Marathon (MPC) Beats on Q1 Earnings, Approves $5B Buyback Again

Independent oil refiner and marketer Marathon Petroleum Corporation MPC reported first-quarter adjusted earnings per share of $2.78, which comfortably beat the Zacks Consensus Estimate of $2.53. The outperformance primarily reflects the stronger-than-expected performance of its Refining & Marketing segment. Operating income of the segment totaled $766 billion, surpassing the consensus mark of $660 million.

However, the company’s bottom line fell from the year-ago adjusted profit of $6.09 due to a higher unit operating cost and a drop in refining margin.

Marathon Petroleum reported revenues of $33.2 billion, which beat the Zacks Consensus Estimate of $31.3 billion but declined 5.3% year over year.

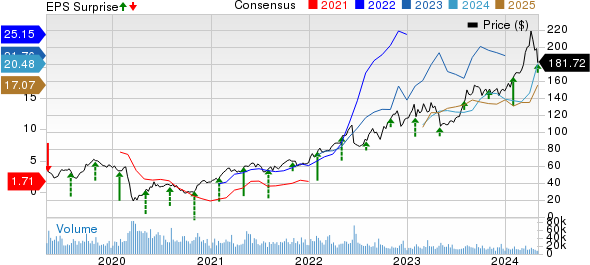

Marathon Petroleum Corporation Price, Consensus and EPS Surprise

Marathon Petroleum Corporation price-consensus-eps-surprise-chart | Marathon Petroleum Corporation Quote

Inside MPC’s Segments

Refining & Marketing: The Refining & Marketing segment reported an operating income of $766 million, which fell 74.7% from the year-ago profit of $3 billion. The drop primarily reflects lower year-over-year margins and a decrease in capacity utilization.

Specifically, the refining margin of $18.99 per barrel declined from $26.15 a year ago. Capacity utilization during the quarter was 82%, down from 89% in the corresponding period of 2023.

Meanwhile, total refined product sales volumes were 3,277 thousand barrels per day (mbpd), down from 3,352 mbpd in the year-ago quarter. Also, throughput dropped from 2,837 mbpd in the year-ago quarter to 2,664 mbpd and underperformed the Zacks Consensus Estimate of 2,728 mbpd.

MPC’s operating costs per barrel increased from $5.68 in the year-ago quarter to $6.14.

Midstream: This unit mainly reflects Marathon Petroleum’s general partner and majority limited partner interests in MPLX LP — a publicly traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets.

Segment profitability was $1.2 billion, up 2.7% from the first quarter of 2023. Earnings were buoyed up by higher rates and volumes processed.

Financial Analysis

Marathon Petroleum reported expenses of $31.4 billion in first-quarter 2024, up 1.3% from the year-ago quarter.

In the reported quarter, Marathon Petroleum spent $636 million on capital programs (46% on Refining & Marketing and 51% on the Midstream segment) compared to $690 million in the year-ago period.

As of Mar 31, the Zacks Rank #2 (Buy) company had cash and cash equivalents of $3.2 billion and total debt, including that of MPLX, of $27.3 billion, with a debt-to-capitalization of 48.3%.

In the first quarter, MPC repurchased $2.2 billion of shares and a further $800 million worth of shares in April. The company, which gave an additional $5 billion share repurchase approval, currently has a remaining authorization of $8.8 billion.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Important Energy Earnings So Far

While we have discussed Marathon Petroleum’s first-quarter result in detail, let’s take a look at some other key energy reports of this season.

Oil service biggie Halliburton HAL reported first-quarter 2024 adjusted net income per share of 76 cents, surpassing the Zacks Consensus Estimate of 74 cents and improving from the year-ago quarter profit of 72 cents (adjusted). The outperformance reflects strength in the international markets, partly offset by weak performance in the North American region.

Halliburton reported first-quarter capital expenditure of $330 million, below our projection of $338.7 million. As of Mar 31, 2024, the company had approximately $1.9 billion in cash/cash equivalents and $7.6 billion in long-term debt, representing a debt-to-capitalization ratio of 44.1. HAL also bought back $250 million worth its stock during the January-March period. The company generated $487 million of cash flow from operations in the first quarter, leading to a free cash flow of $206 million.

Independent oil refiner and marketer Valero Energy VLO reported first-quarter 2024 adjusted earnings of $3.82 per share, which beat the Zacks Consensus Estimate of $3.18, driven by a decline in total cost of sales. Adjusted operating income in the Refining segment totaled $1.7 billion, down from $4.1 billion in the year-ago quarter. The figure also missed our estimate of $1.6 billion.

Valero’s total cost of sales declined to $29.8 billion from the year-ago figure of $32.1 billion. The figure is also below our estimate of $30.4 billion, primarily due to lower material costs and operating expenses. The first-quarter capital investment totaled $661 million, of which $563 million was allotted for sustaining the business.

Meanwhile, energy infrastructure provider Kinder Morgan KMI reported first-quarter adjusted earnings per share of 33 cents, a penny above the Zacks Consensus Estimate. The bottom line was driven by increased financial contributions from the Natural Gas Pipelines, Products Pipelines and Terminals business segments. Moreover, KMI’s first-quarter DCF was $1.42 billion, up from $1.40 billion a year ago.

As of Mar 31, 2024, Kinder Morgan reported $119 million in cash and cash equivalents. Its long-term debt amounted to $30.1 billion at quarter-end. For full-year 2024, KMI anticipates a DCF of $5 billion ($2.26 per share) and an adjusted EBITDA of $8.16 billion, each indicating 8% growth from the previous year’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance