Gates Industrial Corp PLC Reports Mixed Q1 2024 Results, Misses Earnings Estimates

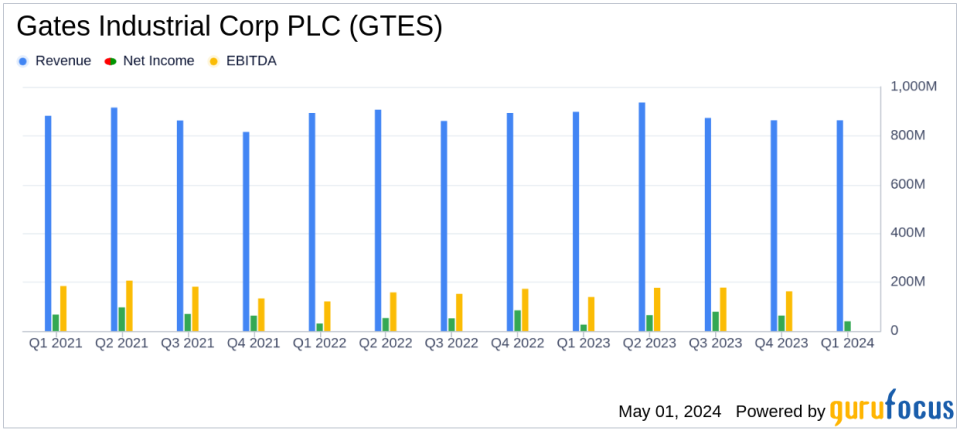

Reported Revenue: $862.6 million in Q1 2024, down 3.9% year-over-year, falling short of the estimated $870.27 million.

Net Income: $40.0 million, significantly below the estimated $85.46 million.

Earnings Per Share (EPS): Reported at $0.15 per diluted share, well below the estimated $0.32.

Adjusted EBITDA: Reached $195.6 million with a margin of 22.7%, indicating operational efficiency despite revenue decline.

Full-Year Adjusted EBITDA Guidance: Increased, reflecting confidence in future performance despite current challenges.

Debt Reduction: Repaid $100 million of existing dollar term loans, strengthening financial stability.

Share Repurchase: Approximately $50 million of ordinary shares repurchased, demonstrating ongoing commitment to shareholder value.

Gates Industrial Corp PLC (NYSE:GTES) disclosed its financial outcomes for the first quarter of 2024 on May 1, as detailed in its 8-K filing. The company, a prominent manufacturer of engineered power transmission and fluid power solutions, reported a decline in net sales and earnings per share (EPS) that fell short of analyst expectations.

Fiscal Performance Overview

For Q1 2024, Gates Industrial reported net sales of $862.6 million, a decrease of 3.9% year-over-year, and below the estimated $870.27 million. The net income attributable to shareholders was $40.0 million, or $0.15 per diluted share, significantly lower than the estimated EPS of $0.32. Adjusted net income per diluted share was $0.31, inclusive of an unfavorable tax impact, which also did not meet the forecasted $0.32 EPS.

Segment and Operational Highlights

The company's Power Transmission segment saw a slight decline in net sales, down 2.8% to $532.8 million, with adjusted EBITDA for the segment increasing by 10.5% to $119.0 million. The Fluid Power segment experienced a more pronounced sales decrease of 5.7% to $329.8 million, although its adjusted EBITDA rose by 14.7% to $76.6 million. These figures reflect the complex dynamics within different operational areas, influenced by varying market demands and strategic company initiatives.

Strategic and Financial Adjustments

CEO Ivo Jurek highlighted the company's strategic adjustments amid softer industrial demand, expressing optimism about the momentum building from enterprise initiatives. Jurek also noted the reduction of gross debt and the increase in full-year 2024 adjusted EBITDA guidance, signaling a proactive management approach in navigating current market challenges.

Financial Position and Future Outlook

As of March 30, 2024, Gates Industrial reported $522.2 million in cash and cash equivalents, with a total debt of $2.4 billion. The company remains committed to its strategic initiatives, aiming to enhance operational efficiency and financial flexibility. The updated guidance for 2024 reflects an anticipated adjusted EBITDA of $745 to $805 million.

Analysis and Investor Implications

The first-quarter results from Gates Industrial highlight the ongoing pressures on the industrial manufacturing sector, compounded by economic headwinds and shifting market demands. However, the company's efforts to optimize its operations and cost structure, coupled with strategic capital allocation, provide a foundation for potential resilience and growth. Investors and stakeholders will likely watch closely how these strategies unfold in the coming quarters, particularly in response to global economic conditions and industry-specific challenges.

Concluding Thoughts

While Gates Industrial's Q1 performance did not meet analyst expectations, its strategic adjustments and proactive financial management articulate a clear pathway toward stabilization and growth. The company's ability to navigate through these challenging times will be critical as it continues to strive for operational excellence and shareholder value enhancement.

For detailed insights and further information, you can access the full earnings report and additional financial data on Gates Industrial Corp PLC's investor relations website.

Explore the complete 8-K earnings release (here) from Gates Industrial Corp PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance