Pacira BioSciences Reports Q1 2024 Results: Aligns with EPS Projections and Announces $150 ...

Total Revenue: Reached $167.1 million in Q1 2024, up from $160.3 million in Q1 2023, exceeding estimates of $165.35 million.

Net Income: Reported at $9.0 million, or $0.19 per share, significantly below the estimated $0.19 per share.

Earnings Per Share (EPS): Basic and diluted EPS stood at $0.19, falling short of the estimated $0.62.

EXPAREL Net Product Sales: Totaled $132.4 million, showing a slight increase from $130.4 million in the previous year.

Operating Expenses: Decreased to $153.9 million from $163.4 million year-over-year, contributing to improved operational efficiency.

Cash Flow: Cash provided by operations was $49.1 million, a substantial increase from $19.1 million in Q1 2023.

Share Repurchase Program: Announced a new $150 million share repurchase program, highlighting confidence in financial stability and future growth prospects.

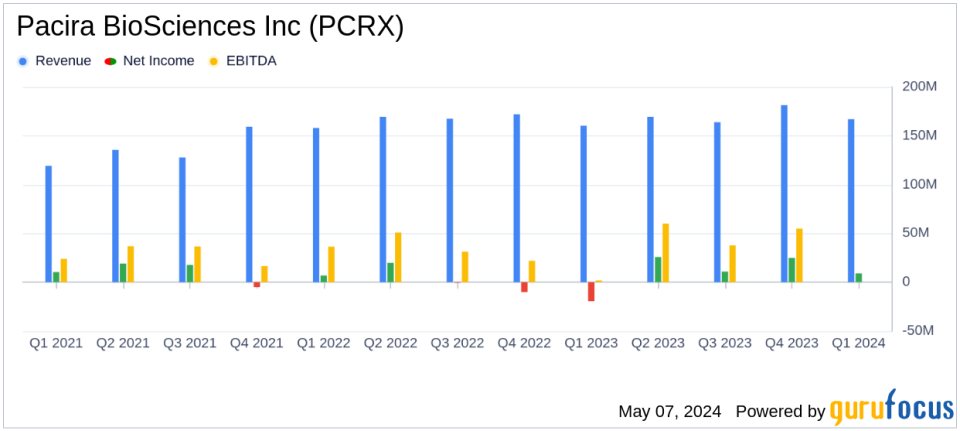

On May 7, 2024, Pacira BioSciences Inc (NASDAQ:PCRX) released its 8-K filing, announcing its financial results for the first quarter of 2024. The company, a leader in non-opioid pain management and regenerative health solutions, reported total revenues of $167.1 million for the quarter, reflecting a year-over-year increase from $160.3 million.

Company Overview

Pacira BioSciences Inc is renowned for its focus on non-opioid pain management, offering three commercialized products: EXPAREL, a long-acting local analgesic; ZILRETTA, an extended-release injection for osteoarthritis pain; and iovera, a device designed for drug-free pain control through targeted cold therapy.

Financial Performance

The company's flagship product, EXPAREL, generated net sales of $132.4 million, slightly up from the previous year's $130.4 million, despite facing challenges such as contracted discounts and changes in vial mix. ZILRETTA sales also saw an increase to $25.8 million from $24.3 million, and iovera sales improved from $4.0 million to $5.0 million. Additionally, the company benefited from $2.5 million in sales of bupivacaine liposome injectable suspension to third-party licensees, a significant rise from $0.7 million in the prior year.

Operating expenses for Q1 2024 were $153.9 million, down from $163.4 million in Q1 2023, contributing to a net income of $9.0 million, or $0.19 per share, a notable improvement from a net loss of $19.5 million, or $(0.43) per share, in the same period last year. The adjusted EBITDA was reported at $44.6 million, up from $41.9 million in the previous year.

Strategic Developments

CEO Frank D. Lee highlighted the solid start to the year for all three products and the company's focus on driving growth. Significant developments include the advancement of EXPAREL for new indications and the positive reception in various care settings. The company also announced a $150 million share repurchase program, underscoring confidence in its future growth trajectory.

Further bolstering its innovation pipeline, Pacira presented positive efficacy and safety data for its gene therapy product candidate, PCRX-201, and received an RMAT designation from the FDA, enhancing its potential impact on osteoarthritis treatments.

Financial Position and Outlook

As of March 31, 2024, Pacira reported a strong liquidity position with $325.9 million in cash, cash equivalents, and investments. The company reiterated its full-year 2024 guidance, expecting total revenue between $680 million and $705 million and maintaining a non-GAAP gross margin of 74% to 76%.

The company's strategic initiatives, including the new share repurchase program and ongoing product developments, are set to reinforce its market position and financial health in the evolving landscape of pain management solutions.

Conclusion

With a robust start to 2024, Pacira BioSciences continues to demonstrate its capability in driving growth and innovation in the non-opioid pain management sector. The alignment of its Q1 earnings per share with analyst projections and strategic investments in its product lineup and share repurchases reflect a balanced approach to growth and shareholder value creation.

For detailed financial figures and future updates, stakeholders and interested investors are encouraged to refer to the official SEC filings.

Explore the complete 8-K earnings release (here) from Pacira BioSciences Inc for further details.

This article first appeared on GuruFocus.