Source: Orthodox Bureau

In the world of liberal capitalism, Japan's comprehensive trading houses give full play to the advantages of the planned economy by virtue of their superb ability to integrate the industrial chain.

Japan's economy can dominate the world, some people say it depends on science and technology, some people say it depends on education, and some people say it depends on the spirit of craftsmen.

But few people notice.There is a unique type of enterprise in Japan: integrated trading houses.

Everything from instant noodles to missiles; from the sale of goods to entertainment and sightseeing. Integrated trading houses are a powerful secret weapon in Japan.

Formerly known as a trading company, Hyundai is an integrated company

It can be said that the history of Japanese comprehensive trading houses is long.

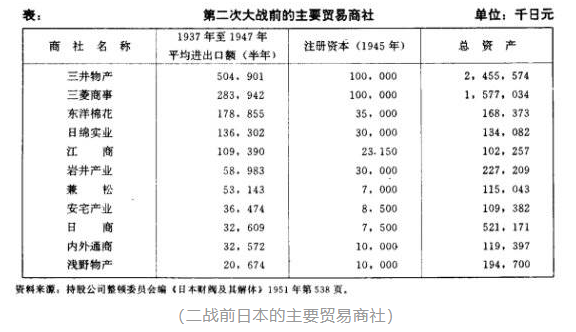

The development of several large integrated trading houses can be traced back to the end of the 19th century, roughly along two routes. One is headed by Mitsui and Mitsubishi, with the smaller Sumitomo Trading Company, which operates a variety of products and services, as the starting point; the other is to change from a professional trading company to an integrated trading company along the main line of development of Itochu, Marubeni, Dongmian, Kansatsu, Nissan, and so on.

After World War II, with the take-off of the Japanese economy, the comprehensive trading company undertakes the important task of importing resources, importing and exporting products and opening up overseas markets that a trading company should have, and has become an important leading force in the rapid development of Japan's economy after World War II. It has also successfully developed a new business model.

If you want to know how strong the Japanese integrated trading company is, you can only look at the strength of Mitsui and Mitsubishi.

Founded in 1876, Mitsui is the first comprehensive trading company in modern Japan. Initially started with import and export trade, the export products are mainly coal, and the imported products are mainly cotton and textile machinery. By 1911 before World War I, Mitsui's imports and exports accounted for 27% of Japan's total trade, 96% of coal, 40% of cotton yarn, 51% of raw cotton imports, and 38% of imports of machinery, vehicles and other manufactured goods.

Mitsui Integrated Trading Co., Ltd. experienced a restructuring in 2016, Mitsui products transformed from "resource No.1" to open up non-resource areas. Mitsui products Co., Ltd. rose 89 places in the 2019 Fortune Global 500, with a profit of $3735900000, ranking second among the nine largest companies.

Mitsubishi, the No. 1 company, had revenues of $145243.3 million in 2019, making it the second-largest company in Japan in 2019. Mitsubishi Corporation is a forward-looking person in pursuit of balanced and all-round development. From mining, paper, electrical, machinery, care for the elderly, chemistry, energy to real estate, environment, fiber and other industries, from raw material manufacturers, product manufacturers to sales agents, retail and other stages, master the industry upstream to dirty trade, lead the development of the industry.

Like Mitsui, Mitsubishi's strategic goal now is to shift to investments that are less affected by changes in resource prices.

Give full play to multiple functions throughout the entire industrial chain

The biggest difference between integrated trading houses and production enterprises and financial enterprises is its strong strength and all-inclusive functions.

The traditional functions of organizing production, entrepot trade, financial investment, transportation and safekeeping, technology transfer and market research are naturally out of the question. Next, let's take a look at several unique skills of comprehensive trading houses.

First of all, the trading company is a sharp-eyed intelligence agency.

One of the secrets of comprehensive trading houses to be invincible in the world is to collect, organize and process all kinds of information extensively and quickly. Especially in the current era of information, the ability to process information quickly is particularly important.

Take Itochu Corporation, a large computer center in Yokohama, which can deliver morning Japanese newspapers with up to 30 pages in 10-20 seconds. At present, Itochu has as many as 25000 telexes and 9000 faxes a day. International calls are even more numerous, and it is said that the amount of information exceeds that of the CIA of the United States.

In 1973, when the world was shocked by the oil crisis in the Middle East-the news of rising oil prices, only the Japanese comprehensive trading company had already known about it and began to actively seek trade cooperation with oil countries in the Middle East.

Taking advantage of the "east wind" of this crisis, Japan's oil trade in the Middle East, which is mainly bridged by Marubeni and Mitsui products, has grown rapidly. In a few years, the share of Middle East oil in Japan's total imports has risen from 10% to 30%.

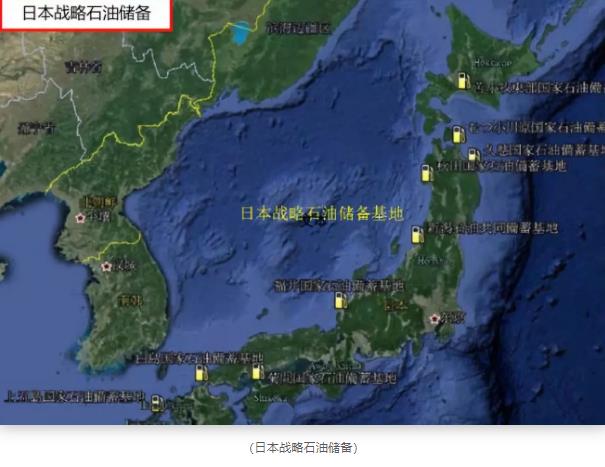

Japan has always been short of oil, and imported oil is not only used, but also stored. According to the oil strategic reserve requirements announced by the International Energy Agency (IEA), the national oil security reserves should be equal to 90 days of domestic consumption. As early as 20 years ago, Japan's private oil reserves have reached 85 days of consumption, which is mainly due to the work of commercial companies. In addition, 10 national oil reserve bases have reserved 91 days of consumption.

In other words, even if all Japanese oil import channels are cut off, its reserves can support the country's consumption for nearly half a year. Comprehensive trading houses have made great contributions to Japan's national security.

Secondly, the trading company is the actuarial institution of intelligent investment.

Integrated trading houses make use of the advantages of a wide range of businesses to make extensive investments overseas. According to statistics, each Japanese comprehensive trading company has an average of 90-120 branches or offices and offices abroad. Wei Jie, deputy general representative of Mitsui products China, said:

Today we have just announced a large energy project in Indonesia, which is a partnership between Mitsui products and Mitsubishi, each with a 25% stake. Japan has several of the largest energy projects in the world, all of which are the cooperation between our two companies.

Trading houses always use the smallest investment to get the maximum return, and they are the "senior investors". Bai Yimin, who has worked for Mitsui products China for 12 years, pointed out:

The trading company cultivates enterprises associated with the trading company, but the shareholding may be only 10%. It believes that after the support and growth of enterprises, the volume of transactions with trading houses will increase.

For example, Mitsubishi Trading Co., Ltd. holds a 10% stake in Japanese companies: Nippon synthetic (10.1%), Japanese ham (12.2%), Okamura production (11.8%), Pacific Metals (11.4%) and so on.

Third, the trading company is the storage expert of the industrial chain.

Comprehensive trading houses are particularly good at integrating the industrial chain, making use of the joint forces of upstream and downstream to formulate a long-term and stable strategy and accurately grasp every link of the economic chain.

For upstream enterprises, trading companies can start from the means of production to conserve them. Take the oil refining industry as an example, in order to provide sufficient supply for upstream enterprises, Shang Society specially invests in oil field exploration. Integrated trading houses will also take the initiative to share sales risks for production enterprises.

For example, according to the information collected, the merchant society regularly puts forward bulk orders to the production enterprises and agrees on the appropriate price. After the two parties sign the supply contract, the risk caused by the price fluctuation in the market will be shared by the integrated trading company and the production enterprise.

Similarly, for downstream retail enterprises, trading firms also share risks with sales companies in the form of reciprocity or equity participation. For example, the largest shareholder of the family convenience store is Itochu, with a shareholding of 50.11%.

On the surface, the integrated business takes risks everywhere, but the superb integration ability of the industrial chain reduces the risk of the business and earns the maximum profit.

The vanguard of the consortium

In the article "controlling the economy, manipulating politics and waging war: you know nothing about the power of Japanese consortia", our bureau introduced the powerful power of Japanese consortia.

If the Japanese consortium is an army, then the integrated trading company is in the vanguard.

The Japanese consortium consists of three parts: the financial system, comprehensive trading houses and industries. The financial system is the capital base of the group, which mainly plays the role of financing and aggregates the financial resources; the industry is like the executor, transforming the financial resources into physical objects.

Integrated trading houses are like the sensitive nose of the market, judging where there is money, and deciding where to invest it, so as to get the maximum return.

As a bright light, the driving multiple of comprehensive business investment is generally 9-10 times, that is, 100 million capital can bring nearly 1 billion of the total investment.

Japanese comprehensive trading houses almost monopolized the whole Japanese market and controlled most of the circulation channels, thus forming a closed market circulation system.

At the peak of the development of Japan's nine major trading houses in 1974, its transaction volume accounted for 32% of Japan's gross national product.

Therefore, Japan's domestic economic market has strong stability and strong anti-risk ability.

In terms of overseas expansion, the import and export volume of the nine comprehensive trading houses accounts for 50% of Japan's total import and export volume, and has a strong foreign trade strength, which has made great contributions to Japan's overseas expansion.

Looking at the global economy, integrated trading houses optimize the allocation of world resources. In the 1994 ranking of the world's largest trading companies by Happiness magazine, nine major trading houses monopolized the top nine. As the carrier of global economic flow, trading companies play the function of optimizing the allocation of human, material and financial resources, and integrated trading companies are the mainstay among trading companies.

In 2013, the Fortune 500 listed 12 companies in the trading industry, including Mitsubishi, Mitsui, Marubeni, Itochu and Sumitomo, which all rose to varying degrees in 2019.

The strength of the Japanese comprehensive trading company is strong and has stood the test of time.

The power of "planned economy"

The rise in iron ore prices in recent years has been a disaster for Chinese steelmakers, while Japanese steelmakers, which have a huge demand for iron ore, are not worried at all.

This is because Japan's comprehensive trading houses, represented by Mitsui products, directly or indirectly own a large number of shares in local iron ore enterprises in the main producing areas of iron ore-Australia, Brazil, Canada and India.

In the introduction to Mitsui's official website, it said:

In 2003, it acquired a 15 per cent stake in valepar, the parent company of vale (formerly Vale SA), the world's largest iron ore producer and seller, and continued to expand the iron ore business in cooperation with Rio Tinto PLC and BHP Group Ltd. Based on the proportion of Mitsui property ownership, the holding output of iron ore has leapt to the fourth place in the world, with annual mining rights and interests exceeding 40 million tons.

With the increase in iron ore prices, the buyer Nippon Steel took the initiative to accept a higher price every time, but the entire Mitsui consortium benefited more because of the resource distribution of Mitsui products (the comprehensive trading company of the Mitsui consortium) upstream of the iron ore.

In other words, Japanese steel companies have paid more money, while Japanese trading houses have earned back the increase in iron ore prices by virtue of their shares. Just like putting the money in the left pocket into the right pocket, Japan as a whole has nothing to lose!

In the face of today's competition for resources, the business not only does not lose, but also can make a steady profit, which is enough to prove the power of the integrated business as a special economic entity.

This kind of power, the comprehensive trading company makes the Japanese economy have a kind of "planned economy" characteristic.

Specifically, the integrated trading company is not only the downstream of underwriting production, but also the provider of raw materials, which has the strength to integrate resources and help Japanese enterprises to exert their competitiveness to the extreme. Toyota's favorite "zero inventory" is also based on this.

"planned economy" should be our specialty.

Edit | Eric