Paycom Software Inc (PAYC) Outperforms Analyst Estimates with Strong Q1 2024 Earnings

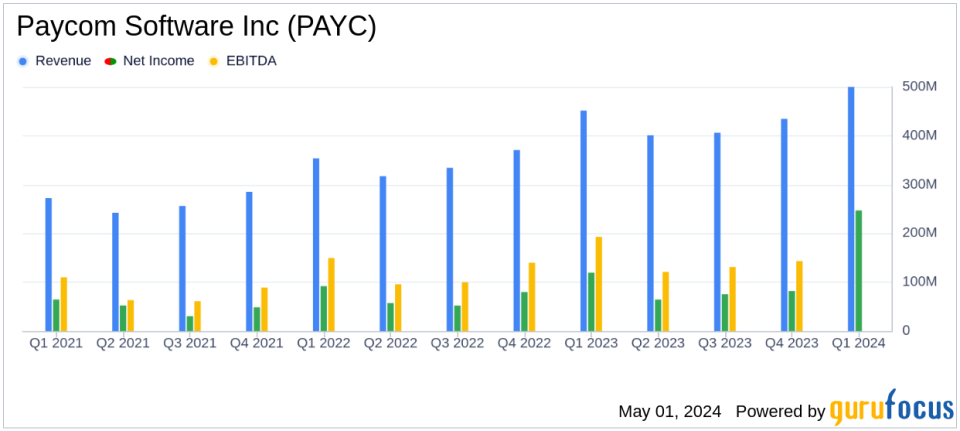

Revenue: Reported at $500 million, an 11% increase year-over-year, surpassing the estimate of $495.84 million.

GAAP Net Income: Reached $247 million, significantly exceeding the estimated $140.77 million.

Earnings Per Share (EPS): GAAP EPS was $4.37, outperforming the estimated $2.45.

Non-GAAP Net Income: Stood at $147 million, or $2.59 per diluted share, slightly above the estimated $2.45 per share.

Adjusted EBITDA: Reported at $230 million, representing 46% of total revenues.

Cash and Cash Equivalents: Increased to $371.3 million as of March 31, 2024, from $294 million at the end of the previous quarter.

Dividends and Share Repurchases: Paid $21.2 million in cash dividends and repurchased shares worth $3.1 million during the quarter.

On May 1, 2024, Paycom Software Inc (NYSE:PAYC), a leader in cloud-based human capital management software, unveiled its financial achievements for the first quarter of 2024, significantly surpassing analyst expectations. The detailed earnings can be viewed in their recent 8-K filing.

Company Overview

Established in 1998, Paycom has grown to serve approximately 19,500 clients, offering a suite of services that spans payroll processing, talent management, and other essential HR functions. Paycoms software solutions cater to mid-sized companies across the United States, aiming to streamline complex HR processes into user-friendly technology applications.

Financial Performance Insights

For Q1 2024, Paycom reported a remarkable revenue of $500 million, an 11% increase year-over-year, and a significant uptick from the estimated $495.84 million. This growth is primarily attributed to an increase in recurring revenues, which now represent 98.4% of total revenues. The company's GAAP net income stood at $247 million, or $4.37 per diluted share, more than doubling the previous year's figures and well above the estimated $2.45 per share.

Non-GAAP net income reached $147 million, or $2.59 per diluted share, slightly above the forecasted $2.45 per share. Adjusted EBITDA was reported at $230 million, indicating a robust margin of 46% of total revenues. These figures demonstrate Paycom's effective cost management and operational efficiency.

Strategic Highlights and Future Outlook

Chad Richison, Paycom's founder and CEO, emphasized the company's focus on enhancing solution automation capabilities and expanding client ROI. The strategic direction is clear: to leverage innovative technology like their Beti platform to drive further market penetration and client satisfaction.

Looking ahead, Paycom expects Q2 revenues to be between $434 million and $438 million, with adjusted EBITDA ranging from $151 million to $155 million. For the full year, they anticipate revenues between $1.860 billion and $1.885 billion, with adjusted EBITDA expected to be between $720 million and $730 million.

Balance Sheet and Cash Flow

As of March 31, 2024, Paycom's balance sheet showed $371.3 million in cash and cash equivalents, up from $294 million at the end of 2023. The company continues to maintain a strong liquidity position, with total debt remaining at zero. During the quarter, Paycom returned $21.2 million to shareholders through dividends and repurchased $3.1 million in stock, underscoring its commitment to delivering shareholder value.

Investor Considerations

The impressive financial performance of Paycom in Q1 2024, coupled with its strategic initiatives for growth and efficiency, presents a compelling case for investors. The company's ability to exceed analyst expectations reflects its operational excellence and robust market demand for its comprehensive HCM solutions. Investors and stakeholders can look forward to continued growth and profitability as Paycom executes its business strategies effectively.

For detailed financial figures and future projections, stakeholders are encouraged to review Paycom's official 8-K filing.

Explore the complete 8-K earnings release (here) from Paycom Software Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance