E2open Parent Holdings Inc (ETWO) Fiscal 2024 Earnings: Mixed Results Amidst Challenges

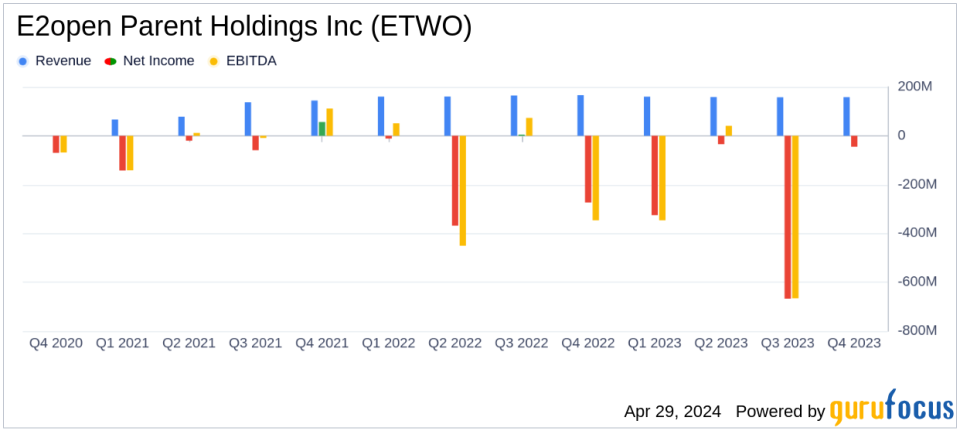

Q4 FY24 Total Revenue: Reported at $158.5 million, marking a decrease of 4.7% year-over-year, falling short of the estimated $155.39 million.

Q4 FY24 GAAP Net Loss: Stood at $45.5 million, significantly reduced from a net loss of $303.5 million in the same quarter the previous year.

Q4 FY24 GAAP EPS: Recorded a loss of $0.14, compared to a loss of $0.90 per share year-over-year.

FY24 Total Revenue: Reached $634.6 million, a decrease of 2.7% from the previous fiscal year, below the estimated $631.05 million.

FY24 GAAP Net Loss: Totaled $1,185.1 million, worsening from a net loss of $720.2 million in the prior fiscal year.

FY24 GAAP EPS: Reported a loss of $3.52 per share, deepening from a loss of $2.15 per share in the previous year.

FY24 Operating Cash Flow: Improved to $84.9 million, up 24.6% from $68.1 million in the prior year.

E2open Parent Holdings Inc (NYSE:ETWO) disclosed its financial outcomes for the fiscal fourth quarter and full year ended February 29, 2024, revealing a complex fiscal landscape. The company, a leading provider of cloud-based supply chain management software, reported a mix of achievements and setbacks, as detailed in its recent 8-K filing. Despite facing a revenue decline and a significant net loss, E2open met some of the analysts' expectations for adjusted earnings per share (EPS) but fell short in other areas.

Company Overview

E2open Parent Holdings Inc operates globally, providing a comprehensive, end-to-end supply chain management platform. Its software integrates networks, data, and applications to optimize the supply chain across various domains, including logistics, manufacturing, and supply management. The company's solutions are critical for businesses aiming to enhance operational efficiency and responsiveness in the dynamic global market.

Fiscal 2024 Performance Highlights

For the fiscal year 2024, E2open reported a GAAP net loss of $1,185.1 million, a significant increase from the previous year's loss of $720.2 million. This deterioration was primarily due to a substantial goodwill impairment charge. The company's total GAAP revenue for the year stood at $634.6 million, marking a decrease of 2.7% from the prior year. Notably, the GAAP subscription revenue saw a slight increase of 0.7%, totaling $536.8 million.

The adjusted EPS for fiscal 2024 was $0.19, slightly above the analyst estimate of $0.17. However, the company's quarterly performance showed a GAAP EPS loss of $0.14, contrasting with an estimated earnings of $0.04 per share for the quarter.

Challenges and Market Position

The fiscal year exposed several challenges for E2open, including a decrease in total revenue and gross profit in both GAAP and non-GAAP terms. The company's gross margin also contracted slightly from the previous year. These financial pressures underscore the competitive and operational challenges E2open faces, particularly in a fluctuating global economic environment.

Despite these challenges, E2open continues to hold a strong market position, underscored by strategic wins and recognitions such as being named a leader in the Gartner Magic Quadrant for Transportation Management Systems and the IDC MarketScape for Multi-Enterprise Supply Chain Commerce Network.

Operational Highlights and Future Outlook

E2open's operational strategy in FY 2024 focused on client-centric growth and operational efficiency, which is evident from their new project wins with major clients like Sonos, Inc. and Rawlings Sporting Goods. Looking ahead to fiscal 2025, the company expects GAAP subscription revenue to be between $532 million and $542 million and total GAAP revenue to range from $630 million to $645 million.

The company's emphasis on enhancing client satisfaction and expanding its product offerings, such as the newly launched Supply Network Discovery, positions it to potentially improve its financial health and market position in the coming years.

Conclusion

While E2open faces significant challenges, including a net loss and revenue decline, its strategic initiatives and strong market positioning may support a turnaround. Investors and stakeholders will likely watch closely to see if the company's focus on operational efficiency and client-centric strategies will translate into improved financial performance in FY 2025.

For detailed financial figures and future projections, interested parties are encouraged to review E2open's full earnings release and join their upcoming conference call, details of which can be found on their website.

Explore the complete 8-K earnings release (here) from E2open Parent Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance