Deep-pocketed investors have adopted a bullish approach towards Caterpillar (NYSE:CAT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CAT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 23 extraordinary options activities for Caterpillar. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 39% leaning bullish and 21% bearish. Among these notable options, 17 are puts, totaling $1,057,581, and 6 are calls, amounting to $329,046.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $280.0 to $365.0 for Caterpillar over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $280.0 to $365.0 for Caterpillar over the last 3 months.

Volume & Open Interest Development

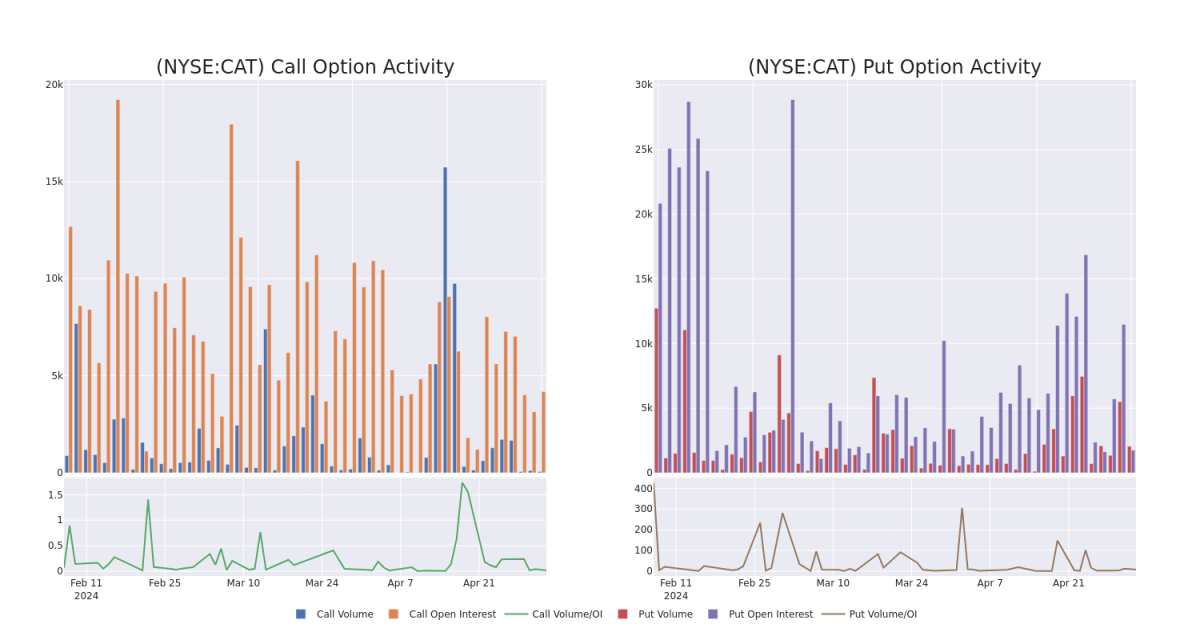

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Caterpillar's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Caterpillar's significant trades, within a strike price range of $280.0 to $365.0, over the past month.

Caterpillar Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | SWEEP | BEARISH | 06/21/24 | $20.15 | $19.4 | $19.68 | $330.00 | $98.4K | 2.0K | 55 |

| CAT | PUT | SWEEP | BULLISH | 08/16/24 | $17.0 | $16.4 | $16.42 | $340.00 | $88.7K | 387 | 234 |

| CAT | PUT | TRADE | BULLISH | 08/16/24 | $19.25 | $17.45 | $18.12 | $340.00 | $81.5K | 387 | 64 |

| CAT | PUT | SWEEP | BULLISH | 08/16/24 | $24.45 | $24.0 | $24.1 | $350.00 | $79.5K | 243 | 234 |

| CAT | PUT | SWEEP | NEUTRAL | 08/16/24 | $23.25 | $21.3 | $22.3 | $350.00 | $77.8K | 243 | 16 |

About Caterpillar

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Having examined the options trading patterns of Caterpillar, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Caterpillar

- Trading volume stands at 696,777, with CAT's price up by 0.5%, positioned at $337.11.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 88 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Caterpillar with Benzinga Pro for real-time alerts.