Mercury Systems Inc (MRCY) Faces Substantial Q3 Losses, Misses Revenue Expectations

Revenue: Reported at $208.3 million, falling short of the estimated $214.32 million.

Net Loss: Recorded a significant loss of $44.6 million, substantially above the estimated loss of $4.07 million.

Earnings Per Share (EPS): Reported a loss of $0.77 per share, considerably worse than the estimated loss of $0.02 per share.

Adjusted EBITDA: Resulted in a loss of $2.4 million, a stark contrast to the $43.5 million in the same quarter of the previous year.

Bookings: Totaled $219.9 million with a book-to-bill ratio of 1.06, indicating more orders were received than billed during the quarter.

Backlog: Achieved a record high of $1.3 billion, up 17% year-over-year, suggesting potential future revenue growth.

Free Cash Flow: Negative $25.7 million, reflecting increased cash burn compared to $12.7 million in the previous year.

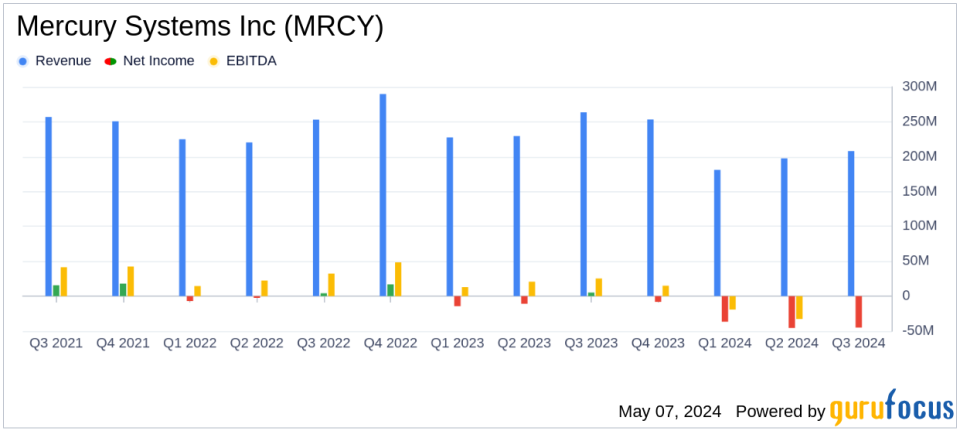

On May 7, 2024, Mercury Systems Inc (NASDAQ:MRCY), a prominent technology provider for the aerospace and defense industry, disclosed its financial results for the third quarter of fiscal year 2024 through an 8-K filing. The company reported significant challenges this quarter, reflecting a downturn in performance compared to the previous year.

Financial Overview

Mercury Systems experienced a decrease in revenue, posting $208.3 million compared to $263.5 million in the same quarter last year. This figure falls below the analyst estimates which projected revenues of $214.32 million. The company also reported a substantial GAAP net loss of $44.6 million, equating to a loss per share of $0.77, a stark contrast to the net income of $5.2 million, or $0.09 per share, reported in the third quarter of fiscal 2023. Adjusted earnings per share stood at -$0.26, deviating from the estimated -$0.02.

The adjusted EBITDA was also in the negative at -$2.4 million, compared to a positive $43.5 million in the prior year. The company's bookings amounted to $219.9 million with a book-to-bill ratio of 1.06, and it reported a record backlog of $1.3 billion, up 17% year-over-year.

Operational Highlights and Challenges

Despite the financial downturn, Mercury Systems highlighted progress in strategic areas such as shifting from development to production programs and streamlining operations. However, the company acknowledged "transitory impacts" confined to a subset of its portfolio, suggesting some operational inefficiencies or market challenges affecting specific segments.

Mercury's CEO, Bill Ballhaus, commented on the results and future outlook, stating:

"In the third quarter of fiscal year 2024, we made solid progress in each of our four priority focus areas... As we continue to make progress this year, we expect to enter FY25 with a clearer path to deliver predictable organic growth, expanding margins, and strong cash flow."

This statement underscores a strategic vision aimed at recovery and growth despite the current setbacks.

Balance Sheet and Cash Flow Insights

The balance sheet shows a mixed scenario with cash and cash equivalents rising to $142.645 million from $71.563 million the previous year. However, cash flows from operating activities were negative at $17.8 million, and the free cash flow worsened to -$25.7 million. These figures indicate liquidity pressures and challenges in cash management amidst the ongoing operational adjustments.

Looking Ahead

For the full fiscal year 2024, Mercury Systems has set its revenue expectations between $800 million and $850 million, reflecting cautious optimism about recovering from the current financial dip. The firm also anticipates bookings to exceed $1 billion and expects positive free cash flow by the end of the fiscal year.

The company's focus on strategic initiatives and operational efficiency, coupled with a strong backlog, provides a foundation for potential recovery and growth. However, investors and stakeholders should remain attentive to how Mercury navigates its current challenges and capitalizes on market opportunities in the highly competitive aerospace and defense sector.

Conclusion

Mercury Systems' third-quarter results highlight significant challenges but also a clear strategy for recovery. As the company continues to adapt and align its operations with market demands, the coming quarters will be crucial in determining its ability to return to profitability and achieve sustainable growth.

Explore the complete 8-K earnings release (here) from Mercury Systems Inc for further details.

This article first appeared on GuruFocus.