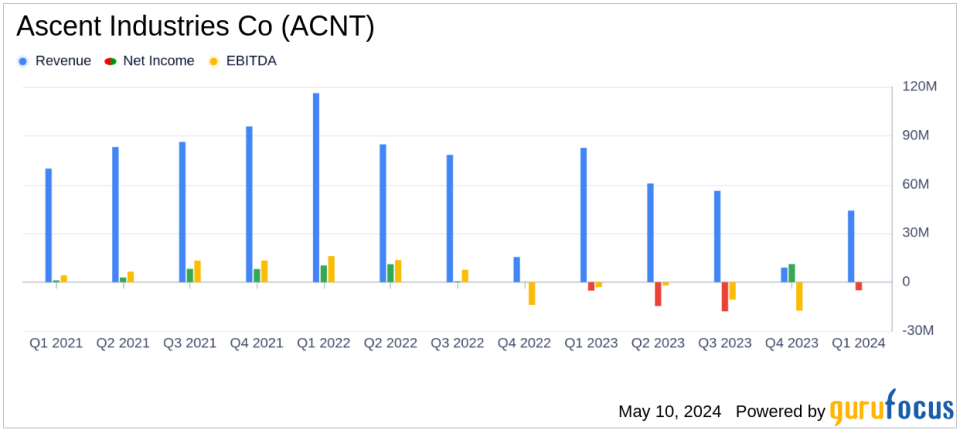

Ascent Industries Co. Reports Mixed Q1 2024 Results Amid Market Challenges

Revenue: Reported $44.1 million, a decrease of 19.6% year-over-year, exceeding estimates of $39.80 million.

Net Loss: Improved to $4.7 million from a previous $5.8 million, yet exceeded the estimated net loss of $3.70 million.

Earnings Per Share (EPS): Recorded a loss of $0.47 per share, an improvement from the previous $0.57 but above the estimated loss of $0.37 per share.

Gross Profit: Increased to $2.5 million from $1.5 million year-over-year, with gross margin improving significantly from 2.7% to 5.7%.

Adjusted EBITDA: Showed improvement at -$3.1 million compared to -$3.7 million in the prior year, indicating some operational efficiency gains despite lower sales.

Liquidity: Maintained strong liquidity with no debt under revolving credit facilities and $63.6 million available under its credit facility.

Share Repurchase: Company repurchased 16,330 shares at an average cost of $9.97 per share, totaling approximately $0.2 million.

On May 8, 2024, Ascent Industries Co (NASDAQ:ACNT), a key player in the chemical and metal industry, disclosed its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company, known for its two primary segments, Ascent Tubular Products and Specialty Chemicals, faced a challenging quarter with a noticeable decline in revenue but showed resilience by improving its gross profit margin significantly.

Financial Performance Overview

Ascent Industries reported a decrease in net sales to $44.1 million in Q1 2024 from $54.9 million in Q1 2023, marking a 19.6% decline year-over-year. This reduction was primarily due to decreased end-market demand and de-stocking trends across both business segments. Despite the lower sales, the company managed to increase its gross profit to $2.5 million (5.7% of net sales) from $1.5 million (2.7% of net sales) in the previous year, reflecting a 72.4% increase in gross profit and a significant improvement in gross profit margin by 300 basis points.

Net Loss and Earnings Per Share

The net loss from continuing operations improved to $4.7 million, or $(0.47) per diluted share, compared to a net loss of $5.8 million, or $(0.57) per diluted share, in the prior year. This improvement was largely attributed to the enhanced gross profit and a reduction in interest expenses due to lower debt levels.

Segment Performance

The Tubular Products segment saw a decrease in net sales from $31.1 million to $23.8 million. However, the operating loss in this segment improved, decreasing to $1.5 million from $3.3 million in Q1 2023. The Specialty Chemicals segment experienced a drop in net sales to $20.3 million from $23.7 million and shifted from an operating income of $1.4 million to an operating loss of $1.4 million, reflecting challenging market conditions.

Liquidity and Capital Management

As of March 31, 2024, Ascent Industries reported robust liquidity with no debt outstanding under its revolving credit facilities and had $63.6 million in availability. During the quarter, the company also repurchased 16,330 shares at an average cost of $9.97 per share, totaling approximately $0.2 million.

Management's Outlook

CEO Bryan Kitchen highlighted the company's strategic initiatives aimed at cost optimization and cash management which have started to yield improvements in margins and bottom line. He expressed optimism about the company's trajectory towards a more profitable and sustainable operating model through continued efficiency drives and strategic adjustments.

Investor and Analyst Perspectives

While Ascent Industries' Q1 2024 performance showed a significant revenue decline, the improvements in gross profit margin and reduced net loss are positive indicators of the company's ability to manage costs effectively amidst challenging market conditions. Investors and analysts might view these results with cautious optimism, focusing on the company's strategic adjustments and market positioning for future growth.

Ascent Industries will conduct a conference call to discuss these results further and provide more insights into their strategic plans moving forward.

For detailed financial figures and future updates, stakeholders are encouraged to refer to the official SEC filings and the company's website.

Explore the complete 8-K earnings release (here) from Ascent Industries Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance