The annual Buffett Shareholders' Meeting, which can be called the “Spring Festival Gala for the Investment Industry,” was held yesterday. More than 40,000 shareholders attended the summit to listen to the wise man's profound insight.

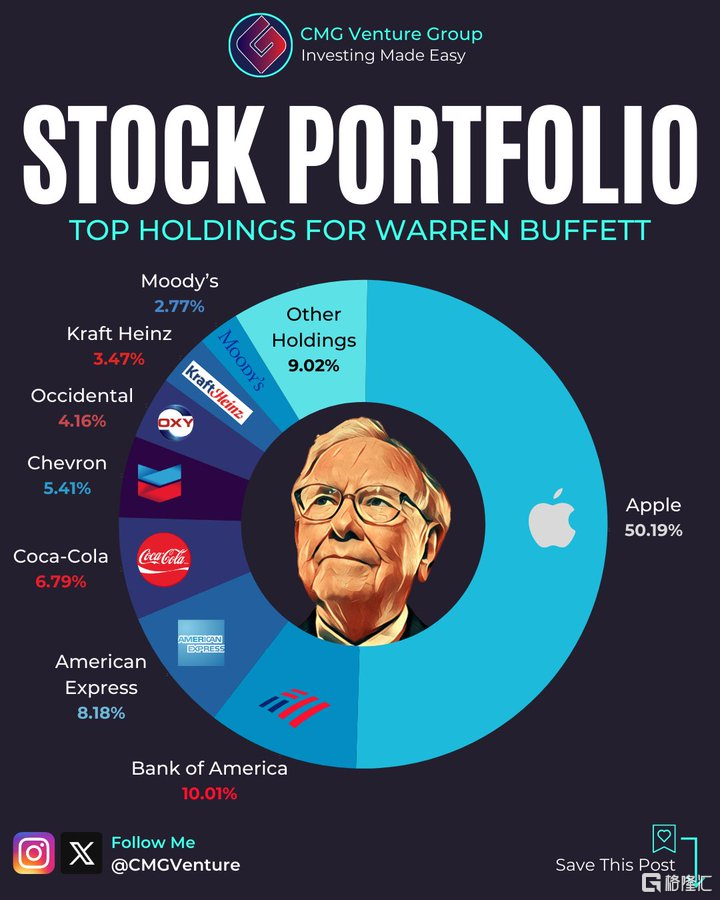

Berkshire Hathaway recorded revenue of 89.869 billion yuan and net profit of 12.702 billion yuan in the first quarter of this year, both exceeding expectations. At the same time, cash reserves continued to accumulate and will reach 200 billion US dollars by the end of June. 75% of equity investment is concentrated in Apple, Bank of America, American Express, Coca Cola, and Chevron.

This year's shareholders' meeting was particularly special. Since Munger passed away last year, 94 year-old Buffett will bring his confirmed successors Greg Abell and Ajit Jahn for a question-and-answer session. I also don't know how many years this combination will last.

How did Buffett perform at the Berkshire Hathaway Shareholders' Meeting without Munger?

How did Buffett perform at the Berkshire Hathaway Shareholders' Meeting without Munger?

01

Lao Ba is extremely cautious about investing in technology stocks, and only starts when he understands it. For example, Berkshire hasn't even touched AI, which is currently popular.

At the beginning of the Q&A, a very sharp question was raised: Since we are optimistic about Apple, why cut our holdings drastically?

Berkshire Hathaway's quarterly report shows that Apple's shareholding value dropped from 174.3 billion US dollars to 135.4 billion US dollars. I believe many people want to use this issue to spy on Buffett's views on changes in Apple's moat. Coincidentally, Apple CEO Tim Cook was also present today.

Now that it's here, Apple is the only Berkshire shareholding ratio and is also the largest market capitalization company with a fault line. There are indeed some dangerous signs in this year's performance.

The iPhone, which contributed the most revenue, fell 10.5% year over year in this quarter, and revenue in Greater China fell 8%. According to IDC data, Apple phone shipments in the first quarter fell 9.6% year on year, while in the Chinese market they fell 6.6% year on year. However, Apple recently immediately announced an unprecedented share repurchase of 110 billion US dollars, an increase of 22% over last year, and raised the dividend to 25 US dollars per share. Under these conditions, they still want to reduce their holdings, and there is some reason for investors to worry.

On this issue, Buffett concluded, “Unless there is a dramatic event that actually changes the allocation of capital, we will use Apple as our biggest investment.”

The original purpose of reducing holdings was that the US government, which is burdened with a huge fiscal deficit, may raise the federal tax rate in the future. Berkshire's current tax rate is still at a low level, and selling apples is a tax avoidance measure to deal with future high tax rates.

AI, which is currently all the rage, is a topic that Lao Ba cannot avoid. Although he expressed humility about his perception of AI, he also proposed the characteristics of a double-edged sword, and its influence is comparable to that of nuclear weapons.

He mentioned that AI not only has the potential to do good deeds, but can also be used for bad purposes, such as fraud. He mentioned that generative AI may be used to create realistic fake images or videos for illegal activities such as scams. Just like nuclear weapons, when the US side used it to end war in World War II, it also knew that it could end civilization, and eventually chose to “release the elves from the bottle.”

Also, when asked which Berkshire business has the greatest risk in the face of AI, Buffett pointed out that any labor-intensive industry may face the threat of AI. He believes that AI technology may change the nature of work and improve efficiency, but it may also lead to a redistribution of the labor force.

Focusing more closely, I asked about the impact of AI-enabled autonomous driving on the auto insurance business. If Tesla's driverless business can be carried out smoothly, the risk level can be reduced by half compared to humans driving their own cars, then does that mean a sharp decline in the auto insurance business volume.

Buffett believes that autonomous driving has not yet been fully implemented, and the accuracy of the data experience still needs to be verified. Even if Tesla's data is accurate, it doesn't mean that the average risk incidence rate will decrease, and Tesla also says that they want to sell insurance themselves, but it's still not clear whether this model will succeed.

Regarding the NEV industry, Buffett didn't explain too much about reducing their holdings at BYD. The changes are difficult. There is uncertainty about whether NEVs will become the only trend, but apparently this is not their betting choice.

Buffett said that BYD's investment is quite similar to the purchase of Japan's five major trading companies five years ago. They are all making relatively large investments outside of the US, so they must carefully select targets.

But outside of the US, how does Buffett consider the global market?

02

Buffett's failure to give detailed explanations on investing in Japanese stocks at this shareholders' meeting left quite a few people disappointed because of the recent huge returns and continuous movements of this investment, which has long attracted close attention from the market.

Arguably, this is Buffett's largest investment layout in overseas markets.

Berkshire has been continuously financing in Japan since September 2019, using credit to buy Japanese stocks in Japanese yen. It began announcing a 5% shareholding in five Japanese trading companies (Marubeni, Mitsubishi, Mitsui, Sumitomo, and Itochu) in August 2020. According to the closing price at the time of disclosure, the total market value of its holdings reached US$6.25 billion at that time. Since then, Berkshire has increased its holdings in these five trading companies over the years.

As of February of this year, Berkshire already held about 9% of the shares in these five Japanese trading companies. However, the stock prices of these trading companies have increased by an average of more than 1.9 times since Berkshire began investing (if calculated from 2020, Marubeni, Mitsubishi, Mitsui, Sumitomo, and Itochu rose 508%, 431%, 387%, 264%, and 220%, respectively), and Berkshire's profits from the five major trading companies have exceeded 12 billion US dollars.

And these investments, Buffett can be said to be a complete “white wolf in empty gloves,” spending almost nothing of his own money.

Since issuing its first Japanese yen bond in 2019, Berkshire has continued to issue Japanese yen bonds as if it were an addiction. According to statistics, 32 of the 40 bonds issued in the past have been Japanese yen bonds. In September of last year, it issued about 7.6 billion US dollars in yen bonds.

On April 18 this year, Berkshire once again issued 263.3 billion yen (about 1.71 billion US dollars) of yen bonds.

Some of these Japanese yen bonds have maturities of more than 30 years, and interest rates are extremely low, with interest rates of only 0.5%. It can be said that it was just in time for Japan to end the negative interest rate window period.

Now that the Bank of Japan intends to enter the interest rate hike cycle, there will be no such cheap capital in the future.

Buffett, on the other hand, used all of these ultra-low cost funds to buy the five major trading companies. The latter not only brings about 14% of Berkshire's acquisition, but also has a very impressive dividend every year (according to reports, an average annual dividend rate of 5%), and share buybacks to increase the value of the stock.

However, these five major trading companies all have a very important economic position in Japan and the world. They control almost 90% of the Japanese industry, and operate steadily, so there is no need to worry about business risks.

In other words, Berkshire uses funds at 0.5% interest rate costs to buy assets with a 5% return, and this alone can earn at least 4% of the price difference.

Whether it's the spread between the interest rate for issuing bonds and the dividend rate, or using Japanese yen bonds to buy the five major trading companies to get huge returns on market capitalization growth, Buffett's investment in Japanese stocks is definitely extremely profitable. Even if the yen depreciates 50% against the US dollar from 2020 to now, the overall return is still extremely impressive.

After all, this itself is an “empty glove white wolf” that costs almost nothing.

Buffett's answers also seem to confirm his optimism about continuing to invest in Japanese stocks. In addition, he recently issued a large amount of Japanese yen bonds, so it is not ruled out that they will continue to increase Japanese stocks.

03

By the end of the first quarter, Berkshire's cash reserves reached a record high of $189 billion. And its management scale last year was $347.358 billion.

This means that its position size is only around 60%.

A long time ago, Berkshire's cash reserves exceeded 100 billion dollars, and in recent years there have been no major investments.

Even if they invest heavily in Japanese stocks now, they use the method of borrowing eggs, and basically don't need to spend their own money.

Many people have always wondered if Buffett was too cautious and conservative in holding such a huge amount of cash flow, wasting 100 billion dollars of cash assets in vain, and not making it exert better value.

Lao Ba explained, “We would love to spend this money, but we won't spend it unless we think what we're doing is very risky and can bring us a lot of money.”

This is actually very much in line with Lao Ba's “baseball theory”. Wait for a good time with very little risk and great rewards, then swing at the right time. If he didn't have such an opportunity, he'd rather not take action.

Not only is the current economic environment in the US much more uncertain and stressful than before, but the current interest rate level of 5.4% is also clearly high. In this environment, even Buffett, who has been firmly betting on the US national transportation for a long time, can't find many mobile meetings that make him feel comfortable.

Buffett revealed that Berkshire is evaluating investment opportunities in Canada. However, he believes that India has many opportunities, and may even have similar opportunities to invest in Japan. However, Berkshire's opinion on India is not deep enough, and no clear opportunities have been explored.

At the current level of US dollar interest rates, the return on a risk-free asset such as cash itself is high enough.

This is also the reason why Buffett holds huge cash assets in US dollars while issuing huge US dollar bonds to buy Japanese stocks.

This kind of operation can be said to have perfectly captured fund risk control, international exchange rate difference dividends, and leveraged investment.

On the other hand, Berkshire's concept of holding huge cash assets and putting safety and prudence first has also enabled it to obtain more hidden benefits unmatched by other investment institutions.

Berkshire's risk control management, which is more stable than Bank of America, allows it to form a strong brand value, making it easier for its insurance and other companies to be in a more favorable position when developing business operations, such as financing and acquisition negotiations, and can be obtained at a lower cost.

For example, the reason behind the Japanese investment, where you can wear white wolves empty-handed at almost no cost, is based on their strong brand value endorsement. Otherwise, it would certainly not be that easy for other international investment banks to take advantage of Japanese assets in the same way; at least the five major trading companies would not easily cooperate.

Comparatively speaking, there are many major international investment banks, but few can achieve such large-scale and continuous success.

For example, SoftBank Group, Sun Zhengyi has successfully invested in many super unicorns in the Internet field, but investors are also frightened by the fact that they can easily lose tens of billions of dollars in the face of headwinds.

Therefore, Sun Zhengyi is regarded by investors as a “gambler” of fund investment rather than a “stock god.” SoftBank's shareholders' meeting will not attract the attention of global shareholders.

The same goes for Sister Mu Dou, who exclusively bets on the tech circuit. Although every trading move she makes is a source of buzz in the market, the focus of people's attention is only that she is “betting” again, that's all.

Not to mention all kinds of star fund managers in our country who bet on a single track became popular and quickly fell to the altar.

Whether it's their ideas, insight, conduct, or layout methods, the gap between them and Buffett can indeed be seen to be so huge that it is difficult to bridge.

Editor/Jeffrey

没有芒格的伯克希尔哈撒韦股东大会,巴菲特如何表现?

没有芒格的伯克希尔哈撒韦股东大会,巴菲特如何表现?