Source: Sina Hong Kong stocks

Vanke became the protagonist of the news this year, a little later than last year. Although "thriller" is not nearly as effective as "living" and renaming "real estate" last year, it is also enough to make many office workers and potential home buyers shiver.

Among them, the faint signal of "failure" makes everyone want to care about what's going on.

Vanke's partial salary cut by 40%?

The actions of real estate enterprises, especially the head housing enterprises, attract people's attention. It is obvious that the head housing enterprises in addition to the national layout, the market in each city is very familiar, more sensitive to the market. At the same time, they usually invest a lot of manpower and money in market research and analysis, and have their own professional research team.

The actions of real estate enterprises, especially the head housing enterprises, attract people's attention. It is obvious that the head housing enterprises in addition to the national layout, the market in each city is very familiar, more sensitive to the market. At the same time, they usually invest a lot of manpower and money in market research and analysis, and have their own professional research team.

For example, a well-known typical case: in 2017, Evergrande hired Ren Zeping, former chief economist of founder Securities, to be the chief economist of Evergrande Group and director of Evergrande Economic Research Institute with an annual salary of 15 million. Therefore, although people complain that Vanke is a "drama master", they are still very concerned about its words and deeds.

(September 2018) "survive", "de-Localization", (February 2019) "We can't find an industry with the prospect of making money from real estate", (Yu Liang reiterated in June 2019) "the judgment of the real estate industry in the silver era has not changed".

Last week, the China Index Research Institute released the "sales performance of Chinese Real Estate Enterprises TOP100 from January to October 2019". Vanke ranked third with sales of 519.9 billion yuan and has properly entered the 500 billion Real Estate Enterprises Club. And this is only one aspect.

According to Vanke's third-quarter report in 2019, the operating income in the third quarter of this year was about 84.595 billion yuan, an increase of 20.77 percent over the same period last year; the net profit belonging to shareholders of listed companies was about 6.399 billion yuan, up 31.64 percent from the same period last year; and the gross profit margin was 27.6 percent, down 0.2 percentage points from the same period last year.

By the end of September 2019, Vanke's short-term loans and interest-bearing liabilities due within one year totaled 59.08 billion yuan. Of the interest-bearing liabilities, 74.0% are long-term liabilities.

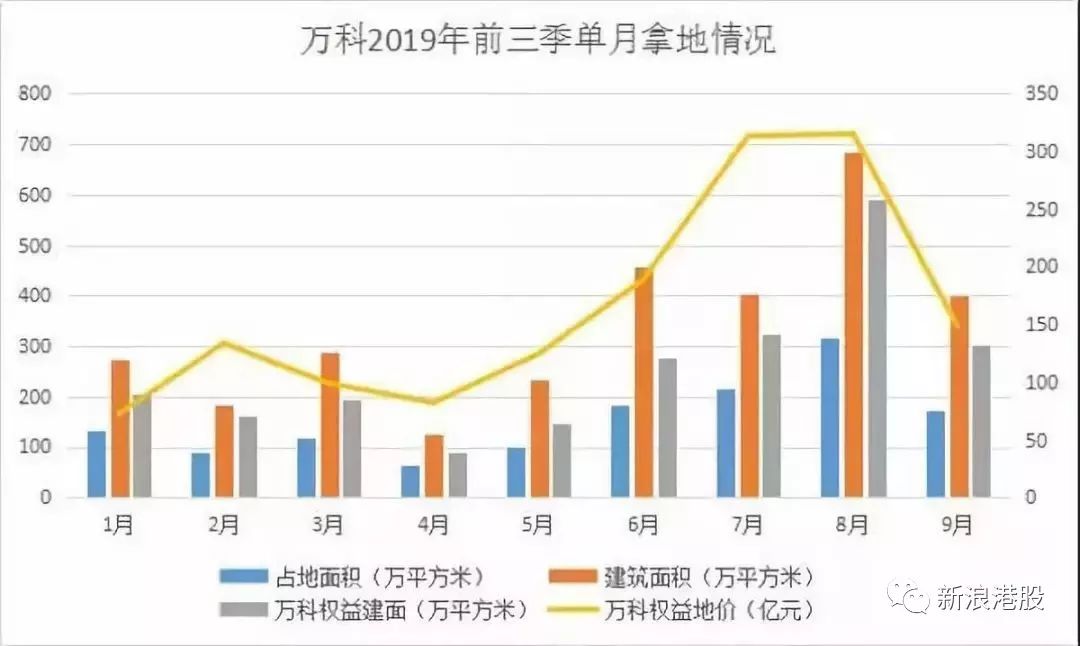

Vanke, which holds a lot of monetary funds, is also very aggressive. Recently, according to Leju Holdings Ltd financial incomplete statistics, about 90 days in the third quarter, Vanke won 62 land projects! The premium paid for the interest is as high as 77.685 billion yuan.

Source of picture | Leju Holdings Ltd Finance and Economics collated according to public information

According to the "New value of Chinese Real Estate Enterprises TOP100 from January to August 2019" released by the Kerry Research Center, Country Garden Holdings ranked first and Vanke ranked second, with a new land value of about 369.34 billion yuan.

But Vanke, which is developing so rapidly, why does it have to "stingy" thousands of yuan and reduce the basic salary of its employees by 40%?

According to media reports, Vanke's salary system has been expanded from 28 levels in the past to 50 levels, while the pay reduction is mainly due to a reduction in basic salary, which turns part of the reduction into performance.

For example, a senior manager, based on his previous salary, had a base salary of 14400 yuan and a performance of 3600 yuan, but now his base salary is 7600 yuan.

Vanke's response is that after the adjustment, the salary level of most people has not changed much.

There is no denying that such a salary system must greatly stimulate the subjective initiative of employees. After all, if you don't work hard, you will get much less income than before.

But in fact, it is still a pay cut. Social insurance and house fund's payment does not depend on the total income you get. The original basic salary is counted as social insurance and house fund's contribution base, while performance is not counted.

Although, even if you work very hard to achieve performance appraisal, the salary you get temporarily will remain the same, but the pension, medical insurance, reproductive insurance, provident fund and so on will be significantly less in the future.

Vanke has always been very concerned about the expenditure of labor costs. does it save costs in this respect? That doesn't seem to be the case.

Looking at Vanke's 2018 annual report, board chairman Yu Liang's after-tax bonus is 14.993 million, president and CEO Zhu Jiusheng's after-tax bonus is 12.417 million, and other executives with tens of millions of bonuses are the chief operating officer and chief financial officer. the bonuses of the union chairman and chief risk officer are also as high as more than 9 million.

Of course, this level of bonus income for executives is normal in the real estate industry. However, the basic salary of some employees has dropped by 40% this time, but according to headhunters, it is lower than that of the same type of head housing companies.

Some leverage experts may want to say that Vanke implements a business partner system, and business partners emphasize inferior responsibility (see today's vocabulary), but also have to bear the risk of the company.

But don't forget that there is something called system and corporate inertia. The team at the helm is important, but the difference between the income of ordinary employees and that of ordinary employees is 108000 miles, which is really shocking.

What are the implications for us who eat melons?

By the end of October, 408 developers had gone bankrupt this year, compared with nearly 300 at the beginning of August. According to the Forbes Chinese website, the number of housing companies going bankrupt this year has increased by about 30% compared with last year.

It is inevitable that the number of housing enterprises will be greatly reduced in the future. On the one hand, the Matthew effect is becoming more and more obvious, and housing enterprises are desperately trying to squeeze into hundreds of billions and tens of billions of real estate enterprise clubs; on the other hand, with the irreversible reduction of demographic factors, the future demand itself will also decrease.

Of course, when the real estate enterprises see this clearly, Country Garden Holdings will engage in robots, Evergrande will spend money on cars, and Poly and Vanke will be "de-localized"....

Interestingly, this phenomenon is quite similar to that of anxious workers. Almost everyone is constantly trying new ways to make money, such as WeChat merchants, purchasing agents, part-time jobs, fried shoes.

Anxiety is a common problem in this rapidly changing era, and I am also anxious. But the real estate companies have now reached an amazing consensus: focus on the main business! Silently adhere to one or more future development directions.

In fact, for individuals, this is also very worthwhile to learn from.

Put your mind on your main business, and those who want to get rich have basically become some scams or leeks of high-risk investment. The reliable way for young people to increase their income is to actively seek promotion, and it is normal for them to double or triple their middle income.

Even if your base salary is reduced one day, at least your base salary has been greatly increased, instead of being directly sentenced to death, your base salary will be reduced to layoffs in disguise.

More than 400 real estate enterprises failed to "survive"

It is true that the differentiation of the real estate industry is becoming more and more obvious, and the number of small and medium-sized housing enterprises disappearing is increasing.

As of October 31, the number of real estate-related enterprises declared bankrupt in 2019 has exceeded 400, and the growth rate of the number of bankrupt real estate enterprises has accelerated after entering the second half of 2019, according to the announcement of the people's court announcement network.

On the bankruptcy list, most of them are small and medium-sized housing enterprises, and most of them are concentrated in third-and fourth-tier cities. Of course, among the housing enterprises that are in deep trouble in 2019, there is no lack of well-known or even among the top 100 well-known housing enterprises in the country.

The reason for the bankruptcy of 400 + small housing enterprises is that they failed to find "life-saving money".

As we all know, real estate is a typical industry with high turnover, high leverage and high debt, which is extremely sensitive to the capital environment and financing environment.

Once the financing policy is tightened, large housing enterprises can still get back their funds with the help of price reduction promotion, while small and medium-sized housing enterprises may face the problem of "survival".

Live! The hidden meaning of this sentence is that when external forces can not borrow money, endogenous hematopoiesis has become the most important thing for real estate enterprises, everything can only rely on their own! Since 2019, in the context of debt-intensive maturity and declining sales, most housing companies can only borrow the new to pay off the old.

According to the statistics of Evergrande Research Institute, by the end of 2018, the balance of interest-bearing liabilities of housing enterprises in various major channels is as high as 20.3 trillion, which is expected to expire in 2019-2021, of which the maturity in 2019 will be as high as 6.8 trillion yuan.

Among them, maturing bonds account for an important proportion. According to Wind statistics, from 2018 to 2021, the total maturity of real estate bonds exceeded 1 trillion yuan.

As we all know, real estate is a typical capital-intensive industry, and the "three highs" of high turnover, high debt and high leverage are the most distinct characteristics.

Once the financing channels are cut off, there is a high probability that small and medium-sized housing enterprises will face the dilemma of "living".

Since 2019, there have been a number of bankruptcy cases of real estate-related enterprises across the country. In the bankruptcy list, there are basically unknown small and medium-sized housing enterprises. Most of them have only ever been involved in the real estate business, and the bankruptcy of such enterprises has a relatively limited impact on the real estate industry. But it is worth mentioning that some large and medium-sized real estate enterprises that have operated well in the past also frequently "explode", this kind of market signal can not be ignored.

Recently, Sansheng Hongye, a well-known housing enterprise, was exposed that it was in arrears with employees' financial management funds, and was listed by the court as an "old scoundrel". Just a month ago, the housing company had just made the top 100 list, and its controller was ranked No. 398 on the Hurun rich list.

June 2019 A-share listed housing enterprise: silver billion Group (000981) under the heavy pressure of 50 billion debts, declared bankruptcy and restructuring because of the broken capital chain.

Under the pre-sale system, buyers need to pay the purchase money first, and only after 2-3 years can the housing enterprises wait for the developers to hand over the buildings. during this period, once the developers break the capital chain and misappropriate the construction funds, the houses subscribed by investors are very likely to become unfinished buildings.

As far as the country is concerned, "housing speculation" is still a medium-and long-term basic policy.

Real estate is losing the biggest "financier".

China's real estate industry in 2019 is more complicated than in any previous year.

According to incomplete statistics, of the 415 real estate controls in the first nine months of 2019, there were more than two per working day on average, setting a new historical record.

On July 30, the meeting of the political Bureau of the CPC Central Committee again mentioned "housing speculation" and proposed for the first time that "real estate should not be used as a means to stimulate the economy in the short term."

On the evening of July 31, the central bank directly named the real estate industry and occupied more credit resources, aiming to guide commercial banks to change their traditional credit path dependence and reasonably control the release of real estate loans.

This is undoubtedly the policy that real estate fears most: banks will control the scale of real estate loans. As of June 31, 2019, 26 listed banks provided loans to the real estate industry as high as 29.7 trillion yuan.

It can be seen that commercial banks have always been the largest "financiers" in the real estate industry.

However, as the Politburo set the tone, the central bank began to lock up housing-related loans. Since October 2019, major commercial banks have frequently received huge fines for providing housing-related funds in violation of regulations:

On October 8, China CITIC Bank Corporation Hangzhou Branch was fined 1.95 million yuan because the loan funds were misappropriated to buy a house and misappropriated to a real estate company.

On October 10th, Industrial Bank Beijing Branch provided financing to housing enterprises in violation of regulations and was fined 6 million yuan.

On October 10th, the Beijing Branch of Pudong Development Bank was fined 2.9 million yuan for illegal use of credit funds for investment and house purchase and for issuing land reserve loans through trust channels.

On October 11, the Yiwu Branch of Ping an Bank used the credit funds to pay the down payment of the house purchase and was fined 500000 yuan.

......

Yan Yuejin, research director of the think tank Center of the Yiju Research Institute, said that the risk of banks giving illegal 'blood transfusions' to real estate through off-balance sheet and other channels will increase in an all-round way, and the future capital cost and capital chain of real estate enterprises will be under certain pressure, especially small and medium-sized real estate enterprises.

The interest rate exceeds 15%! Real estate companies are "braving their heads" to borrow money.

Domestic financing is blocked, many real estate enterprises have to go abroad, overseas bond financing. According to the statistics of the Central Plains Real Estate Research Center, real estate companies raised US $53.36 billion in 2019, up 50% from the same period last year. Although various policies have been tightened, the number of US dollar financing for real estate companies is still a record.

In September alone, property companies raised as much as $3.797 billion in overseas dollars, up more than 140 per cent from $1.58 billion in August.

Bond-issuing rates are also rising, and 10% is no longer the ceiling. According to Wind, at least three real estate dollar bonds have issued bonds with interest rates of more than 15 per cent in 2019.

Most recently, on July 10, Taihe Group (000732) announced that Taihe's wholly-owned subsidiary intends to issue $400m of bonds with an annual coupon of 15%, payable semi-annually.

The high cost surprised the industry, while Taihe had a net profit margin of 12.6% in 2018. It means that, regardless of losing money, it is also necessary to borrow "usury" to maintain cash flow.

However, this is not the highest interest rate. At the beginning of 2019, the interest rate on a dollar bill issued by contemporary home ownership (01107.HK) reached 15.5%. It can be seen that since 2019, housing companies have become more desperate for capital than anything else.

Discount promotion, only to sell the house and get the money back

Since 2019, the major financing channels of real estate enterprises are being closed, which is a cruel reality. If house sales fail to generate cash flow in time, the huge amount of debt due will undoubtedly sound the alarm.

From the 2019 semi-annual report revealed: the two leading housing enterprises-Vanke, Country Garden Holdings, have been very determined to promote sales, seize money, control land, and reduce the speed of turnover.

During the National Day "Golden week", large-scale housing enterprises represented by Evergrande and Country Garden Holdings concentrated on price reduction and promotion, frequently brushing the screen. In October 2019, Evergrande achieved sales of 90.3 billion yuan, a year-on-year increase of 70.2%, setting an all-time high for two consecutive months.

However, the Carey Research Center pointed out that although some large housing companies increased their sales performance in October through a wide range of discount promotions, the overall market was not as good as the head real estate data, and the overall removal rate of the project was not good.

Nearly 60 per cent of TOP50 real estate companies reported a month-on-month decline in monthly performance in October 2019, with most of them falling by between 20 per cent and 30 per cent month-on-month from September, according to the Carey research centre.

In terms of target completion, by the end of October, more than 30% of the housing enterprises that had set annual sales targets for the year had a target completion rate of between 70% and 80%, while the remaining few housing enterprises had a target completion rate of less than 70%.

In the context of slowing industry growth, tighter regulation and expensive financing, some real estate enterprises are still under great pressure to achieve their 2019 performance targets. In the next 2 months, or will increase sales promotion, price reduction efforts, actively promote the market, sprint for the whole year.

China's real estate has officially entered the second half, and the reshuffle may have just begun.

Edit / Edward

房企,尤其是头部房企们的动作,格外引人关注。很显然,头部房企们除了在全国布局,各个城市的行情都很熟悉,对行情更敏感。同时,它们通常还投入了大量的人力和资金进行市场调研和分析,拥有自己的专业研究团队。

房企,尤其是头部房企们的动作,格外引人关注。很显然,头部房企们除了在全国布局,各个城市的行情都很熟悉,对行情更敏感。同时,它们通常还投入了大量的人力和资金进行市场调研和分析,拥有自己的专业研究团队。