We Think The Compensation For Olympic Steel, Inc.'s (NASDAQ:ZEUS) CEO Looks About Right

Key Insights

Olympic Steel to hold its Annual General Meeting on 3rd of May

CEO Rick Marabito's total compensation includes salary of US$735.0k

The total compensation is similar to the average for the industry

Over the past three years, Olympic Steel's EPS grew by 5.5% and over the past three years, the total shareholder return was 136%

Performance at Olympic Steel, Inc. (NASDAQ:ZEUS) has been reasonably good and CEO Rick Marabito has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 3rd of May. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Olympic Steel

How Does Total Compensation For Rick Marabito Compare With Other Companies In The Industry?

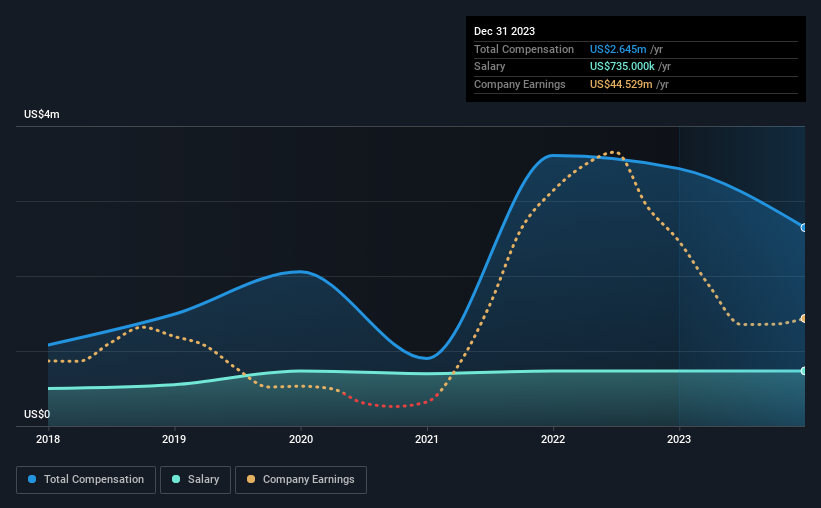

Our data indicates that Olympic Steel, Inc. has a market capitalization of US$742m, and total annual CEO compensation was reported as US$2.6m for the year to December 2023. Notably, that's a decrease of 23% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$735k.

In comparison with other companies in the American Metals and Mining industry with market capitalizations ranging from US$400m to US$1.6b, the reported median CEO total compensation was US$2.6m. From this we gather that Rick Marabito is paid around the median for CEOs in the industry. Moreover, Rick Marabito also holds US$2.9m worth of Olympic Steel stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$735k | US$735k | 28% |

Other | US$1.9m | US$2.7m | 72% |

Total Compensation | US$2.6m | US$3.4m | 100% |

Talking in terms of the industry, salary represented approximately 29% of total compensation out of all the companies we analyzed, while other remuneration made up 71% of the pie. Olympic Steel is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Olympic Steel, Inc.'s Growth

Over the past three years, Olympic Steel, Inc. has seen its earnings per share (EPS) grow by 5.5% per year. In the last year, its revenue is down 16%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Olympic Steel, Inc. Been A Good Investment?

We think that the total shareholder return of 136%, over three years, would leave most Olympic Steel, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for Olympic Steel you should be aware of, and 1 of them can't be ignored.

Switching gears from Olympic Steel, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.