Ultragenyx Pharmaceutical Inc (RARE) Q1 2024 Earnings: Misses EPS Estimates, Revenue Grows ...

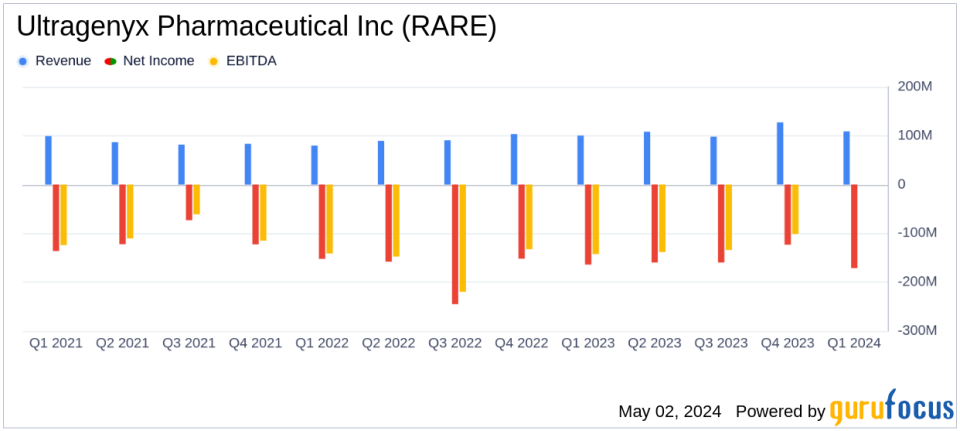

Total Revenue: Reported $109 million in Q1 2024, an 8% increase year-over-year, falling short of the estimated $116.01 million.

Net Loss: Increased to $170.68 million in Q1 2024 from $163.97 million in Q1 2023, with a net loss per share of $2.03, falling short of the estimated loss per share of $1.73.

Operating Expenses: Rose to $274 million in Q1 2024 from $254.6 million in Q1 2023, driven by higher research and development costs.

Cash Position: Ended Q1 2024 with $569 million in cash, cash equivalents, and marketable debt securities, down from $777.11 million at the end of 2023.

2024 Revenue Guidance: Reaffirmed total revenue guidance for 2024 to be between $500 million and $530 million.

Research Highlights: Positive interim Phase 1/2 data from GTX-102 Angelman syndrome study showed clinically meaningful improvement, with plans for a Phase 3 trial initiation by the end of 2024.

On May 2, 2024, Ultragenyx Pharmaceutical Inc (NASDAQ:RARE) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company, a prominent player in the biopharmaceutical sector focusing on rare and ultrarare genetic diseases, reported a net loss of $170.68 million or $2.03 per share, which did not meet the estimated earnings per share of -$1.73. Despite the larger-than-expected loss, the company achieved a total revenue of $109 million, reflecting an 8% increase year-over-year but slightly below the estimated $116.01 million.

About Ultragenyx Pharmaceutical Inc

Ultragenyx Pharmaceutical Inc is dedicated to identifying, developing, and commercializing innovative products for the treatment of serious rare and ultra-rare diseases. Its portfolio includes Crysvita for X-linked hypophosphatemia, Dojolvi for long-chain fatty acid oxidation disorders, and Mepsevii for Mucopolysaccharidosis VII, among others. The company's approach combines rapid clinical development and advanced therapy platforms to deliver novel treatments for complex genetic disorders.

Financial Performance Insights

The first quarter results illuminated several key financial dynamics. Crysvita, the company's leading product, generated $83 million, marking a 9% increase from the previous year, driven by significant growth in Latin America and Turkey. Dojolvi also showed robust performance with a 14% increase in revenue, totaling $16 million. However, the company faced escalated operating expenses, totaling $274 million due to increased investment in research and development and commercial product launches, contributing to the net loss.

Strategic Developments and Clinical Milestones

Ultragenyx is advancing its clinical pipeline with multiple Phase 3 programs and has recently completed enrollment for its osteogenesis imperfecta studies. The company also shared promising interim data from its Phase 1/2 study of GTX-102 for Angelman syndrome, setting the stage for a Phase 3 trial initiation slated for late 2024. These developments highlight Ultragenyx's commitment to addressing gaps in treatment for rare genetic diseases and enhancing its commercial product portfolio.

2024 Financial Guidance and Future Prospects

Looking ahead, Ultragenyx reaffirmed its 2024 revenue guidance, projecting totals between $500 million and $530 million. The company expects continued revenue growth from Crysvita and Dojolvi, alongside advancements in its clinical programs. Despite the current net loss, these factors provide a basis for potential future profitability and operational success.

Conclusion

While Ultragenyx Pharmaceutical Inc faces challenges with higher operational costs and a net loss this quarter, its growing revenue streams and robust clinical pipeline offer a solid foundation for future growth. The company's strategic focus on rare genetic diseases positions it uniquely in the biopharmaceutical industry, with potential for significant impact on patient care and shareholder value in the long term.

For more detailed information and updates, please visit Ultragenyx Pharmaceutical Inc's investor relations page.

Explore the complete 8-K earnings release (here) from Ultragenyx Pharmaceutical Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance