Clearwater Paper Corp (CLW) Q1 2024 Earnings: Misses Analyst Estimates Amidst Production Challenges

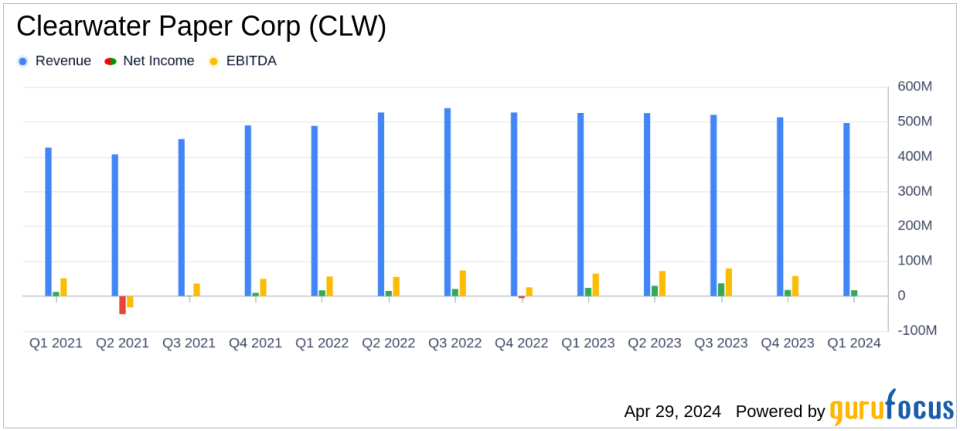

Net Sales: Reported at $496 million, a decrease of 6% year-over-year, falling short of estimates of $508 million.

Net Income: Reported at $17 million, down from $24 million in the previous year, falling short of estimates of $19 million.

Earnings Per Share (EPS): Reported at $1.02 per diluted share, below estimates of $1.11 per share.

Adjusted EBITDA: Reported at $62 million, a decrease from $66 million in the previous year.

Consumer Products Segment: Net sales increased by 2% to $253 million, with operating income significantly rising to $32 million from $4 million the previous year.

Pulp and Paperboard Segment: Net sales decreased by 12% to $245 million, with a substantial drop in operating income to $25 million from $57 million.

Debt Management: Reduced net debt by $33 million during the quarter, enhancing financial stability.

On April 29, 2024, Clearwater Paper Corp (NYSE:CLW) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The company, a leading manufacturer of private label tissue and bleached paperboard, reported net sales of $496 million, a decrease of 6% from the previous year, and a net income of $17 million, or $1.02 per diluted share. These figures fell short of analyst expectations, which estimated earnings of $1.11 per share on revenue of $508 million.

Clearwater Paper Corp is engaged in the manufacturing and selling of private label tissue, paperboard, and pulp-based products. The company operates through two segments: Consumer Products and Pulp and Paperboard. The majority of its revenue is generated from the Pulp and Paperboard segment, with the United States being its primary market.

Operational Highlights and Financial Performance

The first quarter saw a significant disruption due to a severe weather event at the Lewiston site, impacting production. Despite these challenges, the company managed to achieve solid results, driven by strong operational execution and lower input costs, particularly in wood, energy, and freight. The Consumer Products segment showed a notable improvement, with operating income rising to $32 million from $4 million in the previous year, supported by higher sales volumes and reduced input costs.

Adjusted EBITDA for Q1 2024 stood at $62 million, a slight decrease from $66 million in the same quarter last year. The company successfully reduced its net debt by $33 million and repurchased $1 million of outstanding shares.

Strategic Developments and Future Outlook

Clearwater Paper is on the verge of acquiring a bleached paperboard manufacturing facility in Augusta, Georgia, from Graphic Packaging International, LLC for $700 million. This acquisition is expected to close shortly and is anticipated to enhance the company's production capabilities and market reach.

President and CEO Arsen Kitch expressed optimism about the future, citing expected continued strength in tissue performance and a recovery in paperboard demand. The company aims to integrate the new facility smoothly and leverage its capabilities to bolster overall performance.

Analysis of Financial Statements

The detailed financial statements reveal a decrease in net sales across both primary segments, with the Pulp and Paperboard segment experiencing a 12% drop in sales. This decline was primarily due to lower sales prices and the adverse effects of the weather event. However, the decrease in operating expenses and prudent financial management helped mitigate broader financial impacts.

The balance sheet remains robust with an increase in total assets from $1,671.8 million at the end of December 2023 to $1,679.7 million by March 2024. The company's efforts to streamline operations and reduce debt are evident from the financials, positioning it well for future investment and growth.

Conclusion

Clearwater Paper's first quarter of 2024 reflects a resilient performance amidst challenging conditions. The company's strategic acquisitions and focus on operational efficiency are expected to drive future growth. However, the missed earnings estimates highlight the ongoing challenges in the market and the impact of external disruptions on production. Investors and stakeholders will likely watch closely how the company navigates these challenges and capitalizes on its strategic initiatives in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Clearwater Paper Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance