Vivid Seats Inc (SEAT) Q1 Earnings: Mixed Results Amid Strong Revenue Growth

Marketplace GOV: Reached $1.028 billion, marking a 20% increase from $855.5 million in Q1 2023.

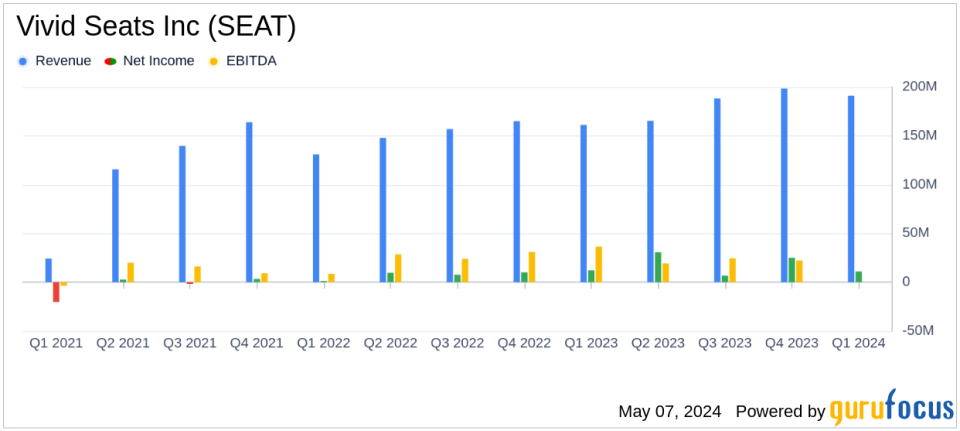

Revenue: $190.9 million, up 18% year-over-year, surpassing estimates of $181.67 million.

Net Income: Reported at $10.7 million, a significant decrease of 65% from $30.3 million in Q1 2023, and fell short of estimates of $12 million.

Adjusted EBITDA: $38.9 million, down 8% from $42.4 million in the previous year.

Cash Flow: Generated $39 million from operations, initiating a 2024 share repurchase program.

2024 Financial Outlook: Expects Marketplace GOV between $4.2 billion to $4.5 billion, with revenues projected to be between $810.0 million to $840.0 million and Adjusted EBITDA between $160.0 million to $170.0 million.

Vivid Seats Inc (NASDAQ:SEAT) released its 8-K filing on May 7, 2024, revealing a quarter of robust revenue growth yet a significant decline in net income. The company, a prominent player in the online ticket marketplace, reported a first-quarter revenue of $190.9 million, surpassing the estimated $181.67 million and marking an 18% increase from the previous year. However, net income plummeted by 65% to $10.7 million, falling short of the anticipated $11.94 million.

About Vivid Seats Inc

Founded in 2001, Vivid Seats operates as a vital hub for ticket sales spanning concerts, sports, and theater events across North America. The company has carved a niche in the entertainment ticketing industry by partnering with major brands like ESPN and Rolling Stone, and by offering a comprehensive rewards program, Vivid Seats Rewards.

Operational Highlights and Financial Metrics

The first quarter saw a notable 20% year-over-year increase in Marketplace Gross Order Value (GOV), reaching over $1 billion. This growth reflects the company's effective strategy in enhancing ticket listings across its platforms. Despite these gains, the net income suffered, primarily due to increased operational costs and investments aimed at international expansion.

Adjusted EBITDA was reported at $38.9 million, a decrease of 8% from the previous year, indicating challenges in cost management amidst expansion efforts. The company also highlighted its strategic moves, including the initiation of a share repurchase program, underscoring its commitment to returning value to shareholders.

Balance Sheet and Cash Flow Insights

The balance sheet remains robust with $154 million in cash and cash equivalents as of March 31, 2024, an increase from the end of 2023. This financial stability is supported by a strong cash flow from operations, which stood at $39 million for the quarter, facilitating strategic investments and debt management.

Looking Ahead: 2024 Financial Outlook

Vivid Seats provided an optimistic outlook for 2024, projecting Marketplace GOV between $4.2 billion and $4.5 billion, and revenues expected to range from $810 million to $840 million. The company anticipates Adjusted EBITDA to be between $160 million and $170 million, reflecting confidence in sustained growth driven by strategic initiatives and market expansion.

Management's Perspective

We are proud to deliver another strong quarter, showcasing the power of our core business and the momentum that has continued into 2024, said Stan Chia, CEO of Vivid Seats. With our focus on accelerating our international expansion timeline, we have made excellent progress internationalizing our platform to scale efficiently across geographies and look forward to that launch later this year.

Conclusion

While Vivid Seats Inc (NASDAQ:SEAT) demonstrated impressive revenue growth and strategic positioning in Q1 2024, the decline in net income highlights the costs associated with expansion and scaling operations. Investors and stakeholders will likely watch closely how the company balances growth-driven spending with profitability in the upcoming quarters.

For more detailed information and to stay updated on SEAT's progress, visit the Vivid Seats Investor Relations website.

Explore the complete 8-K earnings release (here) from Vivid Seats Inc for further details.

This article first appeared on GuruFocus.