Nuclear energy specialist Cameco (NYSE:CCJ) recently posted mixed results for its first-quarter earnings report, and that didn’t please the market. In particular, options traders appear bearish on the company’s prospects. However, this pessimism overlooks broader fundamentals that appear attractive for the underlying industry. As a result, I am bullish on CCJ stock.

Cameco Misses Its Bottom-Line Target

On April 29, Cameco posted earnings per share of nine cents, missing the consensus target of 25 cents. Still, on the top line, the company generated revenue of $575.23 million, handily beating analysts’ expectations of $461.5 million. Unfortunately, this wasn’t enough for the market, sending CCJ stock tumbling down on the disclosure.

Cameco CEO Tim Gitzel provided the framing. “In Q1 operational performance was strong across our uranium, fuel services and Westinghouse segments. Financial results are in line with the 2024 outlook we provided, which has not changed, and are as expected, reflecting normal quarterly variability and the required purchase accounting and other non-operational acquisition-related costs for Westinghouse,” the head executive stated.

In November of last year, Cameco announced the acquisition of Westinghouse Electric Company via a strategic partnership with Brookfield Asset Management (NYSE:BAM).

Options Traders Go after CCJ Stock

Despite Gitzel’s explanation, along with Cameco’s big revenue beat, the market – particularly options traders – wanted more. Subsequently, the derivatives arena saw elevated activity for transactions with bearish sentiment in the immediate earnings aftermath.

On April 30, TipRanks’ unusual options activity screener identified two big transactions: 3,528 contracts bought of the CCJ May 17 ’24 46.00 Put and 3,155 contracts sold of the CCJ Jun 21 ’24 48.00 Call. On the other hand, the biggest options trade with bullish sentiment on the same day was for 260 contracts sold of the CCJ May 17 ’24 35.00 Put.

Initially, the bears benefited from their wagers. At the end of April 29, CCJ stock stood at $49.43. By the late morning hours of the following session, shares slipped to $45.63. Nevertheless, the bulls gradually brought Cameco higher toward the end of last week. That’s probably no fluke.

Focus on the Fundamentals

For anyone considering CCJ stock, the main bullish catalyst is rising demand. On a related note, geopolitical dynamics could potentially disrupt global energy supply chains. Therefore, Cameco will likely become more relevant, not less.

First, the explosion of advanced technologies such as cloud computing, data centers, and artificial intelligence doesn’t come for free. Much like the cryptocurrency sector, these and many other innovations require massive amounts of electricity.

Frankly, the U.S. may be running out of power. It sounds like a ludicrous concept. However, The Washington Post sounded the alarm earlier this year that AI – along with the boom in clean-tech manufacturing – has pushed the power grid near its breaking point. What’s worrisome is that utilities can’t keep pace with the accelerated energy demand.

Fundamentally, nuclear power carries controversy due to the very real threat of meltdowns. However, the science cannot be ignored. According to the Nuclear Energy Institute, one uranium fuel pellet “creates as much energy as one ton of coal, 149 gallons of oil or 17,000 cubic feet of natural gas.”

No other energy source comes close to this magnitude of energy density. Combined with other pressure points such as population growth, the U.S. and other advanced economies will find themselves in a position to need more energy-related commodities.

And that reality brings up the second fundamental catalyst – geopolitics. At a time when energy resources are desperately needed, another article by The Washington Post reminded everyone about another harsh reality: the U.S. imports uranium from Russia.

Here, Russia’s invasion of Ukraine and America’s response present an extraordinarily delicate situation. The conflict shows no sign of abating. With Congress passing the aid package for Ukraine amounting to nearly $61 billion, the Kremlin is in no mood to do any favors for Washington.

However, Congress took things a step further, passing a Russian uranium import ban. It’s a tricky move, considering how much Russia controls the uranium market. Nevertheless, the political move does open the door to bolstering U.S. nuclear fuel production, which should be a positive for CCJ stock.

CCJ May be More Undervalued Than It Looks

Of course, there’s no such thing as a perfect investment. One of the flaws that CCJ stock suffers from is that it appears overvalued. For example, shares trade at around 11.41x trailing-year revenue. While it’s difficult to appropriately peg uranium producers, it’s a blistering multiple compared to the metals and mining sector.

That said, analysts, on average, are projecting revenue to hit $2.25 billion at the end of this year. If so, that would be up 19.2% from last year’s result of $1.89 billion. Further, the most optimistic target calls for sales of $2.4 billion. Given the fundamentals of high demand and potential supply disruption, that could be a very reasonable target.

Assuming a share count of 434.63 million, CCJ stock is trading at roughly 8.8x projected 2024 high-side revenue. It’s not objectively undervalued, but it is priced more attractively relative to these future revenue projections than its current price-to-sales multiple suggests.

Is Cameco Stock a Buy, According to Analysts?

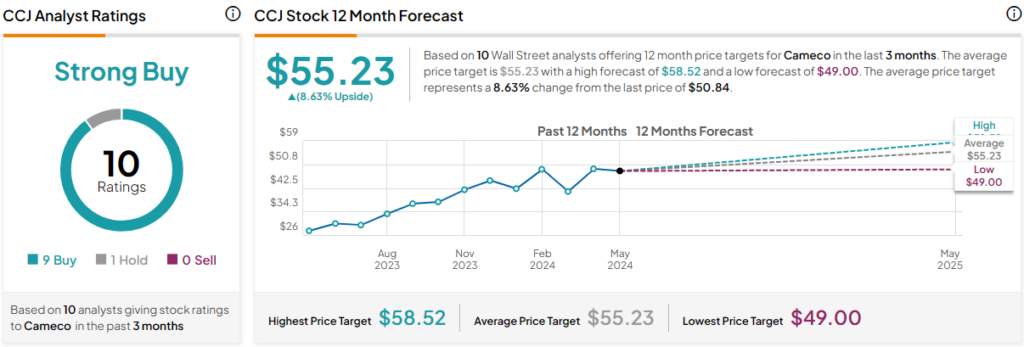

Turning to Wall Street, CCJ stock has a Strong Buy consensus rating based on nine Buys, one Hold, and zero Sell ratings. The average CCJ stock price target is $55.23, implying 8.6% upside potential.

The Takeaway: CCJ Stock Is a Marathon, Not a Sprint

While options traders didn’t care for Cameco’s Q1 earnings results, those who are skeptical about the company may be missing the forest for the trees. It’s an unignorable reality that the U.S. and likely other advanced economies need power.

At the same time, the geopolitical front is threatening to disrupt energy-related supply chains, which has forced action that appears favorable to Cameco. Therefore, with CCJ stock poised to rise higher, it could be a discounted opportunity, even though it doesn’t look like it on paper.