Rimini Street Inc (RMNI) Q1 2024 Earnings: Narrowly Misses EPS Estimates, Reveals Modest ...

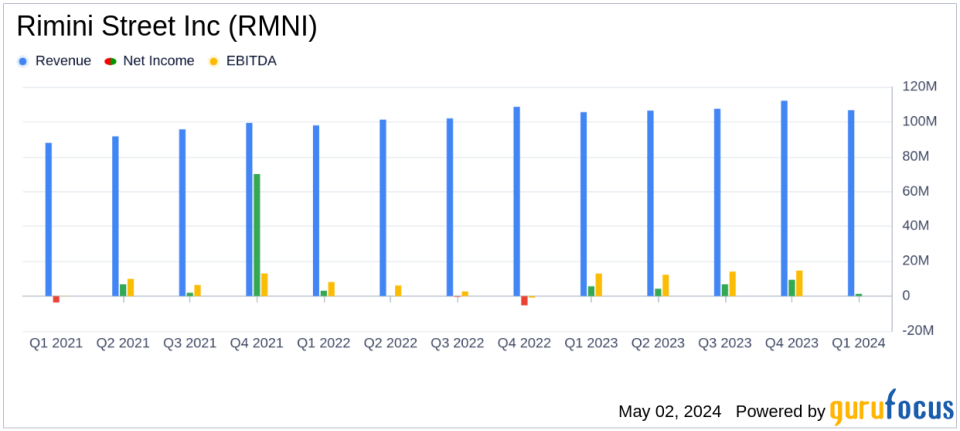

Revenue: Reported at $106.7 million, up by 1.2% year-over-year, slightly surpassing the estimate of $106.21 million.

Net Income: Posted $1.3 million, significantly below the estimated $9.61 million.

Earnings Per Share (EPS): Recorded at $0.01, falling short of the estimated $0.10.

Gross Margin: Declined to 59.8% from 62.7% in the same period last year.

Operating Income: Decreased to $3.4 million from $10.7 million year-over-year.

Subscription Revenue: Totaled $103.9 million, accounting for 97.4% of total revenue, up from 96.8% last year.

Active Clients: Increased to 3,040, marking a growth of 1.1% compared to last year.

Rimini Street Inc (NASDAQ:RMNI) released its 8-K filing on May 2, 2024, disclosing its financial results for the fiscal first quarter ended March 31, 2024. The company reported revenue of $106.7 million, slightly above the analyst's expectation of $106.21 million. However, the earnings per share (EPS) stood at $0.01, missing the estimated EPS of $0.10. This performance reflects a nuanced trajectory in Rimini Street's financial health and operational dynamics.

Rimini Street Inc is a prominent provider of enterprise software support products and services, notably as a third-party support provider for Oracle and SAP software products. The company also partners with Salesforce and AWS, offering a broad spectrum of solutions to manage and optimize enterprise applications and databases. The majority of its revenue is generated in the United States, though it maintains a significant international presence.

Financial Performance Overview

The company's revenue saw a modest year-over-year increase of 1.2% from $105.5 million in the first quarter of the previous year. This growth was supported by a slight rise in U.S. revenue and a 1.6% increase in international revenue. Subscription revenue, which constitutes 97.4% of the total revenue, increased to $103.9 million from $102.1 million in the prior year. Despite these gains, the gross margin declined to 59.8% from 62.7%, and operating income significantly decreased to $3.4 million from $10.7 million year-over-year.

Net income also fell to $1.3 million from $5.6 million in the previous year, reflecting challenges in maintaining profitability amidst operational adjustments. The company's balance sheet shows a healthy cash position of $129 million, although this is a slight decrease from $135 million a year earlier.

Strategic Developments and Challenges

Rimini Street announced several strategic initiatives during the quarter, including the launch of Rimini Custom, a new software support offering, and significant leadership appointments aimed at bolstering its sales and operational capabilities. The company also celebrated a decade of growth in Japan, highlighting its sustained international expansion.

However, challenges remain as the company reported a decline in its revenue retention rate from 92% to 89% year-over-year, indicating potential issues in client retention or contract values. Additionally, operating income and net income reductions point to rising costs or inefficiencies that could impact future profitability.

Operational Highlights and Outlook

Rimini Street's operational metrics provide mixed signals. While the annualized recurring revenue grew by 1.8%, the total number of active clients saw a modest increase, suggesting a competitive but gradually expanding market presence. The company has suspended its future financial guidance due to ongoing litigation with Oracle, which adds a layer of uncertainty regarding its forward-looking financial health.

In conclusion, Rimini Street's first quarter of 2024 encapsulates a period of modest revenue growth coupled with profitability challenges. The company's strategic initiatives and international expansions are promising, yet the impact of litigation and client retention rates will be critical to watch in the upcoming quarters. Investors and stakeholders will likely keep a close eye on how Rimini Street navigates these operational and legal challenges while striving to maintain its growth trajectory in the competitive enterprise software support market.

Explore the complete 8-K earnings release (here) from Rimini Street Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance