Whales with a lot of money to spend have taken a noticeably bullish stance on Cardinal Health.

Looking at options history for Cardinal Health (NYSE:CAH) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $175,854 and 6, calls, for a total amount of $365,811.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $115.0 for Cardinal Health during the past quarter.

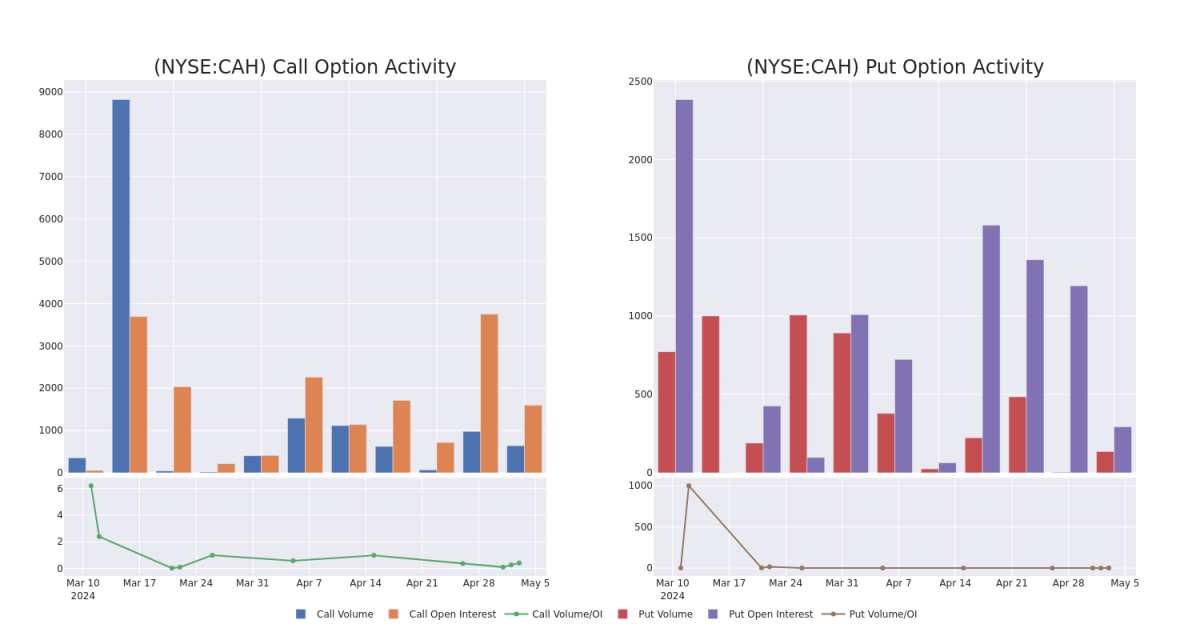

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cardinal Health's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cardinal Health's significant trades, within a strike price range of $70.0 to $115.0, over the past month.

Cardinal Health Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAH | CALL | TRADE | BULLISH | 01/17/25 | $3.1 | $2.75 | $3.1 | $115.00 | $139.5K | 1.3K | 1 |

| CAH | PUT | SWEEP | BULLISH | 01/17/25 | $7.8 | $7.0 | $7.3 | $100.00 | $105.1K | 183 | 0 |

| CAH | PUT | TRADE | BULLISH | 01/17/25 | $5.6 | $5.1 | $5.2 | $95.00 | $70.7K | 111 | 136 |

| CAH | CALL | TRADE | BULLISH | 06/20/25 | $5.7 | $5.5 | $5.7 | $115.00 | $68.4K | 154 | 0 |

| CAH | CALL | SWEEP | NEUTRAL | 05/03/24 | $20.6 | $19.0 | $19.02 | $80.00 | $64.6K | 73 | 16 |

About Cardinal Health

Cardinal Health is one of three leading pharmaceutical wholesalers in the us, engaged in sourcing and distributing of branded, generic, and specialty pharmaceutical products to pharmacies (retail chains, independent, and mail order), hospitals networks, and healthcare providers. Along with Cencora and McKesson, the three comprise well over 90% of the us pharmaceutical wholesale industry. Cardinal Health also supplies medical-surgical products and equipment to healthcare facilities in North America, Europe, and Asia.

Having examined the options trading patterns of Cardinal Health, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Cardinal Health Standing Right Now?

- Currently trading with a volume of 1,194,353, the CAH's price is down by -4.37%, now at $98.48.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 102 days.

What Analysts Are Saying About Cardinal Health

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $112.33333333333333.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Underweight rating for Cardinal Health, targeting a price of $94.

- An analyst from Baird persists with their Outperform rating on Cardinal Health, maintaining a target price of $128.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Cardinal Health, targeting a price of $115.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cardinal Health with Benzinga Pro for real-time alerts.