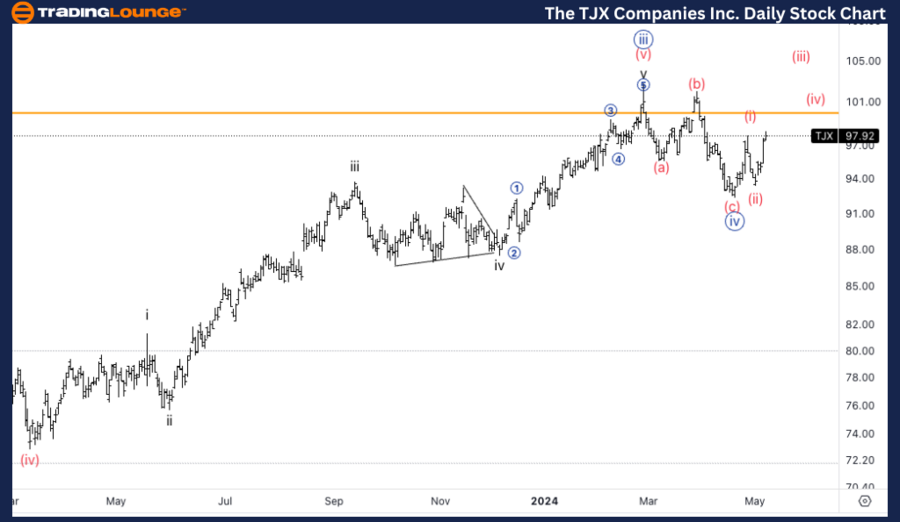

TJX Elliott Wave Analysis Trading Lounge Daily Chart,

The TJX Companies Inc., (TJX) Daily Chart

TJX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minute wave {v}.

Direction: Upside in Minute {v}.

Details: Looking for a bottom in wave {iv} in place to then continue higher. Equality of {v} vs. {i} stands at 108$.

Our detailed Elliott Wave analysis for The TJX Companies Inc. (TJX) as of May 7, 2024, offers insightful perspectives on potential movements for both daily and 4-hour trading charts. This analysis aims to assist traders and investors in identifying strategic positions in line with the predicted trends in TJX's stock prices.

TJX Elliott Wave Technical Analysis – Daily chart

On the daily chart, TJX is currently exhibiting an impulsive, motive wave pattern, specifically within Minute wave {v}. This wave is crucial as it suggests a continued upward momentum following the establishment of a bottom in wave {iv}. The target for equality between wave {v} and wave {i} is projected at $108, indicating significant upside potential.

TJX Elliott Wave Analysis Trading Lounge 4Hr Chart

The TJX Companies Inc., (TJX) 4Hr Chart

TJX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (i) of {v}.

Direction: Upside in wave (iii).

Details: Looking for a CTLP on 100$, we need to break (b) to then start thinking about longs.

TJX Elliott Wave technical analysis – Four hour chart

Zooming into the 4-hour chart, TJX is progressing through Wave (i) of Minute {v}. The focus is on the upcoming wave (iii), which is known for its typically strong upward drive. A critical price point to monitor is the $100 level, where a conclusive break above the (b) wave high will validate bullish sentiments and open the door for positioning long trades.

Technical analyst: Alessio Barretta.

TJX Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0800 after German and EU PMI data

EUR/USD holds above 1.0800 in the European session on Thursday. The data from Germany and the EU showed that the business activity in private sector expanded at an accelerating pace in May, helping the Euro find demand. US PMI reports will be published later.

GBP/USD holds the fort above 1.2700, focus on UK/ US PMIs

GBP/USD is clinging to recovery gains above 1.2700 in European trading on Thursday. The US Dollar struggles to extend its upside, lending support to the pair amid an improving market mood. Traders look forward to the UK and US preliminary PMI data for fresh trading impulse.

Gold: Will XAU/USD avert a rising wedge breakdown?

Gold price is licking its wound near a five-day high below $2,370 in the Asian session on Thursday. Gold price is on a three-day downtrend, undermined by the hawkish Minutes of the US Federal Reserve (Fed) May policy meeting.

As Ethereum spot ETF approval nears, these altcoins could explode

It is not surprising that altcoins related to Bitcoin saw a major rally post-Bitcoin spot ETF approval. Likewise, tokens closely related to Ether could ride the ETF approval wave. Ethereum Classic, Pepe, Floki and other DeFi tokens could gain momentum as the ETH ETF approval deadline nears.

US S&P Global PMIs Preview: Economic expansion set to persist in May

On Thursday, S&P Global will issue its flash estimates of the United States (US) Purchasing Managers Indexes (PMIs), a monthly survey of business activity. The survey is separated into services and manufacturing output and aggregated into a single statistic, the Composite PMI.