Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI) Q1 2024 Earnings: Surpasses ...

GAAP Diluted EPS: Reported at $0.98 for Q1 2024, significantly surpassing the estimated $0.57.

Adjusted EPS: Achieved $0.68, exceeding the quarterly estimate of $0.57.

Net Investment Income: GAAP-based decreased by 30% year-over-year to $8.7 million; however, Adjusted Net Investment Income saw a 37% increase to $64.3 million.

Revenue: Total revenue reached $105.8 million, significantly exceeding the estimated $77.10 million.

Net Income: GAAP net income surged to $123 million, far surpassing the estimated $64.18 million.

Portfolio Growth: Expanded by 36% over the past twelve months, now totaling $6.4 billion in managed assets.

Dividend: Declared a quarterly dividend of $0.415 per share, with a 2% discount offered on the Dividend Reinvestment and Stock Purchase Plan for Q2 2024.

Hannon Armstrong Sustainable Infrastructure Capital Inc (NYSE:HASI) disclosed its first quarter 2024 financial results on May 7, 2024, demonstrating a significant outperformance in revenue and establishing a $2 billion strategic partnership with KKR. The detailed earnings can be explored in their 8-K filing.

Hannon Armstrong focuses on providing debt and equity financing primarily for energy-efficiency and renewable-energy projects across the United States. Their investment strategy is geared towards projects that not only yield financial returns but also contribute positively to the environment by reducing carbon emissions and promoting sustainable energy use.

Financial Highlights and Performance Metrics

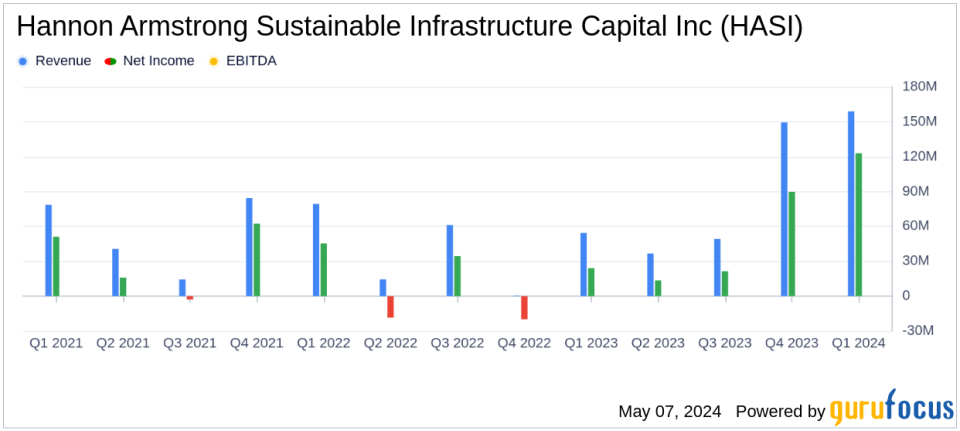

For Q1 2024, HASI reported a GAAP diluted EPS of $0.98, a substantial increase from $0.26 in the same quarter the previous year. The adjusted EPS also rose to $0.68 from $0.53 year-over-year. This performance significantly exceeds the analyst's estimated EPS of $0.57 for the quarter. Total revenue surged to $105.8 million, up from $69.1 million in Q1 2023, surpassing the estimated $77.10 million and indicating robust growth in the companys financial health.

The company's net investment income on a GAAP basis saw a decrease, settling at $8.7 million, down 30% year-over-year. However, the adjusted net investment income, which provides a more accurate reflection of the core earnings, increased by 37% to $64.3 million.

The portfolio grew by 36% over the past twelve months, reaching $6.4 billion, with managed assets expanding by 24% to $12.9 billion. This growth is a testament to HASI's effective asset management and strategic investment decisions.

Strategic Developments and Sustainability Impact

The quarter was marked by significant strategic developments, including the announcement of a $2 billion partnership with KKR through CarbonCount Holdings 1 LLC, aimed at investing in sustainable infrastructure assets. Additionally, HASI increased the capacity and extended the maturities of its revolving credit and commercial paper programs, enhancing its liquidity framework.

On the sustainability front, HASI's projects are estimated to avoid approximately 520,000 metric tons of carbon emissions annually, showcasing the company's commitment to environmental stewardship alongside financial performance.

Challenges and Forward Outlook

Despite the positive outcomes, HASI faces challenges such as increased interest expenses, which rose by $25 million due to a larger average outstanding debt balance and higher rates. The company also recorded a $2 million provision for loss on receivables and securitization assets, reflecting some level of risk in its receivables.

Looking ahead, HASI aims for an annual adjusted earnings per share growth rate of 8% to 10% from 2024 to 2026, with dividend distributions set at a payout ratio of 60-70% of annual adjusted earnings per share. This guidance underscores HASI's confidence in its operational strategy and financial planning.

Conclusion

Hannon Armstrong's Q1 2024 results not only surpassed analyst expectations in terms of revenue but also highlighted the company's strategic initiatives and commitment to sustainability. With a robust pipeline and strategic partnerships in place, HASI is well-positioned to continue its growth trajectory while contributing positively to the global energy transition.

Explore the complete 8-K earnings release (here) from Hannon Armstrong Sustainable Infrastructure Capital Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance