CarGurus Inc (CARG) Q1 2024 Earnings: Surpasses Analyst Net Income Expectations with Robust Growth

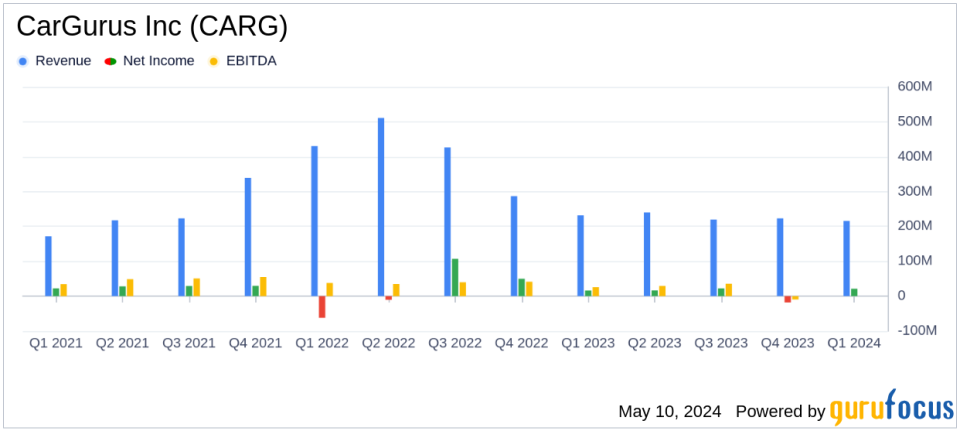

Consolidated Net Income: $21.3 million, an 80% increase year-over-year, below the estimated $29.43 million.

Total Revenue: $215.8 million, down 7% year-over-year, below the estimated $216.81 million.

Marketplace Revenue: $187.2 million, up 12% year-over-year, indicating strong growth in core business areas.

GAAP EPS: $0.20, reflecting substantial earnings growth compared to the previous year.

Non-GAAP Adjusted EBITDA: $50.4 million, a 24% increase year-over-year, demonstrating improved operational efficiency.

Share Repurchase: Repurchased $81.1 million worth of shares, representing 3.3% of outstanding capital, signaling confidence in the company's financial health and future prospects.

Cash Position: Ended the quarter with $246.3 million in cash and cash equivalents, a decrease from the previous period, reflecting significant share repurchases and ongoing investments.

On May 9, 2024, CarGurus Inc (NASDAQ:CARG) announced its first quarter results for the year, revealing significant financial achievements and strategic advancements. The company, a leading online automotive marketplace, detailed its performance in a recently released 8-K filing. CarGurus reported a consolidated net income of $21.3 million, marking an impressive 80% increase year-over-year, and surpassing the analyst's estimate of $29.43 million for the quarter.

CarGurus operates through its U.S. Marketplace and Digital Wholesale segments, primarily generating revenue from the U.S. Marketplace. The company's platform offers various marketplace listing products, including Restricted and Enhanced or Featured Listings, providing comprehensive data analytics on pricing and consumer behavior.

Financial Performance Insights

The first quarter saw marketplace revenue rise to $187.2 million, a 12% increase from the previous year, driven by a 14% growth in QARSD (Quarterly Average Revenue per Selling Dealer) and an expanded dealer network. However, wholesale and product revenues saw declines of 36% and 69%, respectively, which contributed to a 7% overall revenue dip to $215.8 million. Despite these challenges, gross profit improved by 13%, benefiting from an 81% margin.

Operating expenses were up 6% to $148.7 million, but the substantial growth in net income and a 24% increase in non-GAAP Adjusted EBITDA to $50.4 million highlight effective cost management and operational efficiency. The company also demonstrated confidence in its financial health by repurchasing $81.1 million worth of shares, representing 3.3% of outstanding capital.

Operational Highlights and Future Outlook

CarGurus reported stability in its U.S. paying dealers at 24,419, maintaining the previous year's levels, while international dealers saw a slight 2% decrease. The digital engagement metrics were robust, with U.S. and international monthly unique users growing by 6% and 19%, respectively.

For the upcoming second quarter of 2024, CarGurus anticipates total revenue to be between $202 million and $222 million, with marketplace revenue projected at $189 million to $194 million. The guidance reflects expectations for continued growth in dealer networks and user engagement, despite broader market uncertainties.

Strategic Moves and Market Position

Jason Trevisan, CEO of CarGurus, expressed satisfaction with the quarter's results, emphasizing the strategic enhancements in dealer partnerships and consumer connections. The company's focus on integrating digital wholesale operations and optimizing market strategies was particularly noted for its potential to drive long-term growth.

CarGurus continues to lead as the most visited automotive shopping site in the U.S., a testament to its strong market presence and effective user engagement strategies. The company's innovative approach to online car buying and selling positions it well for sustained growth in the evolving automotive market landscape.

Investors and stakeholders are encouraged to view the detailed financial results and listen to the earnings call webcast available on the CarGurus Investor Relations website.

Explore the complete 8-K earnings release (here) from CarGurus Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance