AAON Inc (AAON) Q1 2024 Earnings: Navigating Challenges with Strategic Growth Initiatives

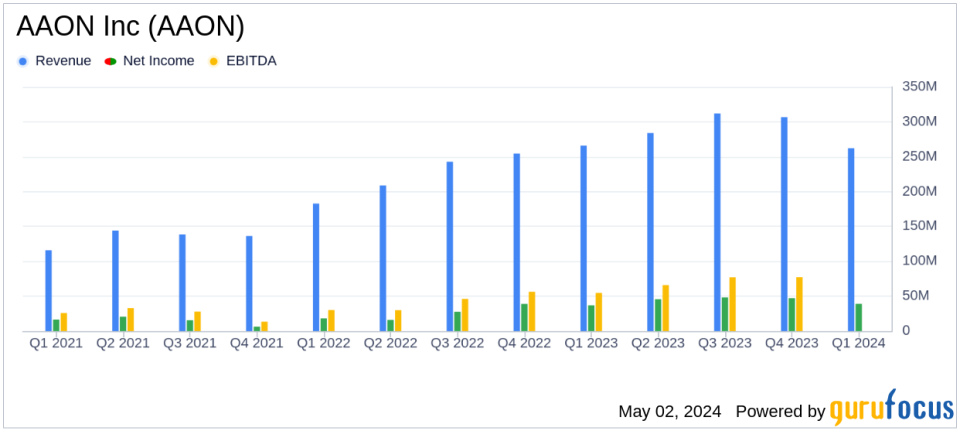

Revenue: Reported at $262.1 million, down 1.4% year-over-year, falling short of estimates of $284.81 million.

Net Income: Reached $39.02 million, up 6.0% from the previous year, slightly above the estimates of $39.00 million.

Earnings Per Share (EPS): Posted at $0.46, slightly below the estimated $0.47.

Gross Profit Margin: Expanded to 35.2% from 29.0% in the prior year, indicating improved profitability.

Operating Income: Increased to $46.97 million, showing a growth of 6.3% year-over-year.

Backlog: Ended the quarter at $558.4 million, down 6.9% year-over-year but up sequentially, indicating fluctuating demand dynamics.

Cash Flow from Operations: Strong performance with $92.4 million, significantly raised from $4.8 million in the same quarter last year.

On May 2, 2024, AAON Inc (NASDAQ:AAON), a leading manufacturer of air-conditioning and heating equipment, released its 8-K filing detailing the financial outcomes for the first quarter of 2024. The company reported a slight decrease in net sales by 1.4% year-over-year, totaling $262.1 million, which fell short of the analyst's revenue estimate of $284.81 million. However, earnings per share (EPS) of $0.46 aligned closely with the expected $0.47, showcasing a resilient operational strategy amidst market fluctuations.

AAON Inc specializes in providing HVAC solutions that cater to the commercial and industrial sectors, primarily in North America. The company's product range includes rooftop units, chillers, air-handling units, and more, designed to meet the diverse needs of new construction and replacement markets.

Financial Performance Insights

The first quarter saw a mixed performance across different business segments. Notably, the AAON Coil Products and BASX segments experienced declines of 27.4% and 9.3% respectively, while the AAON Oklahoma segment grew by 4.0%. Despite the sales volume decrease of 5.7%, the company benefited from a pricing strategy that contributed a 4.3% increase, helping to mitigate broader sales challenges.

Gross profit margin impressively expanded to 35.2% from 29.0% in the previous year, driven by favorable pricing relative to moderating cost inflation. However, selling, general, and administrative (SG&A) expenses rose to 17.3% of sales, reflecting increased professional fees and strategic long-term investments.

Strategic Operations and Future Outlook

AAON's CEO, Gary Fields, highlighted the quarter's mixed results but remained optimistic about future performance, citing strong bookings and backlog increases, particularly in the data center market. The company's proactive management of pricing and costs, coupled with strategic investments in production capacity and technology, are expected to bolster future results.

"Despite the slow start to the year, we believe results will continue to improve as we progress through 2024," stated Gary Fields.

Chief Financial Officer Rebecca Thompson noted the strong operational cash flow, which significantly increased to $92.4 million from $4.8 million in the prior year's quarter. This financial strength has enabled AAON to invest further in growth opportunities while maintaining a robust balance sheet with no outstanding debt on its revolving credit facility.

Challenges and Industry Dynamics

The company faces ongoing challenges, including supply chain constraints and the impending refrigerant regulations, which may cause market volatility. However, AAON's strategic focus on enhancing production efficiency and expanding its market presence in high-growth sectors like data centers positions it well to navigate these hurdles effectively.

Conclusion

While AAON Inc (NASDAQ:AAON) experienced a slight dip in revenue in the first quarter of 2024, its strategic initiatives have led to improved profit margins and strong cash flow, underscoring the company's resilience in a challenging market. With a clear focus on operational efficiency and market expansion, AAON remains poised for sustainable growth in the evolving HVAC industry.

Explore the complete 8-K earnings release (here) from AAON Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance