Deep-pocketed investors have adopted a bullish approach towards Applied Mat (NASDAQ:AMAT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMAT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Applied Mat. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 33% bearish. Among these notable options, 10 are puts, totaling $561,318, and 8 are calls, amounting to $286,378.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $210.0 for Applied Mat over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Applied Mat's options for a given strike price.

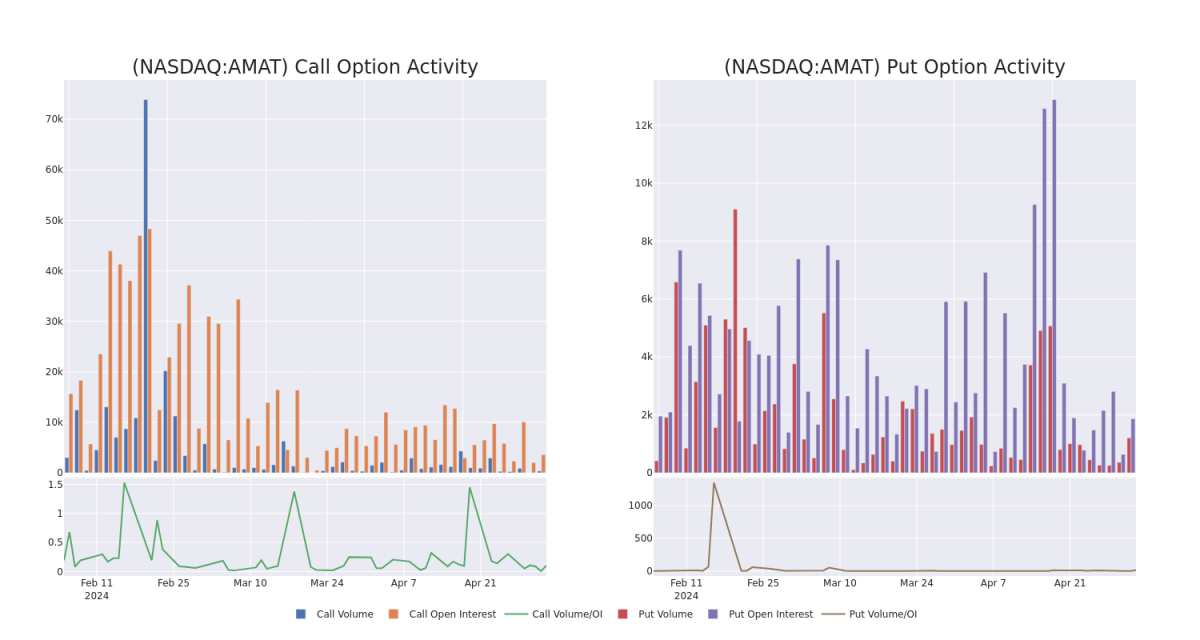

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat's whale activity within a strike price range from $70.0 to $210.0 in the last 30 days.

Applied Mat Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | PUT | TRADE | NEUTRAL | 01/16/26 | $32.5 | $30.05 | $31.19 | $200.00 | $155.9K | 156 | 0 |

| AMAT | PUT | TRADE | BEARISH | 01/16/26 | $36.0 | $35.75 | $36.0 | $210.00 | $68.4K | 23 | 1 |

| AMAT | PUT | SWEEP | BULLISH | 01/17/25 | $25.9 | $25.55 | $25.55 | $210.00 | $63.8K | 130 | 0 |

| AMAT | CALL | TRADE | BULLISH | 07/19/24 | $56.6 | $55.8 | $56.6 | $150.00 | $56.6K | 74 | 10 |

| AMAT | PUT | SWEEP | BEARISH | 10/18/24 | $14.8 | $14.65 | $14.8 | $195.00 | $53.2K | 80 | 363 |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

Applied Mat's Current Market Status

- With a volume of 1,720,017, the price of AMAT is up 3.32% at $204.49.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

What The Experts Say On Applied Mat

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $260.0.

- An analyst from Evercore ISI Group downgraded its action to Outperform with a price target of $260.

- Showing optimism, an analyst from Cantor Fitzgerald upgrades its rating to Overweight with a revised price target of $260.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Applied Mat with Benzinga Pro for real-time alerts.