This article is synthesized from the general helm of ETF, the industry analyst of ETF and the head cow.

As we all know, the core of financial investment is to buy low and sell high.

Four words are easy to say, but extremely difficult to do. Of course, there are only three trends in financial markets: falling, fluctuating and rising. In other words, you basically have a 33.3% probability of correct rate in each forecast, but this correct rate does not guarantee stable profits in the medium-and long-term investment career in the financial markets.

What we need to do is to use a relatively perfect trading system and strategy to keep ourselves calm when any situation occurs. After all, you can't blame the market even if you don't make any money. If you have a good trading method, you can still get a good return in a volatile city.

Today, I will introduce this method to you-grid trading strategy.

With a net in hand, you can fluctuate without worry.

Grid trading, also known as fishing net trading, grid trading method is based on the principle that fishermen open their nets and catch all the fish within the range of the nets.

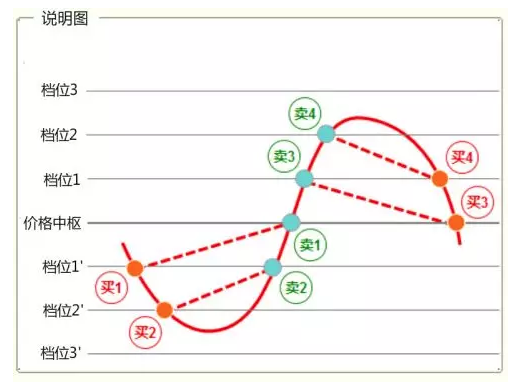

Explain it more clearly, that is,Investors set the value center in the fluctuating market, set the gear in the upper and lower space of the value center, use the "gear" mode to mechanically operate the investment target, buy in stages when falling, and sell in stages when they rise.As shown below:

Because the grid method does not rely on artificial thinking, it is completely a kind of procedural behavior, like fishing nets, making use of the fluctuation of the market to buy low and sell high in the grid, which can reasonably control the position, avoid chasing the rise and kill the fall, and has a strong anti-risk ability.

The grid trading strategy requires investors to choose the middle position as the price center in the volatility space, and divide the volatility space around the price center into several gears.

Suppose the investor buys a certain amount of fund in the central position of the price, and buys a certain amount of fund when the price falls to gear 1'. At this time, the investor needs to set up a selling order at the price above 1', pay for the price at 1 'below the gear, and continue to buy a certain amount of fund when the price changes to 2'. Sell funds bought in gear 1 'when the price returns to the price center.

On the contrary, if the investor buys the fund in the price center and the fund rises to gear 1, then the investor needs to sell a certain amount of fund and continue to set up a selling order in gear 2 above gear 1 and sell a certain amount of fund; set up a purchase order in the price center below gear 1 and buy the same amount of fund as gear 1.

Through the introduction of the principle, we can see that investors automatically buy low and sell high in the whole transaction process, even if the net value of the fund finally returns to the value center, we can still get the corresponding income.

Some people may have questionsAccording to the above principle, as long as the investment target of fluctuation law can use grid strategy, stocks and ETF can be used, why do you say that ETF and grid strategy match better?

Because individual stocks are prone to black swan risk or unilateral rise or fall, once individual stocks fall below the bottom of the planned range, investors will fall into the risk of long-term trap, and when the market goes up through the top of the investment, it is easy to step short, depriving investors of profit opportunities. But,ETF is an index fund that spreads the risk of individual stocks.

Examples of specific operation

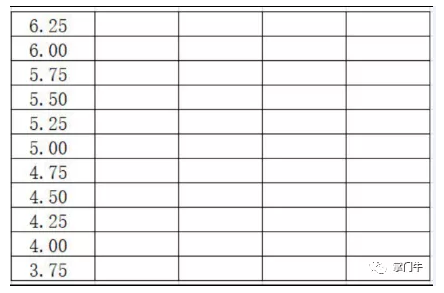

Suppose: suppose we choose an index ETF trading price of 5 yuan per share. The amount of money we have invested in this variety is 500000, that is, the full position is 500000.

The mesh density is 5%. The maximum drop is expected to be 25%. So our conclusion is to buy 50, 000 shares (250000) at 5 yuan, and the remaining 250000 will be used to cover 50, 000 positions each time.

Let's draw a table first, as shown below:

1. First analyze the first situation: after buying 250000, it goes up first and then falls. As shown in the figure:

The price went up from 5 yuan to 6.25 yuan, and then fell from 6.25 yuan to 5 yuan. If you don't lose your original position, your profit will increase by 12500 yuan. The following is the detailed delivery order.

2. In the second case, after buying 250000, it goes down first and then goes up. As shown in the figure:

When the price falls from 5 yuan to 3.75 yuan, and then rises from 3.75 yuan to 5 yuan, your original position remains unchanged and your profit increases by 12500 yuan. The following is the detailed delivery order.

Of course, the above is the ideal rise and fall situation, and the actual situation is much more complicated than we assumed. But the core logic remains the same, that is, not to predict, rise and fall with it, and make short-term market fluctuations.

3. For example, let's draw a few more graphs of random rise and fall of the index.

Such as the picture above: a total of 6 boxes were sold, with a profit of 0.25 million 6 = 15000.

These two pictures may more truly reflect the characteristics of the concussion market. So in theory, the higher the frequency of trading, the more grids sold, the higher the profit. Exclude the impact of transaction rates.

It should be noted that there are actually numerous variants of grid intersection, such as the grid spacing can be adjusted according to the transaction frequency, in addition to the difference, but also can be set to equal ratio. In addition to being more than 90% objective, 10% subjective experience is also important.

The advantages of grid trading are suitable for a volatile market, not for a unilateral bull market. Therefore, the long and short strategies must be deeply combined. If you can't stand the long-term, use your own funds as a grid.

The above is the basic grid trading method, set the starting price, set the grid density, set the amount of funds per grid, and then start to implement it.

It should also be noted that in the process of using the grid strategy, we should not only have a certain bottom position, but also prepare a certain amount of spare funds, so that we can cope with the rise and fall of the fund. When dividing the grid, it should be divided according to the bottom fund, the fund shock space and the amount of spare funds, but it can not be divided too much, too much leads to tedious transactions and high transaction costs, and can not be divided too little. otherwise, the grid strategy will not have the effect of buying high and selling low.

How to choose the variety and strategy of grid transaction

(1) the judgment of the market in the near future is to shake the market.

As the grid trading method is mainly suitable for the market environment is the shock market, unilateral rise is easy to sell out of the grid, unilateral decline is easy to break through the grid. Therefore, a prerequisite for using grid trading is that the current market strategy of box shock will be very effective.

(2) choosing ETF is better than stock.

Because individual stocks are prone to the risk of black swans, most stocks are not suitable for grid. The randomness of individual stocks is very strong, the outbreak of industry cycle, favorable policies, corporate performance growth and other data are difficult to predict, especially in recent years, there is a frequent phenomenon of performance fraud of listed companies, it is recommended that we choose ETF, because ETF is an index fund, dispersing the risk of black swans.

(3) choose varieties with low valuation as the bottom.

The choice of low valuation products with a margin of safety is to prevent the variety of investment targets from falling, the risk of falling through the grid, and there is no capital to cover positions. How to judge whether it is a relative bottom can be judged by ETF tracking the absolute valuation level of the underlying index and the historical valuation quantile to determine whether the current valuation is a relatively low level in the historical level.

(4) the varieties with low volatility are not suitable for grid.

The rate of return of the grid depends on the volatility of the variety. It's too verbose to talk about formulas. Just look at a picture and you'll understand it. The more volatile it is, the more likely it is to hit the buying and selling line, and the more times it is sold, the more profits it will cash out.

(5) selection strategy: bottom position + grid.

This benefits to prevent the risk of short, because there is a bottom position, even if you misjudge the market environment, there are bottom positions that can enjoy the benefits of a bull market.

If the market is right to wobble the market, the rest of the money used for grid transactions can reduce costs and help you hold for a longer time. We assume that the size of the position is also related to your judgment of the current market. If you feel that the closer the current point is to the bottom of the market, the larger the size of your position will be. Conversely, the farther the current market point is from the bottom of the market, the smaller your position will be.

Edit / Phoebe