Baillie Gifford's Strategic Moves in Q1 2024: A Closer Look at NVIDIA Corp's Adjustment

Insight into Baillie Gifford (Trades, Portfolio)'s Latest 13F Filing and Its Impact on Key Holdings

Baillie Gifford (Trades, Portfolio), a century-old investment management firm, recently disclosed its 13F filing for the first quarter of 2024. The firm is renowned for its commitment to long-term, bottom-up investing, focusing on companies with potential for sustainable, superior growth. Baillie Gifford (Trades, Portfolio) manages assets for some of the world's most prominent institutional investors, maintaining a strategy that emphasizes fundamental analysis and proprietary research.

Summary of New Buys

Baillie Gifford (Trades, Portfolio)'s portfolio welcomed 15 new stocks in this quarter, highlighted by significant acquisitions in diverse sectors:

Symbotic Inc (NASDAQ:SYM) led the new additions with 9,483,371 shares, representing 0.33% of the portfolio and valued at $426.75 million.

Kaspi.kz JSC (NASDAQ:KSPI) followed, with 1,147,213 shares making up about 0.11% of the portfolio, totaling $147.58 million.

Brunswick Corp (NYSE:BC) was also a notable addition, with 1,293,415 shares valued at $124.84 million, accounting for 0.1% of the portfolio.

Key Position Increases

The firm also increased its stakes in several companies, with the most significant boosts in:

Nu Holdings Ltd (NYSE:NU), which saw an addition of 54,681,625 shares, bringing the total to 169,450,124 shares. This change marked a 47.65% increase in share count and impacted the portfolio by 0.51%, with a total value of $2.02 billion.

Coupang Inc (NYSE:CPNG) also saw a substantial increase, with an additional 23,076,870 shares, bringing the total to 168,600,998 shares, valued at $2.99 billion.

Summary of Sold Out Positions

Baillie Gifford (Trades, Portfolio) exited 13 positions entirely during the first quarter of 2024, including:

Broadridge Financial Solutions Inc (NYSE:BR), where all 2,803,441 shares were sold, impacting the portfolio by -0.46%.

Twilio Inc (NYSE:TWLO) was also completely liquidated, with 3,863,887 shares sold, resulting in a -0.23% portfolio impact.

Key Position Reductions

Significant reductions were made in several holdings, notably:

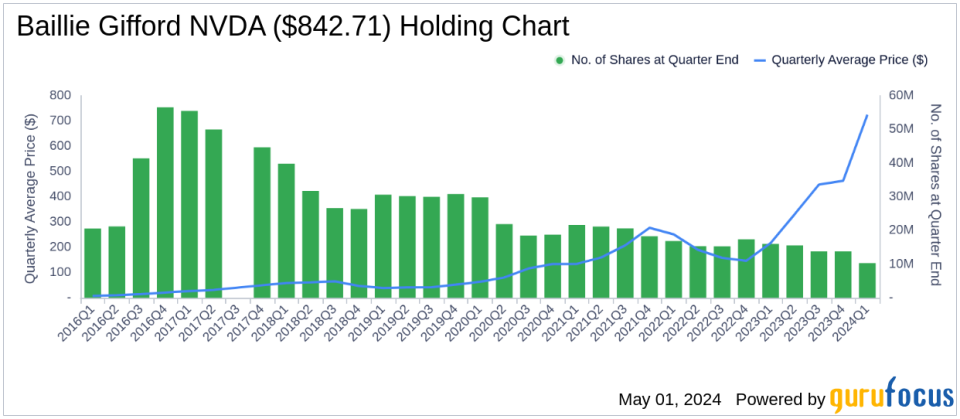

NVIDIA Corp (NASDAQ:NVDA) saw a reduction of 3,470,363 shares, a -25.2% decrease, impacting the portfolio by -1.36%. The stock traded at an average price of $724.8 during the quarter and has returned 32.35% over the past three months and 68.45% year-to-date.

NIO Inc (NYSE:NIO) shares were reduced by 95,730,817, an -83.51% decrease, impacting the portfolio by -0.68%. The stock's average trading price was $6.03 during the quarter, with a -8.06% return over the past three months and -42.12% year-to-date.

Portfolio Overview

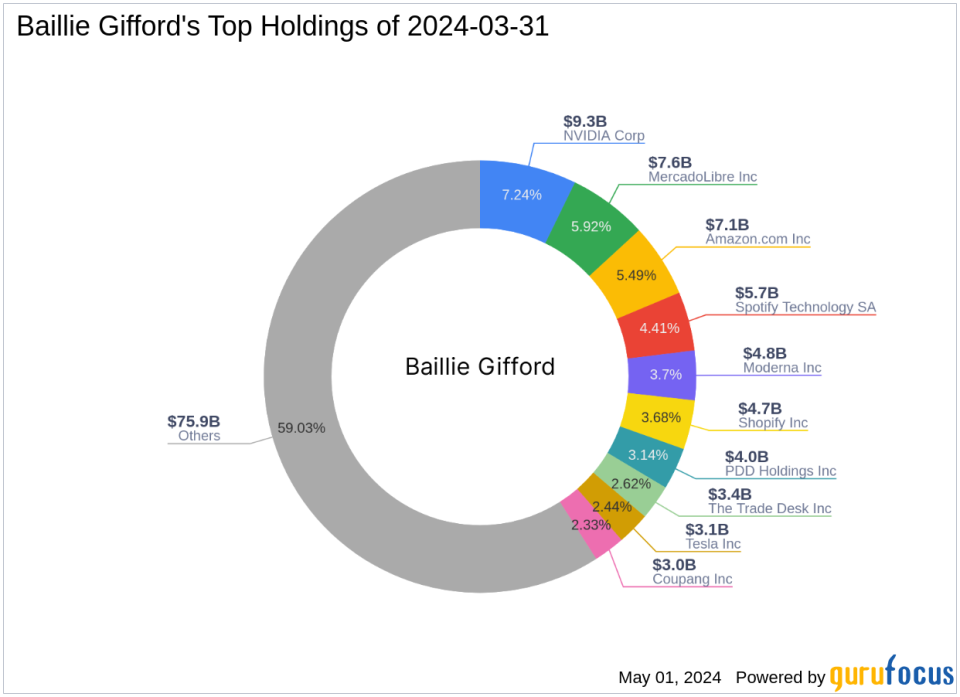

As of the first quarter of 2024, Baillie Gifford (Trades, Portfolio)'s portfolio comprised 290 stocks. The top holdings included 7.24% in NVIDIA Corp (NASDAQ:NVDA), 5.92% in MercadoLibre Inc (NASDAQ:MELI), 5.49% in Amazon.com Inc (NASDAQ:AMZN), 4.41% in Spotify Technology SA (NYSE:SPOT), and 3.7% in Moderna Inc (NASDAQ:MRNA). The investments span across all 11 industries, with significant concentrations in Technology, Consumer Cyclical, and Healthcare sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance