Steris PLC Fiscal 2024 Earnings: Surpasses Revenue Forecasts and Adjusted EPS Expectations

Annual Revenue: Reached $5.5 billion, marking a 12% increase year-over-year, surpassing the estimated $5.445 billion.

Adjusted Annual EPS: Climbed to $8.83, surpassing the estimated $8.60.

Quarterly Revenue: Rose to $1.5 billion in Q4, up 10% from the previous year, surpassing the estimated $1.411 billion.

Adjusted Quarterly EPS: Increased to $2.58, surpassing the estimated $2.35.

Free Cash Flow: Improved significantly to $620.3 million for the fiscal year, driven by enhanced operational efficiency.

Net Income: Adjusted net income for the year was $877.6 million, surpassing the estimated $852.68 million.

Future Outlook: Expects revenue growth of 6.5-7.5% and adjusted EPS of $9.05 to $9.25 for fiscal 2025.

Steris PLC (NYSE:STE), a leading provider in infection prevention and sterilization, announced its fiscal 2024 fourth quarter and full-year earnings on May 8, 2024. The company reported a significant revenue increase and higher adjusted earnings per share, outperforming analyst expectations. The detailed financial results are available in the company's 8-K filing.

Company Overview

Steris PLC, domiciled in Ireland since its 2015 inversion, remains a powerhouse in the medical device sector, particularly in sterilization and infection prevention. The company offers a broad range of products and services, including sterilizers, washer-disinfectors, and other decontamination equipment essential for medical and pharmaceutical applications. Despite its global presence, about 70% of its revenue is generated from the U.S., with additional significant contributions from the UK and other international markets.

Fiscal 2024 Performance Highlights

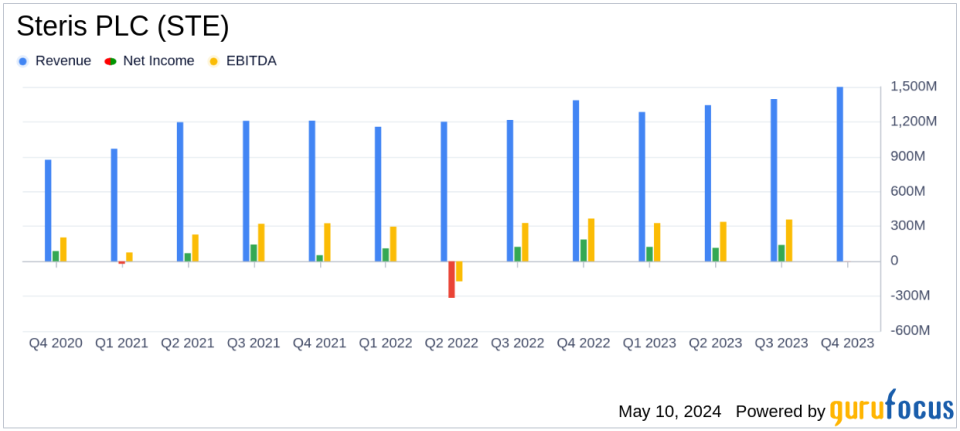

For fiscal year 2024, Steris reported a 12% increase in total revenue, reaching $5.5 billion, compared to $5.0 billion in the previous fiscal year. This growth was driven by a 10% increase in constant currency organic revenue from continuing operations, which stood at $5.0 billion. The adjusted earnings per diluted share also saw a rise, reaching $8.83, up from the prior year's $8.20, surpassing the estimated earnings per share of $8.60.

The fourth quarter showed a robust 10% increase in total revenue to $1.5 billion, with the Healthcare segment particularly strong, reflecting a 14% growth. Adjusted net income for the quarter was $256.3 million, or $2.58 per diluted share, which is an improvement from $229.2 million, or $2.30 per diluted share, in the same quarter of the previous year.

Strategic Moves and Challenges

Amidst its financial growth, Steris has made strategic decisions including a targeted restructuring plan and the divestiture of its Dental segment. These actions are aimed at sharpening the company's focus and strengthening its core businesses. However, these changes also bring challenges, including the costs associated with restructuring and potential disruptions during the transition phases.

Financial Strength and Operational Efficiency

The company's balance sheet remains strong with significant increases in cash flow. The net cash provided by operations for fiscal 2024 was $973.3 million, up from $756.9 million in the previous year. Free cash flow also increased substantially to $620.3 million from $409.6 million. These figures highlight Steris's ability to generate cash and manage its capital efficiently, crucial for sustaining growth and shareholder returns.

Looking Ahead: Fiscal 2025 Projections

For fiscal 2025, Steris expects revenue growth from continuing operations to be between 6.5% and 7.5%. The company also forecasts adjusted earnings per diluted share to range from $9.05 to $9.25. These projections reflect the company's confidence in its operational strategies and market position.

Conclusion

Steris's fiscal 2024 performance underscores its resilience and strategic acumen in a challenging global market. With a robust financial position and strategic initiatives in place, Steris is well-positioned to continue its growth trajectory while enhancing shareholder value. Investors and stakeholders can anticipate continued progress and innovation from Steris in the coming years.

For more detailed information and analysis, investors are encouraged to review the full earnings report and listen to the upcoming conference call scheduled for May 9, 2024, at 9:00 a.m. ET.

Explore the complete 8-K earnings release (here) from Steris PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance