BioNTech (BNTX) to Report Q1 Earnings: Is a Beat in Store?

We expect BioNTech SE BNTX to surpass expectations when it reports first-quarter 2024 results on May 6, before the opening bell.

Let’s see how things have shaped up for the quarter to be reported.

Factors at Play

BioNTech’s top line currently comprises sales of its mRNA-based COVID-19 vaccine, Comirnaty, developed in partnership with Pfizer PFE. The vaccine is approved in several countries and has been a key contributor to BioNTech’s top line.

However, following the end of the pandemic, sales of BioNTech/Pfizer’s COVID-19 vaccine are likely to have fallen sharply from the year-ago quarter’s level.

In the fourth quarter, total revenues declined on a reported basis mainly due to the decrease in COVID-19 vaccine sales and the same is likely to have continued in the first quarter.

Also, inventory write-downs reported by collaboration partner PFE negatively impacted revenues in the last reported quarter. It remains to be seen whether the same trend continued or reversed in the to-be-reported quarter.

The cost of sales declined in the last reported quarter, which is also expected to have prevailed in the to-be-reported quarter.

As declining COVID-19 vaccine sales and inventory write-downs by Pfizer continue to hurt BioNTech’s top line, investors will be keen to get an update on BNTX’s revenue guidance for 2024 on the upcoming conference call.

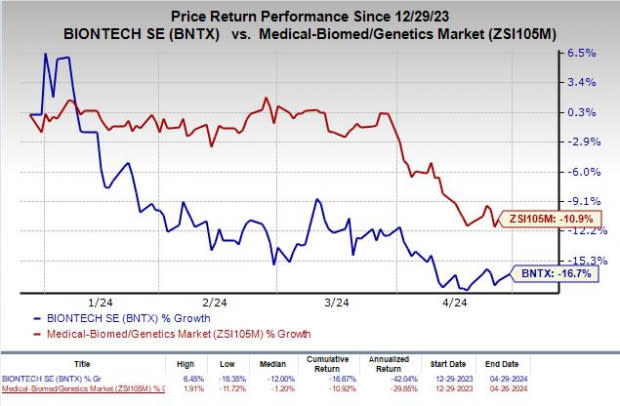

Shares of BioNTech have plunged 16.7% year to date compared with the industry’s decline of 10.9%.

Image Source: Zacks Investment Research

BioNTech is developing a promising portfolio of pipeline candidates and multiple mRNA vaccines that are currently in early to mid-stage development, targeting various cancer indications and infectious diseases like shingles, tuberculosis and mpox.

Higher costs associated with the ongoing clinical studies on these candidates and vaccines escalated the research and development expenses in the last reported quarter, a trend most likely to have continued in the to-be-reported quarter.

General and administrative expenses increased in the last reported quarter owing to higher expenses for IT services as well as wages. It remains to be seen whether the same trend continued in the first quarter or not.

Activities related to the development of the company’s pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Earnings Surprise History

BioNTech has a mixed earnings surprise history so far. The company’s earnings beat estimates in two of the trailing four quarters and missed the same on the remaining two occasions. BNTX delivered a four-quarter average earnings surprise of 330.74%. In the last reported quarter, BioNTech earnings missed estimates by 22.35%.

BioNTech SE Sponsored ADR Price and EPS Surprise

BioNTech SE Sponsored ADR price-eps-surprise | BioNTech SE Sponsored ADR Quote

Earnings Whispers

Our proven model predicts an earnings beat for BioNTech in the to-be-reported quarter. A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is the case here, as elaborated below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: BioNTech’s Earnings ESP is +273.78%. The Most Accurate Estimate stands at earnings of 71 cents, while the Zacks Consensus Estimate is pegged at a loss of 41 cents.

Zacks Rank: BioNTech has a Zacks Rank #3 currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Atara Biotherapeutics, Inc. ATRA has an Earnings ESP of +33.04% and a Zacks Rank #2.

Shares of Atara Biotherapeutics have gained 39.3% in the year-to-date period. Earnings of Atara Biotherapeutics beat estimates in one of the last four quarters and missed the same on the remaining three occasions. On average, ATRA delivered a negative earnings surprise of 20.30% in the last four quarters.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #3.

Shares of Sarepta have gained 33.6% in the year-to-date period. Earnings of Sarepta beat estimates in each of the last four quarters, delivering an average surprise of 464.56%. SRPT will report first-quarter earnings on May 1.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance