Columbia Sportswear Co (COLM) Q1 2024 Earnings: Challenges Persist as Results Miss Analyst Forecasts

Net Sales: $770.0 million, down 6% from $820.6 million in Q1 2023, falling short of estimates of $740.02 million.

Operating Income: $44.7 million, a decline of 21% year-over-year, representing 5.8% of net sales.

Diluted Earnings Per Share (EPS): $0.71, a decrease of 4% from $0.74 in Q1 2023, exceeding the estimated EPS of $0.35.

Gross Margin: Increased by 190 basis points to 50.6% of net sales, primarily due to lower inbound freight costs and favorable sales mix.

Net Income: $42.3 million, down 8% from $46.2 million in Q1 2023, surpassing the estimated net income of $22.47 million.

Inventories: Decreased by 37% to $607.4 million, reflecting efforts to optimize inventory levels.

Cash Position: Ended the quarter with $787.7 million in cash and short-term investments, with no borrowings.

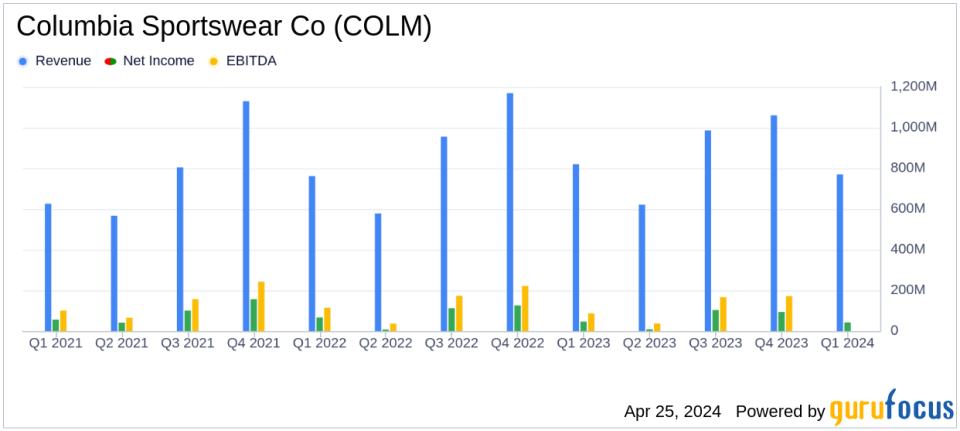

Columbia Sportswear Co (NASDAQ:COLM) disclosed its first quarter 2024 financial outcomes on April 25, 2024, revealing a downturn in several key financial metrics. The company, a renowned manufacturer of outdoor and active-lifestyle apparel and accessories, reported a decrease in net sales and operating income, alongside a dip in earnings per share. The detailed financial results can be accessed through Columbia Sportswear's 8-K filing.

Company Overview

Columbia Sportswear Co operates under four primary brands: Columbia, Sorel, Mountain Hardwear, and prAna, with a significant presence in the United States and notable sales across Latin America and Asia-Pacific, Europe, Middle East, Africa, and Canada. The company primarily sells through wholesale channels but also manages its own branded stores globally. Products are sourced internationally, mainly from Asia.

Financial Performance Analysis

For Q1 2024, Columbia Sportswear reported net sales of $770.0 million, a 6% decline from $820.6 million in Q1 2023, falling short of the estimated $740.02 million. Operating income saw a 21% decrease to $44.7 million, representing 5.8% of net sales, down from 6.9% in the previous year. Diluted earnings per share also decreased by 4% to $0.71, compared to $0.74 in Q1 2023, which was significantly higher than the analyst estimate of $0.35.

The company exited the quarter with $787.7 million in cash, cash equivalents, and short-term investments, and a notable reduction in inventories by 37% year-over-year to $607.4 million, reflecting cautious inventory management in response to market conditions.

Challenges and Market Conditions

The decrease in wholesale net sales in the United States and Canada was attributed to retailer cautiousness, a challenging competitive environment, and generally soft consumer demand. These factors are critical as they directly impact Columbia Sportswear's revenue streams and market position.

Strategic Initiatives and Outlook

Despite the downturn, Columbia Sportswear is actively pursuing brand growth strategies and innovation in product offerings, such as the Columbia Omni-Shade Broad Spectrum Air Flow technology and Omni-MAX footwear system. The company's CEO, Tim Boyle, emphasized the alignment of these initiatives with their expectations and reiterated the full-year net sales outlook, while slightly raising the diluted EPS forecast.

Forward-Looking Statements

The company forecasts a net sales decline of 4.0 to 2.0 percent for 2024, aiming for net sales between $3.35 to $3.42 billion. Operating income is projected to be between $259 to $291 million. These projections underscore the company's cautious yet optimistic approach to navigating current market challenges.

In conclusion, Columbia Sportswear's first quarter of 2024 reflects a challenging period marked by declines in net sales and profitability metrics. However, strategic product innovations and careful financial management provide a basis for cautious optimism. Investors and stakeholders will be watching closely to see how the company's strategies unfold in the coming quarters.

Explore the complete 8-K earnings release (here) from Columbia Sportswear Co for further details.

This article first appeared on GuruFocus.