Source: CICC Strategy, original title “CICC | Hong Kong Stocks: Hong Kong Stock Connect Dividend Tax Questions and Answers”

On May 9, Bloomberg News reported that domestic regulators are considering reducing the 20% income tax that mainland individual investors need to pay when receiving dividends when investing in Hong Kong listed companies through Hong Kong Stock Connect. During the two sessions this year, Chairman Lei Tianliang of the Hong Kong Securities Regulatory Commission also proposed lowering the dividend dividend tax level for Hong Kong Stock Connect individual investors and lowering the entry standards for Hong Kong Stock Connect mainland investors.

We believe that if the Hong Kong Stock Connect dividend tax relief is implemented, it is expected to further boost the enthusiasm of mainland investors to invest in Hong Kong stocks, especially in high-dividend-related sectors, boost sentiment in the short term, and help improve the liquidity of the Hong Kong stock market in the long term.

Q1. What is the current Hong Kong Stock Connect dividend tax standard? Individual investors hold 20% of H shares, up to 28% of red-chip shares; corporate investors can hold for 12 months without exemption

Q1. What is the current Hong Kong Stock Connect dividend tax standard? Individual investors hold 20% of H shares, up to 28% of red-chip shares; corporate investors can hold for 12 months without exemption

Mainland investors are required to pay dividend tax when investing in Hong Kong stocks through Hong Kong Stock Connect. Under current standards, mainland investors receive higher dividend taxes through Hong Kong Stock Connect investments than investors directly opening accounts in Hong Kong. Let's take a closer look:

► Mainland individual investors and investment funds (such as public offerings, etc.): For dividend dividends obtained by mainland individual investors by investing in H shares listed on the Hong Kong Stock Exchange through Hong Kong Stock Connect, H share companies are subject to personal income tax at a rate of 20%; dividend dividends obtained by investing in non-H shares listed on the Hong Kong Stock Exchange are subject to personal income tax at a rate of 20% by China Settlement. Individual investors who have already paid withholding tax abroad can apply for a tax credit from the tax authority in charge of settlement in China.

For red chip stocks listed in Hong Kong, on the basis of Hong Kong Stock Connect's 20% personal income tax, it will also involve whether the company's announced dividends have already been subject to 10% corporate income tax. Take a red-chip structured company as an example. When a Chinese company registered overseas distributes dividends to a non-Chinese resident enterprise, the overseas shareholder must pay withholding income tax at a tax treaty rate of 10%. After adding the 20% dividend tax on Hong Kong Stock Connect individual investors and Mainland securities investment funds, Hong Kong Stock Connect personal investments are ultimately or collectively deducted from the tax rate of 28% [10% + (1-10%) * 20% = 28%].

► Mainland corporate investors (such as social security and insurance, etc.): 1) Dividend dividend income earned by mainland enterprise investors through Hong Kong Stock Connect investing in shares listed on the Hong Kong Stock Exchange is included in their total income and is subject to corporate income tax according to law, but dividend dividend income earned by holding H shares continuously for 12 months is exempt from corporate income tax according to law. 2) If a non-H share listed company has withheld dividend income tax paid on its behalf, mainland corporate investors can apply for a tax credit in accordance with law when filing and paying corporate income tax on their own.

►The dividend tax for investors opening a Hong Kong account is even lower. Among them, the tax rate for investing in H shares is about 10% (non-resident companies should be subject to corporate income tax at a 10% corporate income tax rate to obtain dividends from domestic enterprises), while investing in red chips may also involve a maximum tax rate of 10%. The main consideration is whether the enterprise has already charged 10% corporate income tax dividends.

Chart: Hong Kong Stock Connect dividend tax collection standards under the current system

Q2. How much impact will the adjustments have? Boosting sentiment in the short term, and the scale of direct relief is limited; improving the attractiveness of high-dividend investment and the liquidity of Hong Kong stocks in the medium to long term

According to current reports, the potential adjustment of the Hong Kong Stock Connect dividend tax is currently more likely to target individual investors in the mainland, while for long-term value investors who prefer high dividends, such as social security and insurance, the issue does not involve the Hong Kong Stock Connect dividend tax in the first place, so potential direct tax relief may be limited. However, if public funds that essentially represent individual investors are also included in the scope of potential adjustments, then the impact may be greater.

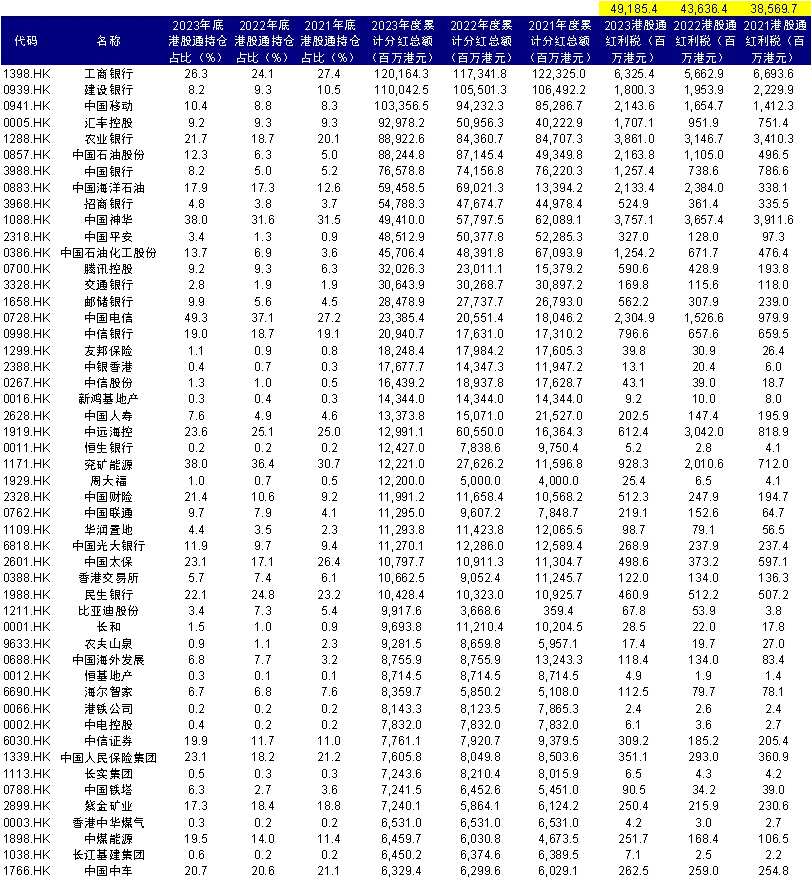

The direct relief is relatively limited in size, but it helps lift the mood. Over the past three years, the total cumulative dividends of all Hong Kong Stock Bills have averaged around HK$1.8 trillion per year. Further calculating the share of Hong Kong Stock Connect investors' holdings in each stock and the Hong Kong Stock Connect dividend tax standard of 20%, we estimate that the total dividend tax levied by the Hong Kong Stock Connect mechanism is approximately HK$45 billion each year. Assuming that mainland individual investors account for about 1/4 of Hong Kong Stock Connect's investment, we expect the direct tax relief brought about by this potential adjustment to be around HK$10 billion each year. If public funds are included, the possible tax relief could be extended to around HK$20 billion. However, considering that the average daily turnover of the main board of the Hong Kong stock market has been around HK$100 billion since this year, the short-term direct relief brought about by this potential adjustment may be limited in scale, but it may provide a boost on an emotional level.

Chart: Simple calculation of Hong Kong stocks through total dividend tax over the past three years

In the medium to long term, it will help boost the attractiveness of Hong Kong stocks as high-dividend assets, enhance the liquidity of Hong Kong stocks, and even help some companies' AH premiums to settle. We took all the companies currently listed in A/H for analysis, and found that due to factors such as A/H discounts, the Hong Kong stock dividend rate of the same company is significantly higher than its A share dividend rate. Even taking into account the current 20% dividend tax rate for Hong Kong Stock Connect, the vast majority of companies still have more attractive Hong Kong stock dividend rates. This also explains, to a certain extent, why south-bound capital from the mainland has continued to favor sectors with high dividends in Hong Kong stocks over the past year. The high-dividend central state-owned enterprises Bank of China, China Mobile, and CNOOC also ranked in the top three for net southbound capital purchases since the beginning of this year. At the same time, despite the recent sharp rebound in the Hong Kong stock market and the A/H share discount premium has subsided, it is still at an all-time high. Therefore, the potential adjustment of the Hong Kong Stock Connect dividend tax is expected to further enhance the attractiveness of high-dividend sectors and targets of Hong Kong stocks, increase liquidity for the Hong Kong stock market, and may even further reduce the A/H discount premium for some related targets.

In August of last year, Hong Kong set up a Liquidity Task Force to focus on subsequent initiatives to improve liquidity. Looking ahead, if the dividend tax related adjustments are implemented, it will be another important measure that has the potential to increase the liquidity of Hong Kong stocks following the stamp duty reduction at the end of last year and the introduction of five measures for cooperation with Hong Kong by the Securities Regulatory Commission last month. We believe that further measures will not be ruled out in the future, which may include reducing transaction costs in the short term (reducing transaction commissions); lowering the investment threshold in the medium term and broadening the scope of investment (appropriately easing the entry threshold for Hong Kong Stock Connect and continuously optimizing the listing system); and activating product innovation in the long term (optimizing the Hong Kong GEM mechanism, setting up a professional board for professional investors, etc.).

Chart: The discount premium situation of A/H listed companies and the attractiveness of Hong Kong stock dividend rates under the current Hong Kong Stock Connect dividend tax regime (1/2)

Chart: The discount premium situation of A/H listed companies and the attractiveness of Hong Kong stock dividend rates under the current Hong Kong Stock Connect dividend tax regime (2/2)

Q3. How to configure? The high dividend value of Hong Kong stocks is expected to continue to show; those with high dividends are selected from the three dimensions of profitability, dividend ability, and willingness to pay dividends

Since 2021, the high-dividend strategy has outperformed A-shares and Hong Kong stocks for three consecutive years, and has received more and more investors' attention and attention, and has even become a “winner and loser” in determining investment returns. However, in the early days of the recent rapid rebound in the Hong Kong stock market due to capital, traditional dividend sectors that had previously performed well, such as raw materials, energy, and telecommunications, were briefly under pressure against the backdrop of a sharp rise in Internet growth. Therefore, another focus of investors' attention is whether the “dumbbell” seesaw of dividends and internet growth in this round of growth means that the dividend factor has failed? We believe that the reason behind this sharp rise in internet growth is not entirely affected by profit improvements. Investors value more high-quality assets that stabilize cash flow and shareholder returns. In a sense, it can be seen as a “new dividend concept.” In the long run, we believe that dividend assets essentially hedge against the general environment where long-term returns are declining and the overall return on investment of the whole society is declining. Therefore, before fiscal forces effectively boost credit cycles and demand, inflation, especially PPI, the strategic value of dividend factors is expected to show further.

In terms of target screening, the focus is on dividend potential and balance sheets, not just dividend rates. High dividends and high dividends may seem like the difference between the words, the meaning and logic are different. High dividends may be the result of low stock prices rather than actual dividend capacity, such as real estate and finance. Instead, high dividends value continuous and stable dividend capacity, so cash flow and balance sheet quality are also important considerations.

edit/new