Cloudflare Inc (NET) Q1 2024 Earnings: Surpasses Revenue Forecasts with Robust Growth

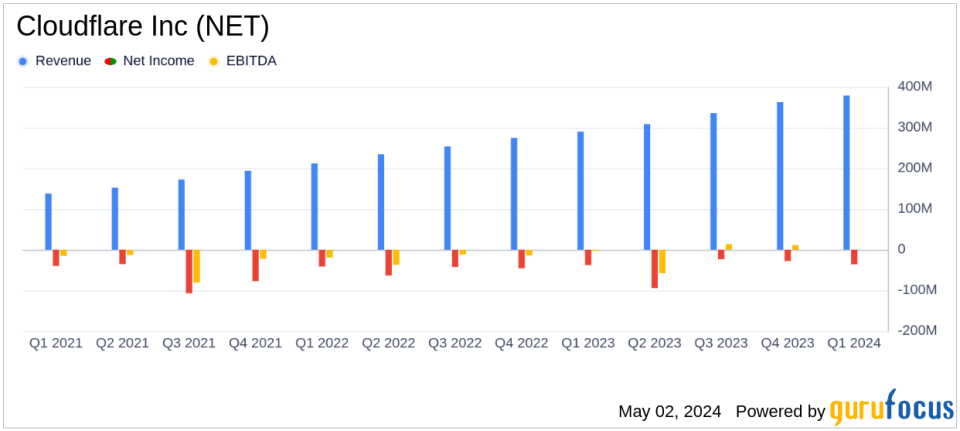

Revenue: Reported at $378.6 million, marking a 30% increase year-over-year, exceeding estimates of $373.08 million.

Net Income: Non-GAAP net income reached $58.2 million, significantly surpassing the estimated $46.65 million.

Earnings Per Share: Non-GAAP EPS was $0.16, exceeding the expected $0.13.

Free Cash Flow: Achieved $35.6 million, representing 9% of revenue, showing robust improvement from $13.9 million in the previous year.

Gross Margin: Non-GAAP gross margin improved to 79.5% from 77.8% year-over-year, indicating enhanced profitability.

Operating Cash Flow: Increased to $73.6 million, up from $36.4 million in the prior year, demonstrating strong operational efficiency.

Future Outlook: Expects Q2 revenue between $393.5 million to $394.5 million and full-year revenue forecast between $1,648.0 million to $1,652.0 million.

On May 2, 2024, Cloudflare Inc (NYSE:NET) announced its financial results for the first quarter ended March 31, 2024, revealing a significant revenue increase and improved operational performance. The company reported first-quarter revenue of $378.6 million, a 30% increase year-over-year, surpassing the analyst's estimate of $373.08 million. This performance highlights Cloudflare's continued growth trajectory and its ability to exceed market expectations. For more details, refer to the company's 8-K filing.

Cloudflare, based in San Francisco, California, is a prominent software company specializing in security and web performance solutions through its advanced content delivery network (CDN). The company's innovative edge computing platform, Workers, allows clients to deploy and execute code globally without the need for server management, enhancing operational efficiency and scalability.

Financial Highlights and Operational Achievements

The first quarter of 2024 was marked not only by revenue growth but also by significant improvements in gross and operating margins. Cloudflare achieved a GAAP gross profit of $293.6 million, translating to a 77.5% gross margin, up from 75.7% in the same quarter last year. Non-GAAP gross profit stood at $301.1 million, with a gross margin of 79.5%. This improvement reflects Cloudflare's disciplined cost management and operational efficiency.

Despite a GAAP loss from operations of $54.6 million, the non-GAAP income from operations was a robust $42.4 million, or 11.2% of revenue, significantly better than the $19.4 million, or 6.7% of revenue, reported in the first quarter of 2023. This indicates a strong underlying operational performance when adjusted for non-recurring items and certain non-cash charges.

The company also reported a healthy cash flow, with operating cash flow at $73.6 million, or 19% of revenue, and free cash flow of $35.6 million, or 9% of revenue. These figures represent substantial improvements from the previous year, underscoring Cloudflare's focus on maintaining liquidity and financial flexibility.

Challenges and Market Position

Despite its strong performance, Cloudflare faces challenges typical of the high-growth tech sector, including intense competition and the need to continually innovate. The company's ability to sustain its growth, manage operational costs, and navigate the competitive landscape will be critical for long-term success.

Cloudflare's CEO, Matthew Prince, highlighted the company's strategic initiatives, particularly in AI, and its commitment to innovation and market leadership. "The first quarter marked a strong start to the year, as we grew revenue 30% year-over-year... I'm incredibly proud of our team's ability to continue building our network, service larger customers, and launch entirely new categories of products," said Prince.

Looking Ahead

For the second quarter of fiscal 2024, Cloudflare anticipates revenue between $393.5 million and $394.5 million, and a non-GAAP income from operations of $35.0 to $36.0 million. The full-year revenue expectation ranges from $1,648.0 to $1,652.0 million, aligning closely with analyst expectations.

The company's ongoing investment in innovation and expansion into new markets, coupled with a strong financial foundation, positions Cloudflare well for continued growth and industry leadership. As Cloudflare advances, investors and stakeholders will likely watch closely how it balances growth-driven investments with profitability and cash flow management.

For more detailed financial information and future updates, visit Cloudflare's investor relations website or access their latest SEC filings.

Explore the complete 8-K earnings release (here) from Cloudflare Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance