Philip Morris (NYSE:PM) posted its Q1 results last Tuesday, with numbers coming in very strong across the board. The global tobacco powerhouse saw impressive growth in both its Heated Tobacco and Oral Nicotine divisions. Even its supposedly waning Combustibles division recorded growth in revenues despite a tiny decline in shipment volumes. With the company poised for continued success, management revised its guidance upwards, forecasting another year of record earnings. Thus, I’m bullish on PM stock.

First-Quarter Results Set the Stage for a Robust FY2024

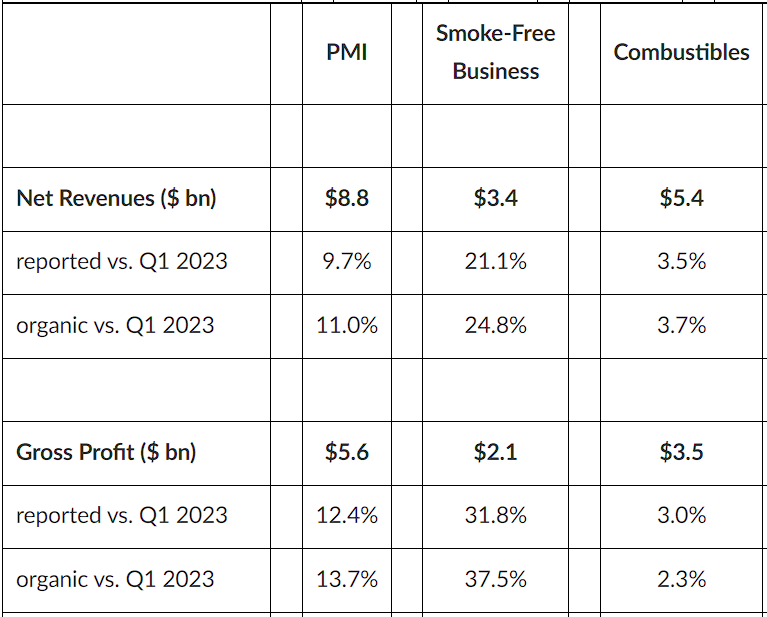

Philip Morris’ Q1 results set the stage for a robust FY2024. The company saw growth across all segments, with total revenues rising 9.7% year-over-year to $8.8 billion. In constant currency, revenues actually rose by an even more significant 11% compared to last year, as you can see below.

Let’s take a closer look at each of Philip Morris’ three major divisions.

Combustibles Perform Well Despite a Pessimistic Narrative

While the market has adopted a pessimistic narrative about the future of combustibles, the reality isn’t quite as dire as it may seem. It’s true that the demand for combustibles is on the decline, and it will likely continue to follow this trajectory. However, the pace of this declining demand is nowhere near disastrous.

In Philip Morris’s Q1 results, the company showed that cigarette volumes only declined by a tiny 0.4% compared to the previous year. In the meantime, Philip Morris leveraged the highly inelastic nature of cigarettes to increase prices much more significantly, leading to sales in the Combustibles division growing by 3.5% year-over-year or by 3.7% in constant currency.

Heated Tobacco Business Keeps Growing

While Philip Morris’ Combustibles division keeps chugging along, providing the company with high-margin cash flows, its Heated Tobacco products are experiencing a rapid increase in adoption. Shipment volumes in heated tobacco units (HTU) grew by an impressive 20.9% compared to last year, reaching 33.1 billion units. Growth was powered by strong IQOS momentum, exceptional growth in Japan, solid fundamentals in Europe, and an advancing contribution from newer markets such as Indonesia.

Moving toward Q2, management expects that growth in HTU shipment volumes will grow further toward 34 billion to 35 billion, marking a notable sequential improvement. This is to be powered by momentum in organic growth and the fact that Q1 HTU shipment volumes were negatively affected by disruption in the Red Sea. This issue held Q1 shipments back by about one billion.

Magnificent Growth in Oral Nicotine Post-Swedish Match Buyout

Besides strong growth in Heated Tobacco, Philip Morris further bolstered its smoke-free category sales due to magnificent growth in its Oral Nicotine division. The division benefited from the momentum of Zyn, the oral nicotine pouches that were added to Philip Morris’ portfolio following the acquisition of Swedish Match last year.

More specifically, nicotine pouches and Snus volumes saw significant growth, rising from 81.1 million and 55.6 million to 145.7 million and 61.4 million, marking gains of 79.3% and 10.5%, respectively. Therefore, Q1 marked the fourth consecutive quarter of market share gains in the U.S. for these categories, with an increase of 1.3 percentage points, leading to a dominant market share of 74%.

Raised Guidance Points to Record FY2024 Profits

Philip Morris’s strong Q1 results and ongoing momentum encouraged management to raise its targets, now expecting record profits for FY2024 in constant currency. Particularly, for Q1, Philip Morris achieved adjusted EPS of $1.50, up 8.7% compared to last year. Nevertheless, this result was heavily impacted by foreign exchange headwinds due to the rise of the dollar. Ex-currency adjusted EPS actually grew by a much more significant 23.2% to $1.70.

Thus, for the full year, management now expects adjusted EPS, in constant currency, to be between $6.55 and $6.67. This indicates a year-over-year increase between 9% and 11% and another year of record profits.

Is PM Stock a Buy, According to Analysts?

Taking a look at Wall Street’s view on the stock, Philip Morris boasts a Moderate Buy consensus rating based on eight Buys, three Holds, and one Sell recommendation assigned in the past three months. At $104.86, the average PM stock price target suggests 9.2% upside potential.

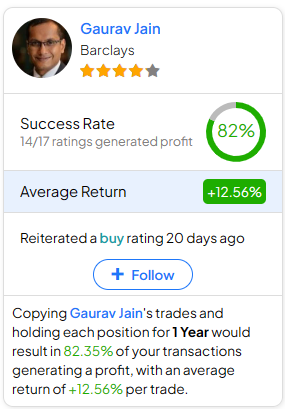

If you’re unsure which analyst you should follow if you want to buy and sell PM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Gaurav Jain of Barclays (NYSE:BCS), with an average return of 12.56% per rating and an 82% success rate.

The Takeaway

Overall, Philip Morris stepped into Fiscal 2024 with momentum, growing sales across all three divisions. In Combustibles, the company has once again demonstrated its ability to effectively counteract the declining trend in the smoker population through its robust pricing power. Simultaneously, its smoke-free products are consistently garnering increasing consumer appeal, reflected in the remarkable surge in shipment volumes for both HTU and Oral units.

With management’s upward guidance revision promising sustained momentum throughout the rest of the year, my confidence in shares of Philip Morris has increased significantly. For this reason, I retain my bullish outlook following its Q1 results.