Hershey (HSY) Q1 Earnings Top, Positive Price Realization Aids

The Hershey Company HSY kickstarted 2024 on a strong note, with the first-quarter top and bottom lines increasing year over year and beating their respective Zacks Consensus Estimate. Sales grew across all three segments.

Hershey’s investments in innovation, marketing and in-store execution have been aiding, leading to better consumer engagement and enhanced market share performance across segments. Also, the successful implementation of a new ERP system marked a notable step toward meeting the company's agility and efficiency goals. Management remains committed to its strategies amid the recent business volatility.

Quarter in Detail

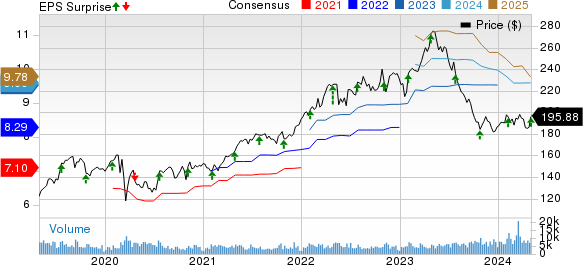

Hershey posted adjusted earnings of $3.07, which increased 3.7% year over year and surpassed the Zacks Consensus Estimate of $2.74.

Hershey Company (The) Price, Consensus and EPS Surprise

Hershey Company (The) price-consensus-eps-surprise-chart | Hershey Company (The) Quote

Consolidated net sales of $3,252.7 million rose 8.9% from the year-ago quarter, cruising past the Zacks Consensus Estimate of $3,124 million. Organic sales on a constant-currency (cc) basis ascended 8.6% on price realization (up 5.2%). Additionally, volumes advanced 3.4% owing to higher everyday core U.S. confection stemming from greater shipments in expectation of the implementation of the company’s ERP system, which was concluded in the second-quarter beginning.

The adjusted gross margin came in at 44.9%, down 170 basis points (bps) year over year due to increased commodity costs, partly made up by price realization and productivity gains. Our model suggested an adjusted gross margin contraction of 250 bps to 44.1%.

Selling, marketing and administrative expenses rose 6.3% year over year on increased levels of media, capability and technology investments. Advertising and related consumer marketing expenses moved up 12%, with elevated investments across all segments. Selling, marketing and administrative expenses, excluding advertising and related consumer marketing, increased 3.3% due to wage and benefits inflation, capability and technology investments.

The adjusted operating profit of $861 million grew 3.7% year over year due to higher sales. However, the adjusted operating profit margin contracted 130 bps to 26.5%. The downside can be attributed to higher investments in brand and capabilities, along with elevated commodity costs, partially compensated by the benefits of price realization and productivity improvements.

Segment Details

The North America Confectionery segment’s net sales increased 10.4% year over year to $2,707.3 million due to the abovementioned higher shipments. The company’s U.S. candy, mint and gum (CMG) retail takeaway for the 12-week ended Apr 14, 2024 rose 1.1% (in multi-outlet plus convenience store channels or MULO+C). The company’s CMG’s share declined about 10 bps year over year. The North America Confectionery segment’s income advanced 6.8% to $948.2 million.

The North America Salty Snacks segment’s net sales rose 1.9% from the year-ago quarter to $275.1 million. Hershey's U.S. salty snack retail takeaway for the 12 weeks ended Mar 31, 2024 in MULO+C declined 4.1% year over year. The segment witnessed a fall in SkinnyPop ready-to-eat popcorn takeaway due to persistent category softness. The segment’s income decreased 17.3% year over year to $38.7 million.

Net sales in the International segment grew 1.8% year over year to $270.3 million. At cc, organic net sales declined 1.3%. Increased shipments related to the aforementioned ERP implementation, along with increases in Europe and Latin America, were countered by planned decreases in Mexico associated with the dairy beverage product line discontinuation in 2023. The segment’s income was $42.8 million, down by $12.2 million.

Other Financials & Guidance

HSY ended the quarter with cash and cash equivalents of $520.4 million, a long-term debt of roughly $3,790 million and a total shareholders’ equity of $4,108.3 million. Management expects capital expenditure of $600-$650 million for 2024 aimed at core confection capacity expansion and constant investments in digital infrastructure.

2024 Guidance

Management expects year-over-year net sales growth of 2-3% for 2024. The company expects adjusted earnings per share (EPS) to be unchanged year over year at $9.59 in 2024.

Management anticipates a reported and adjusted effective tax rate of nearly 13% and interest expenses of around $165-$175 million. Additionally, it expects other expenses of $220-$230 million.

This Zacks Rank #3 (Hold) stock has risen 4.4% in the past six months compared with the industry’s growth of 3.7%.

3 Strong Bets

Here, we have highlighted three better-ranked stocks, namely Colgate-Palmolive CL, Vital Farms VITL and Celsius Holdings CELH.

Colgate-Palmolive, which manufactures and sells consumer products, currently carries a Zacks Rank #2 (Buy). CL delivered a positive earnings surprise of 4.4% in the trailing four quarters, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Colgate-Palmolive’s current fiscal-year sales and earnings calls for growth of 4% and nearly 9%, respectively, from the year-ago reported numbers.

Vital Farms offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 155.4%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 19.5% and nearly 30.5%, respectively, from the year-ago reported numbers.

Celsius Holdings, which develops, processes, markets, distributes and sells functional energy drinks and liquid supplements, currently carries a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings implies growth of 41.6% each from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance