Alkami Technology Inc (ALKT) Q1 2024 Earnings: Surpasses Revenue Estimates Amidst Net Loss Reduction

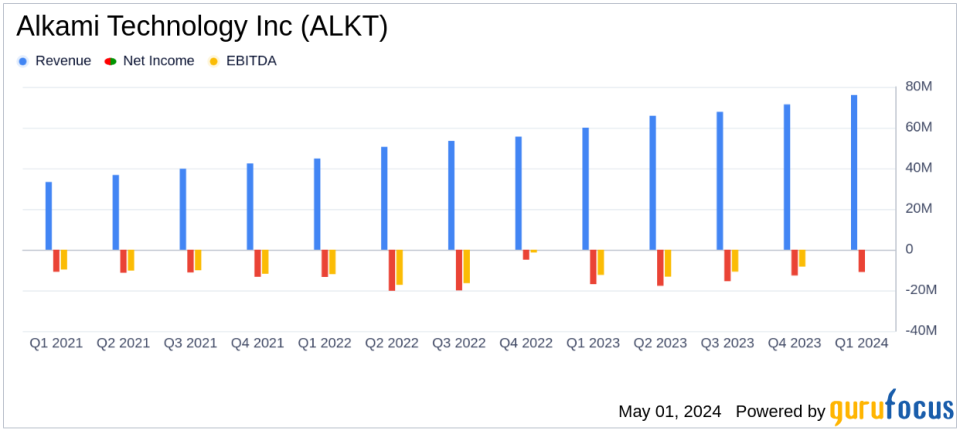

Revenue: Reported $76.1 million, a 26.9% increase year-over-year, surpassing the estimate of $75.54 million.

Net Loss: Recorded at $(11.4) million, an improvement from $(17.0) million in the year-ago quarter, but above the estimated net loss of $2.33 million.

Gross Margin: GAAP gross margin improved to 57.8% from 53.6% in the prior year, with Non-GAAP gross margin reaching 61.7%.

Adjusted EBITDA: Turned positive at $3.8 million, compared to a loss of $(2.9) million in the same quarter last year.

User Growth: Live registered users increased by 3.0 million from the previous year to 18.1 million, indicating strong market share gains.

Annual Recurring Revenue: Grew by 26.1% year-over-year to $303 million, reflecting robust subscription growth.

Future Guidance: Expects Q2 GAAP total revenue between $80.5 million and $82.0 million, and adjusted EBITDA between $2.8 million and $3.8 million.

On May 1, 2024, Alkami Technology Inc (NASDAQ:ALKT), a prominent provider of cloud-based digital banking solutions, disclosed its financial outcomes for the first quarter ending March 31, 2024, through its 8-K filing. The company reported a significant revenue increase and a reduction in net loss, indicating a robust start to the year.

Quarterly Financial Highlights

Alkami announced a GAAP total revenue of $76.1 million for the first quarter, a 26.9% increase from the previous year, surpassing the estimated revenue of $75.54 million. The GAAP gross margin improved to 57.8%, up from 53.6% in the year-ago quarter. Notably, the non-GAAP gross margin also saw an increase, reaching 61.7% compared to 58.1% last year. Despite these gains, the company recorded a GAAP net loss of $11.4 million, which, while substantial, marks an improvement over the $17.0 million loss reported in the same period last year.

Operational and Strategic Developments

CEO Alex Shootman highlighted the quarter's operational successes, including an increase in live registered users to 18.1 million, a growth fueled by significant market share gains and the renewal of a major contract with a top 10 credit union. Alkami's focus on strategic initiatives aimed at cementing its position as a leading digital banking provider was evident in these developments.

"In the first quarter, we delivered another quarter of robust performance... Alkami is well positioned to continue delivering market-leading solutions and strong growth," said Alex Shootman, CEO.

CFO Bryan Hill provided insights into the financial strategy, emphasizing a 20% year-over-year growth in digital banking users and an increase in annual recurring revenue to $303 million, marking a 26.1% rise from the previous year. The company's revenue per user also increased, ending the quarter at $16.71, driven by new client additions and expanded sales.

Financial Position and Outlook

Alkami's balance sheet remains solid with total assets of $397.642 million as of March 31, 2024. The company holds $44.179 million in cash and cash equivalents and has maintained a strong equity position with total stockholders' equity amounting to $322.907 million.

Looking forward, Alkami provided guidance for the second quarter with expected GAAP total revenue between $80.5 million and $82.0 million and adjusted EBITDA ranging from $2.8 million to $3.8 million. For the full year, the company anticipates GAAP total revenue between $328.5 million and $333.0 million and adjusted EBITDA between $20.5 million and $23.5 million.

Conclusion

Alkami's first quarter results reflect a company that is not only growing its top line but also making significant strides in operational efficiency and market expansion. The improvements in gross margins and the strategic client engagements underline Alkami's potential in the competitive digital banking solutions market. As Alkami continues to execute its growth strategies, it remains a noteworthy entity for investors tracking the technology and financial services sectors.

Explore the complete 8-K earnings release (here) from Alkami Technology Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance