Village Farms International Reports Q1/24 Earnings: A Detailed Examination

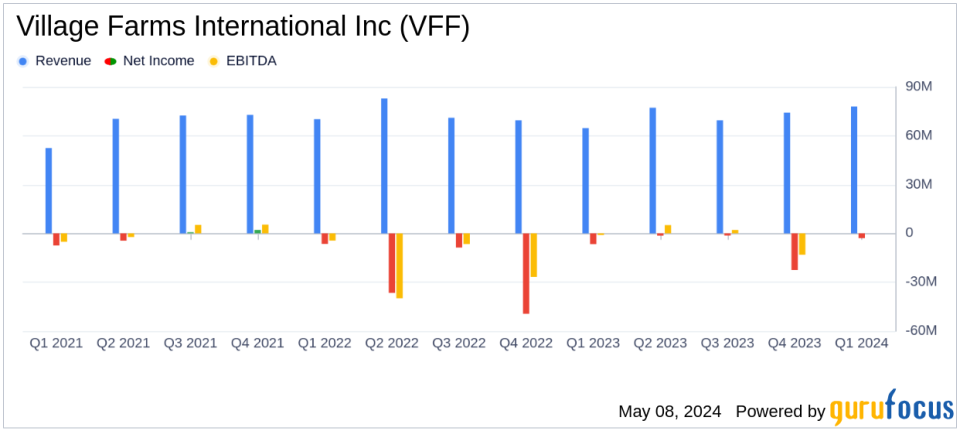

Revenue: Reported $78.1 million, up 21% year-over-year, exceeding estimates of $71.94 million.

Net Loss: Improved to $2.9 million from $6.6 million year-over-year, failing to meet estimates of $2.59 million.

Earnings Per Share (EPS): Reported ($0.03), an improvement from ($0.06) year-over-year, below the estimated ($0.02).

Adjusted EBITDA: Increased significantly to $3.6 million from $0.5 million in the previous year.

Canadian Cannabis Segment: Net sales rose 49% to $37.4 million, with retail branded sales up 28% and non-branded sales up 181%.

U.S. Cannabis Operations: Experienced a net loss of $0.7 million, with sales declining to $4.5 million from $5.0 million.

Fresh Produce Operations: Sales increased by 4% to $36.1 million, turning a net loss of $2.6 million into a net income of $0.1 million.

Village Farms International Inc (NASDAQ:VFF) disclosed its first-quarter financial results on May 8, 2024, revealing significant growth and strategic advancements. The company's 8-K filing highlights a 21% increase in total sales and substantial improvements in both net loss per share and adjusted EBITDA.

Village Farms International, operating extensive agricultural greenhouse facilities in North America, is known for its production and sale of premium quality vegetables and cannabis products. The company's diverse operations include the Produce, Cannabis-Canada, Cannabis-U.S., and Energy segments, with the majority of revenue derived from its Produce business.

Financial Performance Overview

The first quarter of 2024 was marked by robust sales growth, with total revenue reaching $78.1 million, up from $64.7 million in the same period last year. This growth was driven by a 49% increase in Canadian Cannabis sales and a solid performance in the Fresh Produce segment, which saw a 4% increase in sales. Despite these gains, the company reported a consolidated net loss of $2.9 million, an improvement from a loss of $6.6 million in Q1/23. The net loss per share narrowed to $0.03 from $0.06 year-over-year.

Adjusted EBITDA showed a remarkable improvement, rising from $0.5 million in Q1/23 to $3.6 million in Q1/24, indicating enhanced operational efficiency and profitability. The company's strategic focus on high-margin cannabis products and cost-effective production techniques has started to yield financial benefits, as evidenced by these figures.

Strategic Developments and Market Expansion

Village Farms' strategic initiatives have been pivotal in its growth trajectory. The Canadian Cannabis segment, under its subsidiaries Pure Sunfarms and Rose LifeScience, has shown exceptional performance with significant market share gains in key categories such as dried flower and pre-rolls. The launch of innovative products like Hi-Def Pre-Rolls has met with strong market reception, further bolstering its market position.

Internationally, the company is expanding its footprint in Europe with the construction of a production facility in the Netherlands, set to commence operations in late 2024. This move positions Village Farms as a pioneer in the European legal cannabis market, potentially unlocking new revenue streams.

In the U.S., the subsidiary Balanced Health Botanicals continues to innovate in the CBD space, although it faced a slight downturn this quarter. The strategic internalization of gummy production, expected to complete in Q2/24, is anticipated to improve product consistency and profitability.

Operational Highlights and Future Outlook

Operationally, Village Farms is optimizing its production capabilities across segments. The recent commencement of the Delta, British Columbia Renewable Natural Gas Project is expected to contribute to both sustainability goals and bottom-line growth. Additionally, the company's ongoing efforts to divest non-core assets and invest in high-growth areas are reflective of a strategic realignment towards more profitable and sustainable operations.

Looking ahead, Village Farms is well-positioned to capitalize on global cannabis legalization trends and the growing demand for high-quality, sustainably produced agricultural products. With strategic expansions underway and a focus on innovation and market expansion, the company is set to strengthen its market presence and enhance shareholder value.

For detailed financial figures and further information, refer to the full earnings report and management discussion available on the company's website and the SEC filings.

Village Farms International's Q1/24 results not only reflect a solid start to the year but also underscore the effectiveness of its strategic growth initiatives and operational enhancements. As the company continues to navigate the complex landscapes of the produce and cannabis markets, its focus on innovation, market expansion, and sustainability appears poised to drive continued growth and profitability.

Explore the complete 8-K earnings release (here) from Village Farms International Inc for further details.

This article first appeared on GuruFocus.