DraftKings Inc (DKNG) Surpasses Analyst Revenue Forecasts with Strong Q1 Growth, Raises 2024 ...

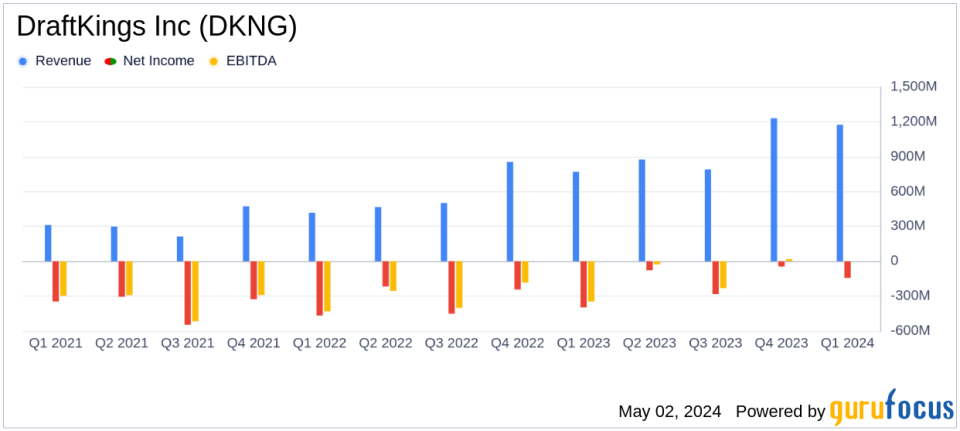

Revenue: Reported Q1 2024 revenue of $1,175 million, a 53% increase year-over-year, surpassing the estimate of $1,124.34 million.

Net Loss: Q1 2024 net loss was $142.57 million, an improvement from a net loss of $397.15 million in Q1 2023, but still above the estimated net loss of $137.41 million.

Earnings Per Share: Reported a loss of $0.30 per share, falling short of the estimated loss of $0.28 per share.

Adjusted EBITDA: Achieved $22.39 million, a significant improvement from a negative $221.61 million in the prior year's quarter.

Guidance Update: Raised 2024 revenue guidance to a range of $4.8 billion to $5.0 billion and Adjusted EBITDA guidance to between $460 million and $540 million.

Customer Growth: Monthly Unique Payers increased by 23% to 3.4 million, with Average Revenue per MUP rising 25% to $114.

Expansion: Launched online sportsbook in Vermont and North Carolina, contributing to increased customer acquisition and engagement.

DraftKings Inc (NASDAQ:DKNG) released its 8-K filing on May 2, 2024, revealing a significant 53% increase in revenue for the first quarter of 2024, amounting to $1,175 million, up from $770 million in the same period last year. This performance not only surpassed the analyst's revenue estimate of $1,124.34 million but also led the company to raise its revenue guidance for 2024 to a midpoint of $4.9 billion. The company's Adjusted EBITDA guidance midpoint was also increased to $500 million.

Company Overview

Founded in 2012, DraftKings started as a daily fantasy sports provider and expanded into online sports and casino gambling following the 2018 Supreme Court ruling that allowed states to legalize online sports wagering. DraftKings now holds a significant market share in the states it operates, offering online sports betting in 24 states and iGaming in seven. The company also operates a non-fungible token (NFT) marketplace and develops and licenses online gaming products.

Q1 Performance Highlights

The first quarter of 2024 was marked by robust customer engagement and the efficient acquisition of new customers, contributing to the impressive revenue growth. The expansion of DraftKings' Sportsbook offering into new jurisdictions like Vermont and North Carolina, coupled with a higher structural sportsbook hold percentage and improved promotional reinvestment for Sportsbook and iGaming, were significant growth drivers. Monthly Unique Payers (MUPs) increased by 23% year-over-year to 3.4 million, while Average Revenue per MUP (ARPMUP) saw a 25% increase to $114.

Financial Position and Future Outlook

DraftKings' balance sheet as of March 31, 2024, shows a strong position with $1,937,973 in total current assets and a total equity of $830,979. The company's proactive management of its cost structure and marketing investments are expected to maintain a healthy Adjusted EBITDA Flow-through Percentage above 50% for the fiscal year 2024.

The company's forward-looking statements indicate a focus on maximizing shareholder value through continued innovation and operational excellence. With the planned expansion into additional jurisdictions like Puerto Rico and the potential inclusion of new states following legislative changes, DraftKings is poised for continued growth.

Challenges and Strategic Moves

Despite the positive outlook, DraftKings faces challenges such as regulatory changes and competitive pressures in the online betting and gaming industry. However, the company's strategic expansions and enhancements in product offerings position it well to navigate these challenges effectively.

In conclusion, DraftKings Inc (NASDAQ:DKNG) not only exceeded expectations with its Q1 2024 earnings but also demonstrated strategic acumen in scaling operations and entering new markets, which bodes well for its future performance. Investors and stakeholders may anticipate continued growth as the company leverages its innovative platform and broadens its market presence.

Explore the complete 8-K earnings release (here) from DraftKings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance