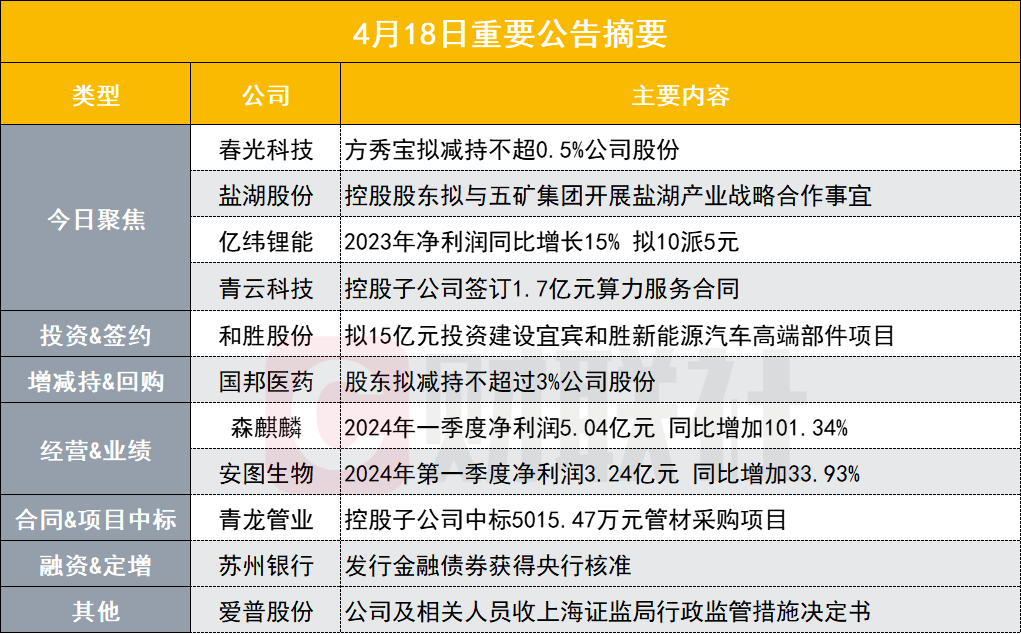

Salt Lake Co., Ltd.: The controlling shareholder plans to develop strategic cooperation in the Salt Lake industry with Minmetals Group

Today's focus

[Wulianban Chunguang Technology: Fang Xiubao plans to reduce the company's shares by no more than 0.5%]

[Wulianban Chunguang Technology: Fang Xiubao plans to reduce the company's shares by no more than 0.5%]

Chunguang Technology announced that shareholder Xiubao plans to reduce the company's shares by no more than 0.5071%.

[Salt Lake Co., Ltd.: The controlling shareholder plans to develop strategic cooperation in the Salt Lake industry with Minmetals Group]

Salt Lake Co., Ltd. announced that on April 18, the company received a “Notice Letter” from Qinghai State-owned Assets Investment Management Co., Ltd. (“Qinghai SDIC”), the controlling shareholder of the company. Qinghai SDIC is planning and carrying out strategic cooperation in the salt lake industry with China Minmetals Group Co., Ltd., and the two sides will jointly build a world-class salt lake industrial base. The relevant plan has not yet been finalized and needs to be approved by the relevant authorities. The content of the “Notice Letter” does not cover the relevant arrangements for the company for the time being.

[Everweft Lithium Energy: Net profit increased 15% year-on-year in 2023, and plans to pay 10 to 5 yuan]

Everweft Lithium Energy announced a net profit of 4.05 billion yuan in 2023, an increase of 15.42% over the previous year, and plans to pay 5 yuan for 10.

[Qingyun Technology: Holding subsidiary signs 170 million yuan computing power service contract]

Qingyun Technology announced that the company's holding subsidiary, Beijing Qingyun Intelligent Computing Technology Co., Ltd. (“Qingyun Intelligent Computing”), signed a “Computing Power Service Contract” with the customer, with a total contract cost of 170 million yuan (tax included). The main transaction content is that Qingyun Intelligent Computing uses the company's AI intelligent computing platform to provide customers with computing power, computing power management, scheduling, resource integration and management, and diverse heterogeneous computing power support.

[Jindun Co., Ltd.: Flying car duct fans are currently still in the R&D stage and have not been used]

Jindun Co., Ltd. issued a stock price change announcement. The flying car duct fan is currently in the research and development stage and has not yet been applied. The company specifically reminds investors to pay attention to investment risks, make rational decisions, and invest prudently.

Investments & Contracts

[Hesheng Co., Ltd.: Plans to invest 1.5 billion yuan to build high-end components project for Yibin Hesheng NEV]

Hesheng Co., Ltd. announced that it signed an “Investment Agreement” with the Yibin Sanjiang New Area Management Committee. After agreement between the two parties, it was decided to invest in the construction of the Yibin Hesheng New Energy Vehicle high-end components project in Yibin's Sanjiang New Area. The total investment of the project is estimated at 1.5 billion yuan.

[Jiuhua Tourism: Plans to invest 326 million yuan in the Jiuhuashan Lion Peak Scenic Area passenger ropeway project]

Jiuhua Tourism announced that it plans to invest abroad in the Jiuhuashan Lion Peak Scenic Area passenger ropeway project. The estimated investment amount is 326.7 million yuan, and the construction period of the project is 24 months.

Increase/decrease holdings & repurchases

[Guobang Pharmaceutical: Shareholders plan to reduce their holdings of the company by no more than 3%]

Guobang Pharmaceutical announced that shareholders Zhejiang Mintou Henghua and Silk Road Fund are co-actors, holding a total of 5.56% of the company's shares. They plan to reduce their total holdings of the company's shares by no more than 16.7647 million shares through centralized bidding and bulk transactions, with a reduction ratio of no more than 3% of the company's total share capital.

[Jiangyan Group: Sino-Singapore Construction Investment Group plans to reduce holdings by no more than 3%]

Jiangyan Group announced that shareholders, Sino-Singapore Investment Corporation, intend to reduce their holdings of the company's shares through centralized bidding and bulk transactions by no more than 19,283,281 shares, or no more than 3.00% of the company's total share capital.

[Haichen Pharmaceutical: Shareholder Liu Xiaoquan plans to reduce holdings by no more than 0.9%]

Haichen Pharmaceutical announced that shareholder Liu Xiaoquan plans to reduce his shareholding by no more than 0.90225%.

Operation & Performance

[Mori Kirin: Net profit of 504 million yuan in the first quarter of 2024 increased 101.34% year-on-year]

Mori Kirin announced that net profit for the first quarter of 2024 was 504 million yuan, an increase of 101.34% over the previous year.

[Antu Biotech: Net profit of 324 million yuan in the first quarter of 2024 increased by 33.93% year-on-year]

Antu Biotech announced that net profit for the first quarter of 2024 was 324 million yuan, an increase of 33.93% over the previous year. The company announced on the same day that net profit for 2023 was 1,217 billion yuan, an increase of 4.28% over the previous year, and plans to distribute a cash dividend of 10.50 yuan (tax included) for every 10 shares to all shareholders.

[Wanhua Chemical: Net profit of 4.16 billion yuan in the first quarter increased 2.57% year-on-year]

Wanhua Chemical announced that net profit for the first quarter was 4.16 billion yuan, up 2.57% year on year. The company announced on the same day that polyurethane products achieved sales revenue of 17.51.79 million yuan in the first quarter, petrochemical products and LPG trade achieved sales revenue of 18.513.68 million yuan, and fine chemicals and new material series products achieved sales revenue of 610,504 million yuan.

[Pereyar: Net profit of 303 million yuan in the first quarter increased by 45.58% year-on-year]

Perea announced that it achieved operating revenue of 2.82 billion yuan in the first quarter, an increase of 34.56% year on year; net profit attributable to shareholders of listed companies was 303 million yuan, an increase of 45.58% year on year. Net profit in 2023 was 1,194 billion yuan, up 46.06% year on year. It is planned to distribute a cash dividend of 9.1 yuan (tax included) for every 10 shares to all registered shareholders.

Contract & Project Bid Winning

[Qinglong Pipe Industry: The holding subsidiary won the bid for a pipe procurement project of RMB 50,147,700]

Qinglong Pipe Industry announced that the holding subsidiary Ningxia Qinglong Steel & Plastic Composite Pipe Co., Ltd. received the “Notice of Winning Bid” issued by Shanxi Wanjiazhai Dianhuangbeigan Branch Line Water Service Co., Ltd., and Ningxia Qinglong Steel & Plastic Composite Pipe Co., Ltd. was the winning bidder for Wanjiazhai's Huangbeigan branch line engineering pipe procurement bid III. The bid amount was RMB 50,1547 million, accounting for 2.43% of the company's total audited revenue in 2023.

[Feilong Co., Ltd.: Received a fixed-point agreement for turbocharger housings]

Feilong Co., Ltd. announced that the company recently received a “Project Fixed-Point Agreement” from an internationally renowned auto parts company. According to the agreement, the company became the supplier of turbocharger housings for this customer's project, with estimated sales revenue of about 320 million yuan during the life cycle.

[Zhongding Co., Ltd.: Received a certificate of designation for the air suspension system assembly product project, the total life cycle amount is about 1,418 billion]

Zhongding Co., Ltd. announced that its subsidiary Anhui Zhongding Shock Absorbing Rubber Technology Co., Ltd. recently received a customer notice that the company has become a batch supplier of air suspension system assembly products for a new platform project of a domestic new energy brand OEM. The life cycle of this project is 6 years, and the total life cycle amount is about 1,418 billion yuan.

Financing & fixed growth

[Bank of Suzhou: Issuing financial bonds approved by the central bank]

The Bank of Suzhou announced that it recently received the “Administrative License Approval Decision” from the People's Bank of China, agreeing that the Bank of Suzhou will issue financial bonds in the national interbank market and overseas markets. The additional balance of financial bonds in 2024 will not exceed 12 billion yuan, and the balance of financial bonds at the end of the year will not exceed 34.3 billion yuan. The administrative license is valid until December 31, 2024. The Bank can independently choose the installment period during the validity period.

other

[Aipu Co., Ltd.: The company and related personnel accept the Shanghai Securities Regulatory Bureau's decision on administrative supervision measures]

Aipu Co., Ltd. announced that recently, Wei Zhonghao, chairman and general manager of the company, Feng Linxia, deputy general manager and head of finance, and Wang Weihua, deputy general manager and board secretary, received a decision on administrative supervision measures from the Shanghai Securities Regulatory Bureau. According to the announcement, Mengze Trading, the holding subsidiary of the company, committed tax evasion. On April 27, 2023, Aipu Co., Ltd. disclosed an announcement on the correction of accounting errors and traceability adjustments. As a result of Mengze Trading's tax evasion, the company's net profit attributable to shareholders of the parent company from 2018 to 2020 was increased by 6171,000 yuan, 36.245,500 yuan, and 998,500 yuan respectively, accounting for 0.56%, 23.88%, and 0.59% of the original disclosed amount; net profit attributable to shareholders of the parent company in 2021 was less than 13.9411 million yuan, accounting for the original disclosed amount 7.39%

[Betta Pharmaceuticals: EYP-1901 intravitreal implant drug clinical trial application accepted]

Betta Pharmaceuticals announced that today, the company received the “Notice of Acceptance” issued by the National Drug Administration (“NMPA”). The company and EyePoint Pharmaceuticals, Inc. (NASDAQ: EYPT, “EyePoint”) jointly declared a clinical trial application for the EYP-1901 intravitreal implant wet age-related macular degeneration (WamD) indication drug have been accepted by the NMPA.

[Zhongnan Construction: There is a risk that the listing may be terminated due to the closing price of the shares falling below 1 yuan/share continuously]

Zhongnan Construction announced that as of April 18, the closing price of the company's shares has been below 1 yuan/share for 10 consecutive trading days. There is a risk that the listing may be terminated in accordance with the above regulations. Investors are kindly requested to pay attention to the risks. Section 9.2.1 (4) of the “Shenzhen Stock Exchange Stock Listing Rules” stipulates that a company that issues only A shares or only B shares on the Shenzhen Stock Exchange has a daily stock closing price of less than 1 yuan for 20 consecutive trading days through the Shenzhen Stock Exchange trading system, and the Shenzhen Stock Exchange terminates its stock listing transactions.

【五连板春光科技:方秀宝拟减持不超0.5%公司股份】

【五连板春光科技:方秀宝拟减持不超0.5%公司股份】