Financial giants have made a conspicuous bullish move on Carvana. Our analysis of options history for Carvana (NYSE:CVNA) revealed 13 unusual trades.

Delving into the details, we found 69% of traders were bullish, while 23% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $142,985, and 9 were calls, valued at $1,296,004.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $95.0 for Carvana during the past quarter.

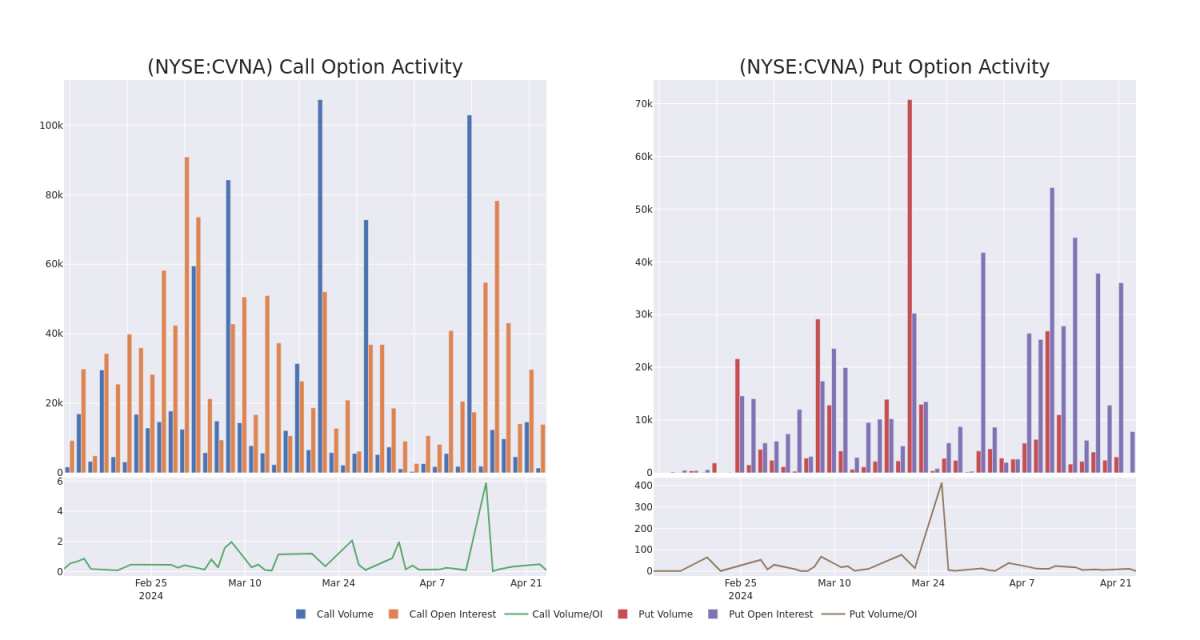

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Carvana's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carvana's whale trades within a strike price range from $65.0 to $95.0 in the last 30 days.

Carvana 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | TRADE | BEARISH | 05/10/24 | $16.5 | $14.45 | $15.0 | $65.00 | $750.0K | 5.0K | 500 |

| CVNA | CALL | SWEEP | NEUTRAL | 01/17/25 | $17.7 | $17.7 | $17.7 | $90.00 | $146.9K | 1.8K | 83 |

| CVNA | CALL | SWEEP | BULLISH | 08/16/24 | $14.35 | $14.15 | $14.35 | $80.00 | $113.3K | 1.2K | 229 |

| CVNA | CALL | SWEEP | BULLISH | 04/26/24 | $7.7 | $7.15 | $7.6 | $70.00 | $81.8K | 4.4K | 4 |

| CVNA | CALL | TRADE | BULLISH | 05/10/24 | $7.45 | $7.35 | $7.45 | $76.00 | $61.0K | 80 | 90 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

In light of the recent options history for Carvana, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Carvana

- With a trading volume of 748,157, the price of CVNA is up by 1.36%, reaching $76.65.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 7 days from now.

Expert Opinions on Carvana

In the last month, 5 experts released ratings on this stock with an average target price of $75.0.

- An analyst from JMP Securities has revised its rating downward to Market Outperform, adjusting the price target to $80.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Carvana, targeting a price of $78.

- An analyst from Evercore ISI Group persists with their In-Line rating on Carvana, maintaining a target price of $77.

- An analyst from Baird persists with their Neutral rating on Carvana, maintaining a target price of $65.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Carvana with a target price of $75.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.