HPE’s edge-to-cloud strategy with an ability to lead in an AI-native environment based on a foundational cloud-native architecture. Leveraging industry-leading AI, the combined company will offer the networking architecture necessary to manage and simplify the increasingly complex connectivity needs for superior user experiences.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

HashiCorp, Inc. (HCP) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance