Whales with a lot of money to spend have taken a noticeably bullish stance on Warner Bros. Discovery.

Looking at options history for Warner Bros. Discovery (NASDAQ:WBD) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 77% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $819,120 and 7, calls, for a total amount of $277,508.

From the overall spotted trades, 2 are puts, for a total amount of $819,120 and 7, calls, for a total amount of $277,508.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.0 to $10.0 for Warner Bros. Discovery over the last 3 months.

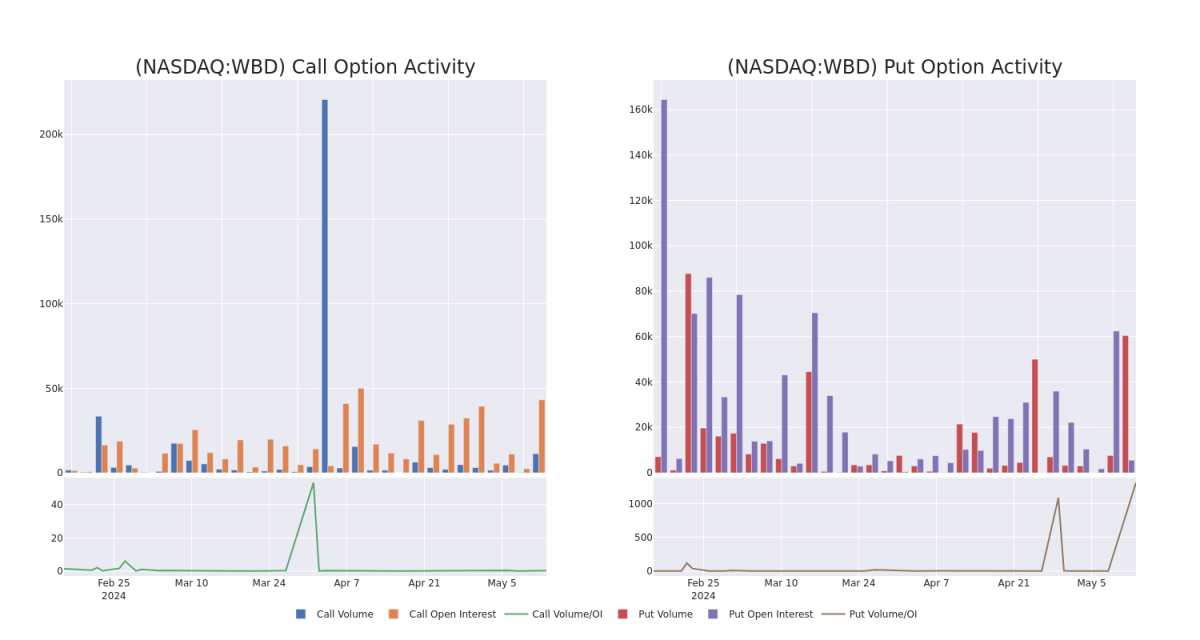

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Warner Bros. Discovery's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Warner Bros. Discovery's whale trades within a strike price range from $7.0 to $10.0 in the last 30 days.

Warner Bros. Discovery Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBD | PUT | TRADE | BULLISH | 06/28/24 | $0.16 | $0.13 | $0.13 | $7.50 | $782.6K | 46 | 60.2K |

| WBD | CALL | SWEEP | BULLISH | 01/17/25 | $0.88 | $0.86 | $0.88 | $10.00 | $63.8K | 23.2K | 835 |

| WBD | CALL | SWEEP | BEARISH | 06/14/24 | $0.24 | $0.22 | $0.22 | $9.00 | $51.4K | 234 | 2.9K |

| WBD | CALL | TRADE | BULLISH | 01/17/25 | $0.89 | $0.85 | $0.89 | $10.00 | $44.5K | 23.2K | 3.4K |

| WBD | PUT | SWEEP | BEARISH | 09/20/24 | $1.85 | $1.61 | $1.83 | $10.00 | $36.5K | 5.4K | 210 |

About Warner Bros. Discovery

Warner Bros. Discovery was formed in 2022 through the combination of WarnerMedia and Discovery Communications. It operates in three global business segments: studios, networks, and direct-to-consumer. Warner Bros. Pictures is the crown jewel of the studios business, producing, distributing, and licensing movies and television shows. The networks business consists of basic cable networks, such as CNN, TNT, TBS, Discovery, HGTV, and the Food Network. Direct-to-consumer includes HBO and the firm's streaming platforms, which have now been consolidated to Max and Discovery+. Much of the DTC content is created within the firm's other two business segments. Each segment operates with a global reach, with Max available in over 60 countries.

After a thorough review of the options trading surrounding Warner Bros. Discovery, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Warner Bros. Discovery's Current Market Status

- Currently trading with a volume of 20,263,570, the WBD's price is up by 1.84%, now at $8.3.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 80 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Warner Bros. Discovery with Benzinga Pro for real-time alerts.