Whales with a lot of money to spend have taken a noticeably bullish stance on Qualcomm.

Looking at options history for Qualcomm (NASDAQ:QCOM) we detected 36 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $376,129 and 26, calls, for a total amount of $2,024,047.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $220.0 for Qualcomm over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Qualcomm options trades today is 1760.45 with a total volume of 6,590.00.

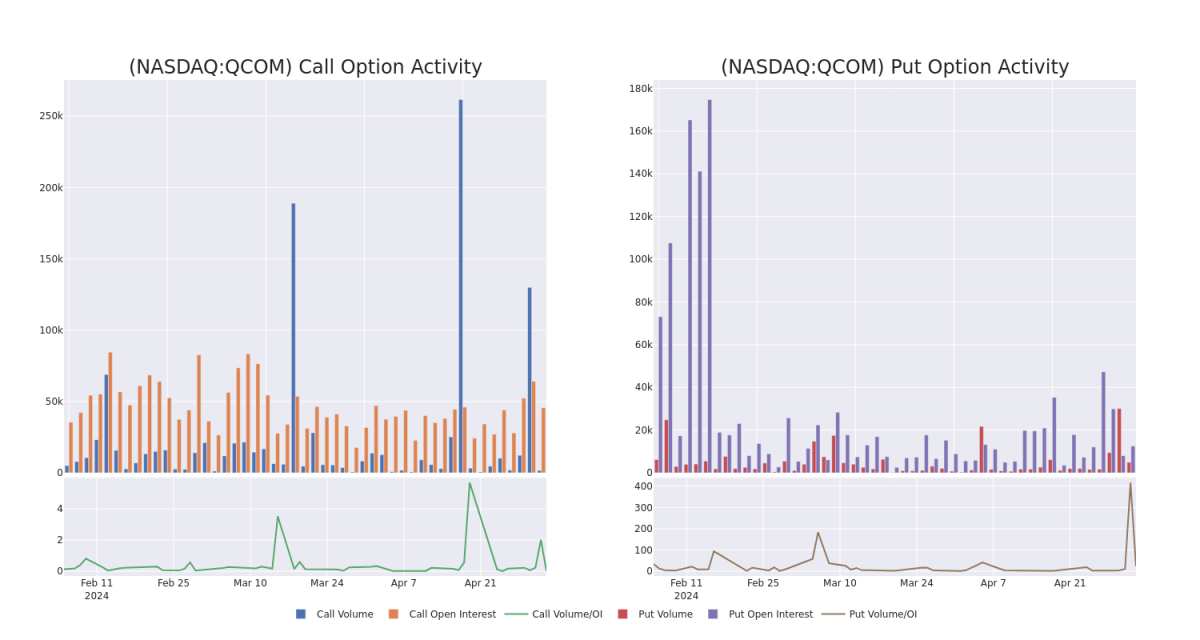

In the following chart, we are able to follow the development of volume and open interest of call and put options for Qualcomm's big money trades within a strike price range of $110.0 to $220.0 over the last 30 days.

Qualcomm Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | CALL | SWEEP | BULLISH | 06/21/24 | $65.45 | $64.7 | $64.7 | $115.00 | $452.9K | 598 | 6 |

| QCOM | CALL | TRADE | BEARISH | 01/16/26 | $73.65 | $72.7 | $72.7 | $115.00 | $218.1K | 61 | 0 |

| QCOM | CALL | SWEEP | BULLISH | 05/03/24 | $64.85 | $62.6 | $64.52 | $115.00 | $193.5K | 31 | 30 |

| QCOM | CALL | SWEEP | BULLISH | 05/03/24 | $2.08 | $1.89 | $2.0 | $180.00 | $136.0K | 3.9K | 328 |

| QCOM | CALL | TRADE | BEARISH | 08/16/24 | $14.85 | $13.9 | $14.25 | $175.00 | $114.0K | 13 | 116 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

After a thorough review of the options trading surrounding Qualcomm, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Qualcomm's Current Market Status

- With a volume of 6,771,381, the price of QCOM is down -0.46% at $179.28.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 89 days.

Professional Analyst Ratings for Qualcomm

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $192.0.

- An analyst from HSBC persists with their Buy rating on Qualcomm, maintaining a target price of $190.

- Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Qualcomm, targeting a price of $200.

- Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Qualcomm with a target price of $170.

- An analyst from Benchmark downgraded its action to Buy with a price target of $200.

- An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Qualcomm options trades with real-time alerts from Benzinga Pro.