National CineMedia Inc. (NCMI) Earnings Overview: Q1 2024 Performance Analysis

Revenue: Reached $37.4 million, up 7.2% year-over-year, exceeding the estimated $34.73 million.

Net Loss: Reported at $34.7 million, improved from a net loss of $45.5 million year-over-year, but was greater than the estimated net loss of $10.2 million.

Earnings Per Share (EPS): Reported a loss of $0.36 per diluted share, significantly more than the estimated loss of $0.08 per share.

Operating Loss: Improved to $22.7 million from $30.6 million in the previous year.

Adjusted OIBDA: Improved to negative $5.7 million from negative $10.9 million year-over-year.

Free Cash Flow: Highlighted as the highest in the last 15 quarters, specific figures not disclosed.

Future Outlook: Expects Q2 2024 revenue to be between $49.5 million and $51.5 million, with Adjusted OIBDA between $3.5 million and $4.5 million.

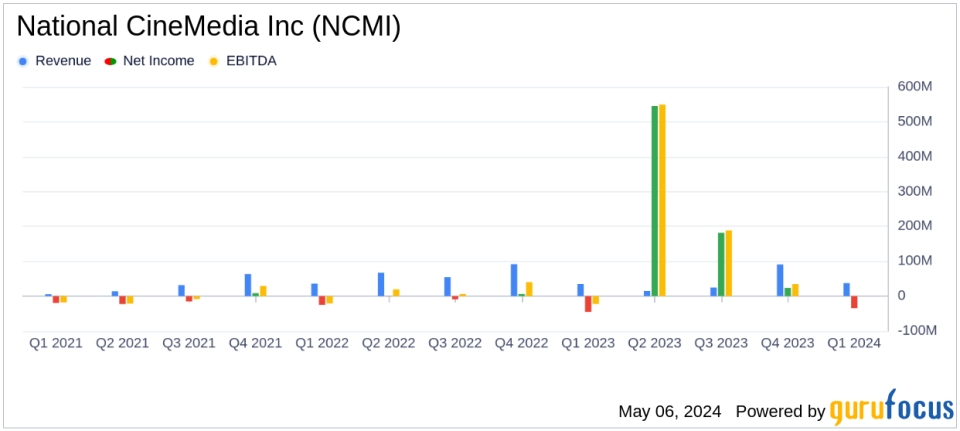

National CineMedia Inc. (NASDAQ:NCMI) disclosed its financial outcomes for the first quarter ended March 28, 2024, through its recent 8-K filing on May 6, 2024. The company, a leader in the U.S. cinema advertising sector, reported a revenue increase and a significant reduction in operating loss compared to the previous year, signaling a slow yet potential recovery from the pandemic's impacts.

About National CineMedia Inc.

National CineMedia Inc. operates the largest cinema advertising network in the U.S., engaging audiences through its Noovie pre-show on over 18,200 screens. The company's advertising platform also extends to digital and out-of-home campaigns, making it a pivotal player in connecting brands with diverse movie-going audiences.

Q1 2024 Financial Highlights

The company reported a revenue of $37.4 million for the quarter, which is a 7.2% increase from $34.9 million in the same quarter the previous year. This performance slightly exceeds analyst expectations, which projected a revenue of $34.73 million. However, NCMI experienced a net loss of $34.7 million, or $0.36 per diluted share, which did not meet the anticipated earnings per share of -$0.08. This net loss shows a reduction from the previous year's net loss of $45.5 million, or $3.13 per diluted share.

Operational improvements were evident as the operating loss decreased to $22.7 million from $30.6 million year-over-year. Adjusted OIBDA also showed improvement, moving from a negative $10.9 million to a negative $5.7 million.

Strategic Movements and Challenges

CEO Tom Lesinski highlighted the resilience of NCMI's platform, noting significant performance in both the upfront and scatter marketplaces. The company's strategic focus on high-quality video advertising solutions and the implementation of a $100 million share repurchase program underscore its commitment to shareholder value. Despite these positive strides, NCMI faces ongoing challenges such as fluctuating theater attendance and the competitive advertising expenditure landscape.

Looking Ahead: Q2 2024 Projections

For the second quarter of 2024, NCMI anticipates revenue between $49.5 million and $51.5 million, which would mark a decrease from the $64.4 million reported in the second quarter of 2023. Adjusted OIBDA is expected to range from $3.5 million to $4.5 million, compared to $12.5 million in the prior year's corresponding quarter.

Investor and Media Communications

NCMI has scheduled a conference call and webcast for May 6, 2024, to discuss these results and provide more insights into its operations and outlook. This proactive engagement with stakeholders is part of NCMI's strategy to maintain transparency and bolster investor confidence amidst its recovery phase.

Conclusion

While National CineMedia Inc. shows signs of recovery with improved revenue and reduced losses, the company still faces significant challenges that could impact its future performance. Investors and analysts will likely watch closely how NCMI navigates these challenges and capitalizes on its strategic initiatives in the coming quarters.

Explore the complete 8-K earnings release (here) from National CineMedia Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance