Financial giants have made a conspicuous bearish move on RTX. Our analysis of options history for RTX (NYSE:RTX) revealed 14 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 64% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $262,150, and 11 were calls, valued at $1,140,666.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $120.0 for RTX over the recent three months.

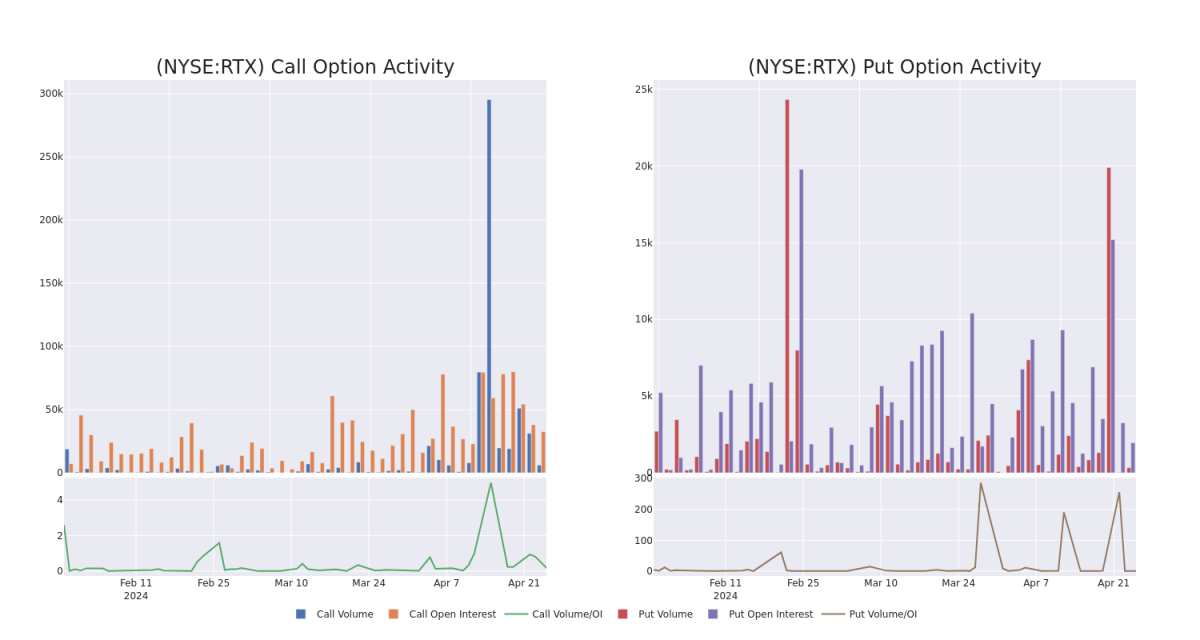

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for RTX's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of RTX's whale trades within a strike price range from $80.0 to $120.0 in the last 30 days.

RTX 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

RTX | CALL | TRADE | BEARISH | 01/17/25 | $6.5 | $6.35 | $6.4 | $105.00 | $640.0K | 6.9K | 1.0K |

RTX | PUT | TRADE | BEARISH | 01/16/26 | $7.1 | $6.8 | $7.0 | $95.00 | $210.0K | 419 | 10 |

RTX | CALL | TRADE | NEUTRAL | 11/15/24 | $1.2 | $1.16 | $1.18 | $120.00 | $94.4K | 959 | 801 |

RTX | CALL | SWEEP | BEARISH | 08/16/24 | $1.46 | $1.38 | $1.38 | $110.00 | $90.6K | 15.3K | 2.1K |

RTX | CALL | TRADE | BEARISH | 08/16/24 | $1.49 | $1.48 | $1.48 | $110.00 | $74.0K | 15.3K | 859 |

About RTX

RTX is a diversified aerospace and defense industrial company formed from the merger of United Technologies and Raytheon, with roughly equal exposure as a supplier to commercial aerospace manufacturers and to the defense market. The company operates in three segments: Collins Aerospace, a diversified aerospace supplier; Pratt & Whitney, an aircraft engine manufacturer; and Raytheon, a defense prime contractor providing a mix of missiles, missile defense systems, sensors, hardware, and communications technology to the military.

Having examined the options trading patterns of RTX, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is RTX Standing Right Now?

With a volume of 3,912,339, the price of RTX is up 0.76% at $101.79.

RSI indicators hint that the underlying stock may be approaching overbought.

Next earnings are expected to be released in 89 days.

What Analysts Are Saying About RTX

In the last month, 5 experts released ratings on this stock with an average target price of $111.8.

An analyst from B of A Securities persists with their Neutral rating on RTX, maintaining a target price of $110.

An analyst from Wells Fargo persists with their Overweight rating on RTX, maintaining a target price of $120.

Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for RTX, targeting a price of $105.

An analyst from Susquehanna has decided to maintain their Positive rating on RTX, which currently sits at a price target of $119.

Maintaining their stance, an analyst from Baird continues to hold a Neutral rating for RTX, targeting a price of $105.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest RTX options trades with real-time alerts from Benzinga Pro.