Buffett moves really fast.

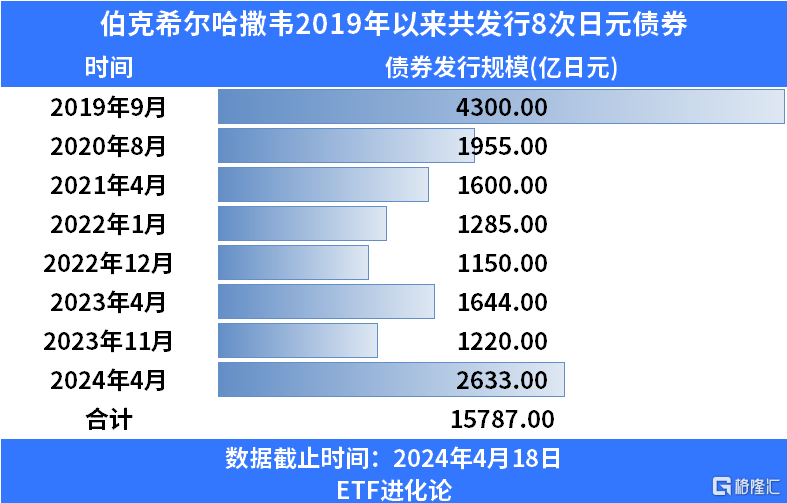

News just came out on April 10 that Warren Buffett's Berkshire Hathaway is preparing to issue new yen bonds, but the exact scale and timing of the issuance have yet to be determined. A week later, the amount of bonds issued was determined to be 263.3 billion yen (1.71 billion US dollars).

This is the largest sale of yen bonds since the company first offered yen bonds in 2019. It is also one of the largest sales of yen bonds by overseas issuers since the Bank of Japan withdrew from negative interest rates in March.

The time this bond went on sale coincided with the yen falling into a quagmire of constant depreciation. From 149 on March 18 to 154 today, yen bears are rampant. What is Buffett, who issued high-profile Japanese yen bonds at this time, thinking?

The time this bond went on sale coincided with the yen falling into a quagmire of constant depreciation. From 149 on March 18 to 154 today, yen bears are rampant. What is Buffett, who issued high-profile Japanese yen bonds at this time, thinking?

Was Buffett the only last buyer of yen?

1 Buffett raised a huge amount of yen debt!

On April 18, Berkshire Hathaway decided to set the total amount of new yen bonds issued at 263.3 billion yen (US$1.71 billion), the largest amount of bonds issued since it was first issued in 2019.

“The scale of this deal “is astonishing,” said Tokyo-based fund manager Haruyasu Kato (Haruyasu Kato) of Asset Management One Co.

Regarding Berkshire's re-issuance of yen bonds, outsiders generally believe that Buffett may use these funds to further invest in Japan's “Big Five Trading Company” stocks.

Munger once revealed that Buffett's logic for borrowing money to buy Japanese stocks in Japan was: “The interest rate in Japan is 0.5% per year for a period of 10 years. So you can borrow all the money 10 years in advance, and you can buy stocks. These stocks have a 5% dividend, so there's a lot of cash flow, no investment, no thinking, and nothing.”

Buffett also further explained in his February shareholder letter why he favors the “Japan's Big Five Trading Companies”: diversified business, high dividends, high free cash flow, and prudent issuance of new shares are important reasons. Berkshire said it hopes to eventually own 9.9% of each of the five major trading companies.

In addition to the big five trading companies, Buffett also revealed that if the stocks were further undervalued, he would consider buying stocks other than the five major trading companies.

An analyst at Daiwa Securities predicts that Buffett may be targeting Japanese banks, insurance companies, and car companies as his next investment targets.

Looking at the daily K-line trend of the Nikkei 225 Index, we can see that Japanese stocks continued to weaken after reaching an all-time high of 41,000 points on March 22. What happened during this period was that after the Bank of Japan withdrew from negative interest rates, the yen began to fall continuously.

After the market discovered that the yen depreciated to more than 152 yen, the Japanese stock market began to perform poorly. J.P. Morgan believes that a further weakening of the yen will have a negative impact on the Japanese stock market at some point.

J.P. Morgan pointed out that although the depreciation of the yen is beneficial to the profit level of Japanese export companies, it will reduce foreign-denominated investment returns for overseas investors without exchange rate hedging. Currently, the expected return on investment in Japanese stocks by overseas investors has dropped by 5%-6%.

2 Foreign investors are now divided over investment in Japanese stocks and Japanese bonds

Regarding Berkshire's 8th issuance of Japanese yen bonds, Takehiko Masuzawa, head of stock trading at Phillip Securities Japan Ltd., said, “This is good news for the Japanese stock market. It may be a buying signal for the Japanese stock market. It may change the trend of the Japanese stock market. The Japanese stock market has been selling for profit.”

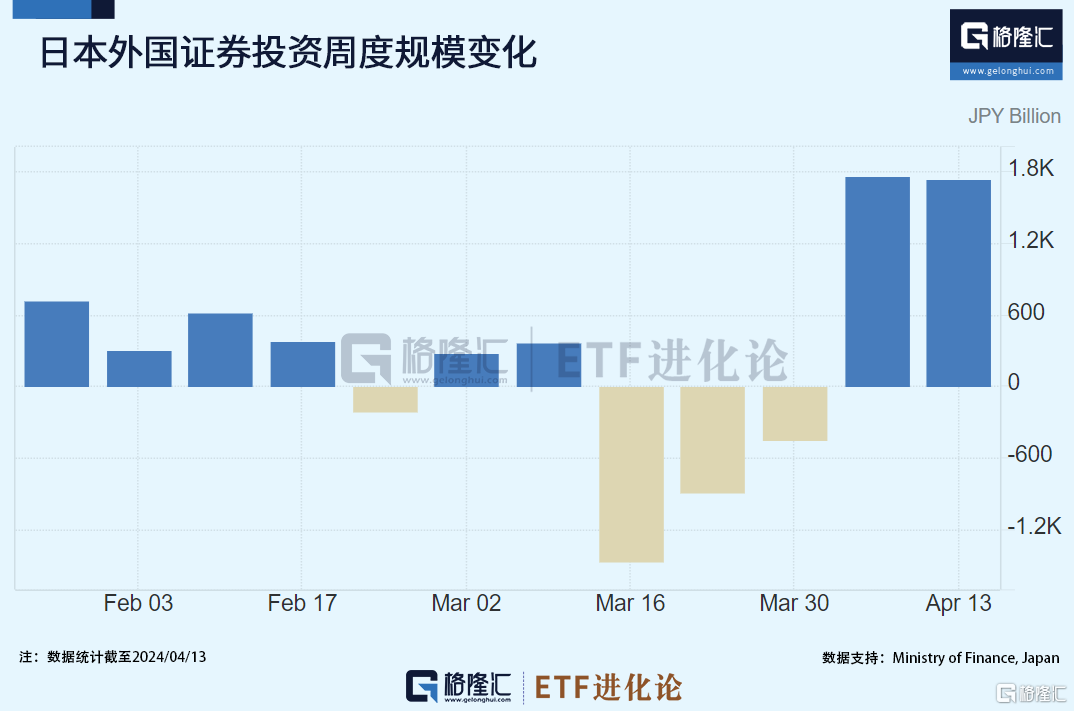

According to statistics from Japan's Ministry of Finance, foreign investors have begun to buy Japanese stocks again.

Since mid-March, after selling 2.4 trillion yen of stocks for three consecutive weeks, foreign investors bought Japanese stocks for two consecutive weeks in April, with a total net purchase of 3.5 trillion yuan. The two weeks directly completely covered the three-week sell-off scale. It can be seen that foreign investors are very firm in buying Japanese stocks.

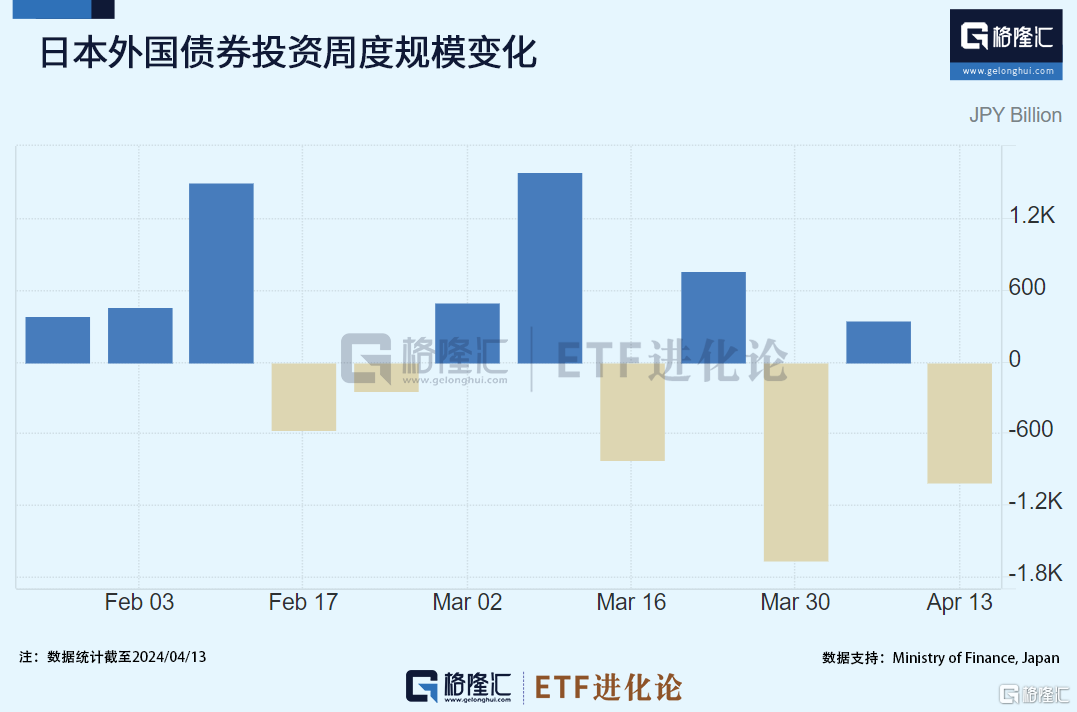

However, foreign investment in Japanese bonds is still fluctuating. In the week ending April 6, foreign investors bought 347.9 billion yen bonds slightly, but the next week they turned around and sold 10,000 yen in a big way.

3 Has Japan really changed?

Along with buying Japanese stocks and selling Japanese bonds, the yen continued to fall to a low of 154.78, a new low in 34 years.

J.P. Morgan Chase and Bank of America are all about to throw off the cold: the yen falling to 160 is close at hand...

Many netizens cried on social media: the yen was about to fall into a piece of waste paper, and the bottom of the yen was copied in the middle of the mountainside...

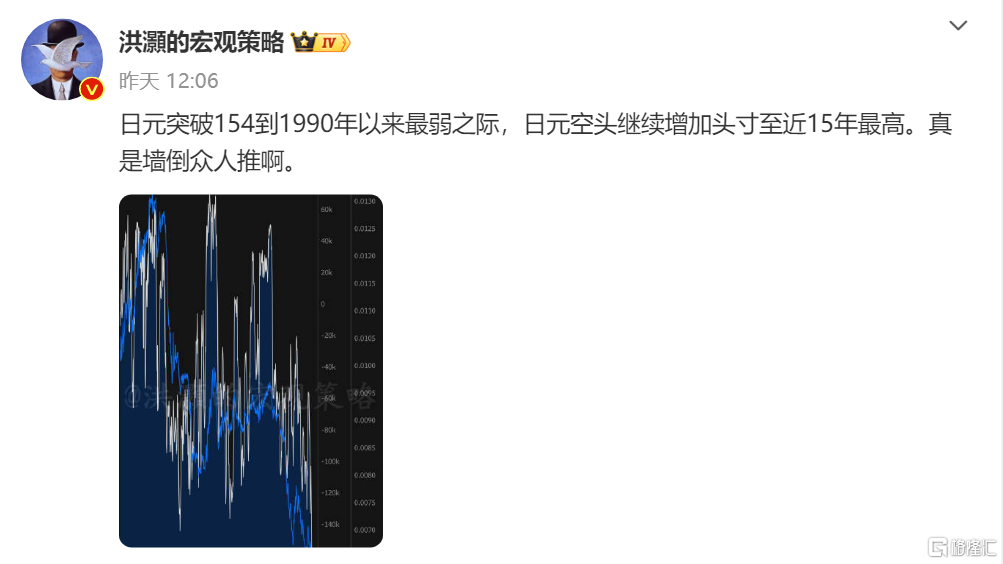

Hong Yu bluntly stated on social media yesterday: “At a time when the yen broke through 154 to its weakest point since 1990, yen bears continued to increase their positions to the highest level in nearly 15 years. It really turned the wall down and the crowd pushed it.”

The news that Buffett is issuing large-scale Japanese yen bonds at this moment is quite a bit like a knight standing on the opposite side of the world for Japan.

If you pay close attention to the trend of the yen exchange rate, you will find that the yen suddenly rose by a wave yesterday at around 14:00 p.m. Beijing time, but then fell rapidly.

On April 17, US Treasury Secretary Janet Yellen issued a joint statement with the Japanese and South Korean treasury ministers, calling them “serious concerns” about the depreciation of the two Asian currencies.

“The US has actually agreed to intervene,” said Keiichi Iguchi, a senior strategist at Resona Holdings Inc., based in Tokyo. “This has increased speculation that coordinated intervention is possible.”

On the same day, South Korea's Ministry of Finance issued a rare statement saying that when South Korea's finance minister Choi Sang-mok met with Japan's finance minister, Suzuki Junichi, they were all worried about the weakening of the Korean won and yen, and that the two countries may take action against erratic exchange rate fluctuations.

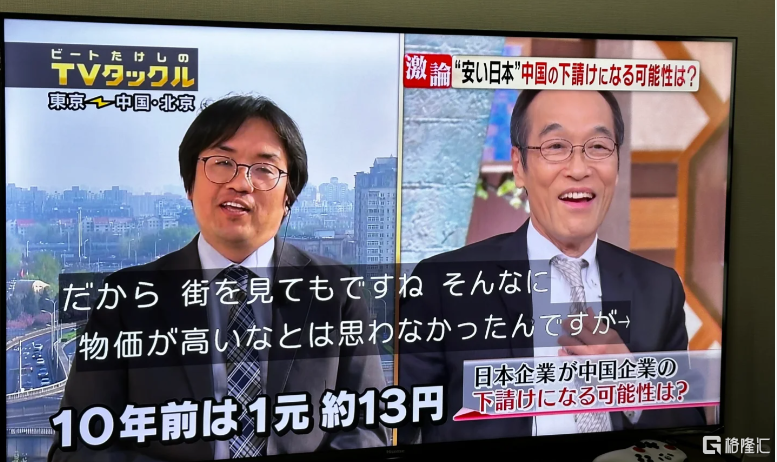

Although the yen has almost depreciated into a piece of waste paper, an unusually optimistic voice is beginning to appear within Japan: Japanese TV is even beginning discussions. The yen is so cheap, how likely is it that Japanese companies will become outsourced to China?

In response, some netizens joked: “Let's continue to depreciate, the world's manufacturing center factory - Japan.”

You must be surprised to find out that the Japanese people seem to have changed; they are all so optimistic now?

Also, Japanese people are starting to discuss buying Japanese stocks, and the gears of fate are turning rapidly.

Jean Eric Salata, Chairman of EQT Asia and Head of Private Equity in Asia, recently discovered an obvious change in Japanese companies. More and more large-scale entrepreneurial activities have begun to emerge in Japan, especially in emerging markets such as SAS software. He believes Japan is ready for a new era of growth.

Using Ku Chaoming's theory of the Great Recession, when the Bank of Japan sacrificed enormous liquidity, Japan was actually still in a state of decline for 30 years because after the asset bubble burst in 1980, companies' balance sheets were seriously damaged, and assets shrunk drastically, but debts remained unchanged.

Under these circumstances, Japanese companies chose to open up resources and save money, reduce investment, and actively repay debts. Businesses are no longer in debt, and economic activity is naturally struggling in the midst of deflation.

Now, it looks like Japanese companies are about to begin a new round of balance sheet expansion. It seems like a new era is really coming. How will the new world pattern evolve?

edit/new

这笔债券发售时点,恰逢日元陷入跌跌不休的贬值泥淖中,从3月18日的149到如今的154,日元空头正猖獗不已,此时高调发行日元债的巴菲特,在想什么?

这笔债券发售时点,恰逢日元陷入跌跌不休的贬值泥淖中,从3月18日的149到如今的154,日元空头正猖獗不已,此时高调发行日元债的巴菲特,在想什么?