MasterBrand Inc (MBC) Q1 2024 Earnings: Surpasses EPS Estimates Amid Sales Decline

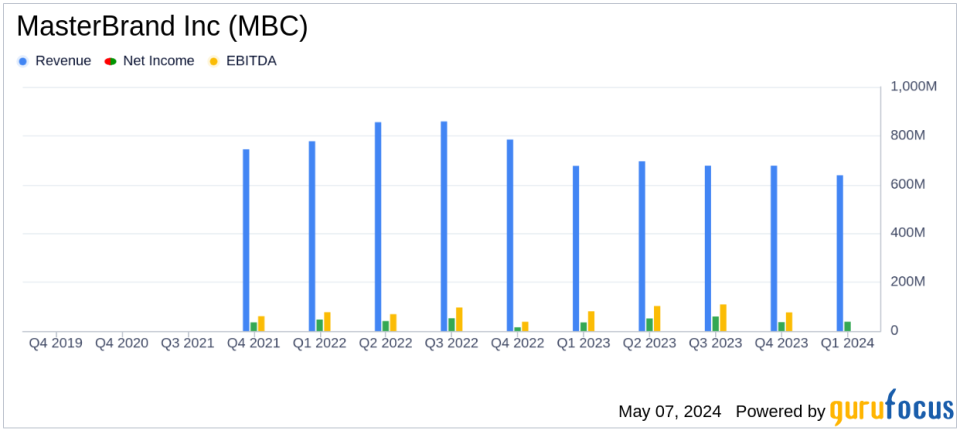

Revenue: Reported at $638.1 million, down 5.7% year-over-year, exceeding estimates of $629.0 million.

Net Income: Increased to $37.5 million from $35.0 million in the prior year, exceeding estimates of $33.10 million.

Earnings Per Share (EPS): Diluted EPS was $0.29, up from $0.27 year-over-year, surpassing the estimated $0.26.

Gross Profit Margin: Expanded by 190 basis points to 32.1%, indicating improved operational efficiency.

Free Cash Flow: Posted at $11.7 million, reflecting disciplined capital management despite a decrease from $59.2 million in the previous year.

Operating Cash Flow: Decreased significantly to $18.7 million from $62.1 million in the first quarter of 2023, highlighting challenges in cash generation.

Adjusted EBITDA Margin: Increased by 40 basis points to 12.4%, reflecting margin improvements from strategic initiatives.

On May 7, 2024, MasterBrand Inc (NYSE:MBC), North America's largest residential cabinet manufacturer, disclosed its financial results for the first quarter of 2024 through an 8-K filing. Despite a decline in net sales, the company reported an improvement in net income and earnings per share, surpassing analyst expectations for the quarter.

MasterBrand operates a vast network of manufacturing facilities and offices, employing over 12,000 associates. The company delivers a wide range of cabinetry products across the United States and Canada through dealers, retailers, and builders. This extensive operation has positioned MasterBrand as a significant player in the Furnishings, Fixtures & Appliances industry.

Financial Performance Overview

For Q1 2024, MasterBrand reported net sales of $638.1 million, a decrease of 5.7% from $676.7 million in the same quarter the previous year. This decline was attributed to trade downs and a normalization of promotional activities. However, the company's strategic cost management initiatives helped offset these challenges, as evidenced by a gross profit margin expansion of 190 basis points to 32.1%.

Net income for the quarter rose to $37.5 million from $35.0 million in Q1 2023, marking a 7.1% increase, primarily due to lower interest expenses and a reduced effective tax rate. Diluted earnings per share increased to $0.29 from $0.27, slightly above the estimated $0.26, showcasing the company's ability to enhance shareholder value amidst market fluctuations.

Adjusted EBITDA stood at $79.4 million with a margin of 12.4%, slightly down from $81.5 million in the prior year but showing a margin increase of 40 basis points. This reflects MasterBrand's effective management and operational efficiency.

Balance Sheet and Cash Flow

As of March 31, 2024, MasterBrand maintained a strong liquidity position with $153.7 million in cash and $477.3 million available under its revolving credit facility. The company's total debt to net income ratio was 3.8x, with a net debt to adjusted EBITDA ratio of 1.5x, indicating a manageable level of leverage.

Operating cash flow for the quarter was $18.7 million, and free cash flow was $11.7 million. Despite a decrease from the previous year's $62.1 million in operating cash flow and $59.2 million in free cash flow, the company continues to generate sufficient cash to fund operations and strategic initiatives.

Strategic Initiatives and Market Outlook

President and CEO Dave Banyard highlighted the progress in strategic initiatives such as Align to Grow, Lead through Lean, and Tech Enabled, which are expected to drive future performance. The company reiterated its full-year 2024 outlook, anticipating a low single-digit percentage to flat year-over-year net sales decline and adjusted EBITDA in the range of $370 million to $400 million.

Despite some macroeconomic uncertainties, MasterBrand's management remains confident in their strategy and operational focus, aiming to meet or exceed their financial targets for 2024.

In summary, MasterBrand Inc's first quarter of 2024 reflects a resilient operational model capable of navigating market challenges, backed by strategic initiatives that bolster profitability and shareholder value. Investors and stakeholders may look forward to potential growth and sustained performance as the company continues to execute its business strategies effectively.

Explore the complete 8-K earnings release (here) from MasterBrand Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance