① This week, Bitcoin ETFs, which are crazy money suckers, finally showed weakness. The strongest BlackRock IBIT fund had zero net capital inflows for two consecutive days; ② Delayed interest rate cuts by the Federal Reserve and poor Bitcoin prices are considered to be the main reasons affecting the performance of Bitcoin ETFs, but analysts believe that cryptocurrencies and their ETFs may still rise in the next few weeks.

Financial Services, April 27 (Editor Malan) This week, the two best Bitcoin ETFs — BlackRock's$iShares Bitcoin Trust (IBIT.US)$and Fidelity's$Fidelity Wise Origin Bitcoin Fund (FBTC.US)$At last, I saw a stop in capital inflows.

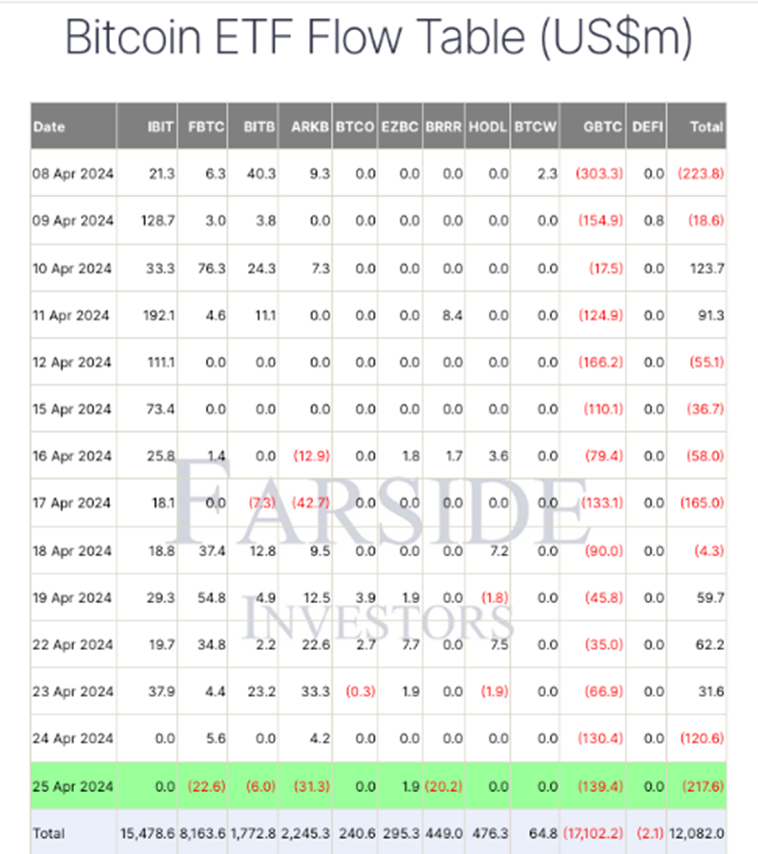

On Thursday, the IBIT fund had zero net capital inflows for two consecutive days. Previously, the fund had maintained a net inflow of capital for 71 consecutive days. FBTC, on the other hand, had its first net outflow in a single day, with an outflow of US$22.6 million, indicating a declining trend in investors' interest in Bitcoin ETFs.

In addition to these two funds and smaller ETFs, the remaining 5 Bitcoin ETFs have all experienced net outflows in a single day. Among them, Grayscale's GBTC fund outflows were the largest, reaching a total of 17.1 billion US dollars as of Thursday.

In addition to these two funds and smaller ETFs, the remaining 5 Bitcoin ETFs have all experienced net outflows in a single day. Among them, Grayscale's GBTC fund outflows were the largest, reaching a total of 17.1 billion US dollars as of Thursday.

Overall, the entire Bitcoin ETF market has attracted a total of 12 billion US dollars, and it has only been more than three months since the official launch of this batch of ETFs. Among them, BlackRock's IBIT attracted the most capital, with a cumulative inflow of 15.4 billion US dollars. Fidelity ranked second, receiving 81.63 million US dollars.

The hope of cryptocurrencies

Earlier this week, James Butterfill, head of research at CoinShares, pointed out that investor interest in Bitcoin ETFs is waning due to concerns that the Federal Reserve may delay interest rate cuts. The weakness of ETFs such as IBIT and FBTC represents how overheated the sector is. He said the market should have taken a breather long ago.

In addition to the delay in interest rate cuts by the Federal Reserve, the stagnation of Bitcoin spot prices is also a key reason affecting ETF performance. Nate Geraci, president of the investment advisory agency ETF Store, said that the suspension of Bitcoin prices may cause ETF capital inflows to stop for a short time, and many large institutions are not ready to enter this market.

However, mainstream brokers such as Morgan Stanley are planning to recommend spot Bitcoin ETFs to their clients, and this move could reignite market interest in this asset.

Quinn Thompson, founder of hedge fund Lekker Capital, analyzed it from another perspective. He believes that the exchange rate of the yen against the US dollar hit its lowest level since 1990. This scale and speed are not normal, which means there will be some intervention or coordination in the next few weeks.

He said that US policymakers may take intervention measures, such as injecting liquidity into the market, which will support the price of assets such as cryptocurrencies.

Noelle Acheson, former general manager of research at CoinDesk, also shared this view, adding that if the Bank of Japan steps in to support the yen, it may sell dollar assets to buy yen, which will cause the dollar to weaken and strengthen the support of cryptocurrency prices.

Editor/Somer

而除了这两只基金和规模较小的ETF之外,剩下的5支比特币ETF都已经出现过单日资金净流出的情况,其中又以Grayscale的GBTC基金流出规模为最,截至周四累计达到171亿美元。

而除了这两只基金和规模较小的ETF之外,剩下的5支比特币ETF都已经出现过单日资金净流出的情况,其中又以Grayscale的GBTC基金流出规模为最,截至周四累计达到171亿美元。