Capital One Financial Corp (COF) Q1 2024 Earnings: Aligns with EPS Projections and Reveals ...

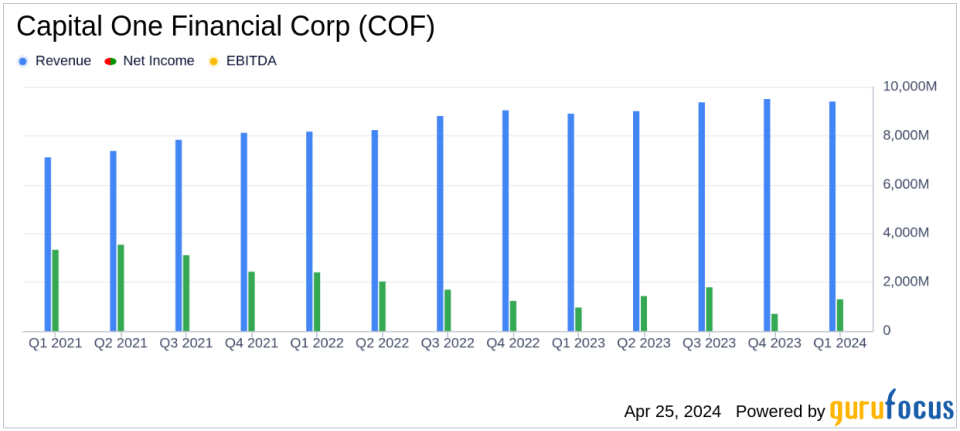

Reported Net Income: $1.3 billion, slightly above the estimated $1.271.84 million.

Earnings Per Share (EPS): Reported at $3.13, falling short of the estimated $3.31.

Revenue: $9.4 billion, exceeding the estimated $9.343.94 million.

Net Interest Margin: Decreased by 4 basis points to 6.69%.

Efficiency Ratio: Improved to 54.64%, with an adjusted efficiency ratio of 54.19%.

Provision for Credit Losses: Decreased by $174 million to $2.7 billion.

Loan Portfolio: Period-end loans held for investment decreased by $5.3 billion to $315.2 billion.

On April 25, 2024, Capital One Financial Corp (NYSE:COF) released its quarterly earnings, revealing a net income of $1.3 billion, or $3.13 per diluted share, which aligns closely with analyst expectations of $3.31 per share. The detailed financial results can be explored in their 8-K filing. This performance marks a significant improvement from the previous quarter's $706 million, and a year-over-year increase from $960 million in Q1 2023. Adjusted for specific items, the EPS stands at $3.21.

Capital One, headquartered in McLean, Virginia, is a diversified financial services company primarily known for its credit card lending, auto loans, and commercial lending. This quarter also highlighted the company's definitive agreement to acquire Discover, signaling a strategic expansion aimed at enhancing its consumer banking and global payments platform.

Financial Highlights and Strategic Analysis

Despite a slight 1% decline in total net revenue to $9.4 billion, Capital One has managed to reduce its total non-interest expense by 10% to $5.1 billion, reflecting efficient operational adjustments. The marketing expenses saw a significant reduction of 19%, and operating expenses were down by 8%. Additionally, the provision for credit losses decreased by $174 million to $2.7 billion, with net charge-offs amounting to $2.6 billion.

The company's balance sheet shows a robust common equity Tier 1 capital ratio of 13.1% as of March 31, 2024. However, there was a slight decrease in period-end loans held for investment, which fell by $5.3 billion, or 2%, to $315.2 billion. This was primarily due to a 3% reduction in credit card period-end loans. On a positive note, period-end total deposits increased by $2.6 billion, or 1%, to $351.0 billion.

Operational Efficiency and Future Outlook

Capital One's operational efficiency is evident from its improved pre-provision earnings, which increased by 13% to $4.3 billion. The net interest margin slightly decreased by 4 basis points to 6.69%, while the efficiency ratio improved to 54.64%, with an adjusted figure of 54.19%. These metrics highlight Capital One's ability to manage costs effectively while navigating the complexities of the financial sector.

The acquisition of Discover is poised to create significant value, enhancing Capital One's capabilities across various consumer and commercial financial services. This strategic move is expected to bolster the company's market position by expanding its customer base and service offerings.

Investor and Market Implications

Investors and market watchers should note the strategic acquisition of Discover, which could redefine Capital One's growth trajectory and competitive stance in the financial services industry. The company's ability to maintain a strong balance sheet while strategically managing expenses and capitalizing on growth opportunities positions it favorably for future financial periods.

Capital One's first quarter performance, characterized by alignment with EPS projections and strategic expansions, sets a promising tone for the fiscal year 2024. Investors are encouraged to monitor how the integration with Discover unfolds, alongside the company's ongoing financial health and market performance.

Explore the complete 8-K earnings release (here) from Capital One Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance