There is tremendous demand for the digital infrastructure needed to support the type of high-performance computing necessary for the large-scale application of crypto blockchain and artificial intelligence. Companies like Applied Digital (NASDAQ:APLD) could to take advantage of this demand by providing next-gen data centers. However, some recent financial misses and ongoing production difficulties suggest investors might do well to hold off and wait to see more signs of positive performance from the company before initiating a position.

Next-Generation Data Centers

Applied Digital designs, develops, and manages innovative data centers scattered across North America, offering solutions in High-Performance Computing (HPC) and Artificial Intelligence (AI). The company has three main business segments: blockchain colocation services, HPC datacenter colocation services, and GPU cloud services, the last of which is under the Sai Computing banner.

The High-Performance Computing industry is on a growth trajectory. Estimates suggest that it could grow from roughly $50 billion in 2023 to $91.86 billion by 2030, which constitutes a compound annual growth rate (CAGR) of 9.1%.

Recent Financial Results and Outlook

The company recently announced results for its third fiscal quarter of 2024, reporting total revenues of $43.3 million. This falls short of the consensus target of $51.92 million, though it reflects a significant 208% increase from the same period in 2023. This expansion in revenues can be mainly attributed to larger capacity across the company’s three datacenter hosting facilities and the addition of a new revenue stream from its Cloud services segment that started operations this fiscal year.

However, the company reported a net loss of $62.8 million, or -$0.32 per share, a stark contrast to the consensus expectation of -$0.10. This increased net loss, compared to a net loss of $7.3 million or -$0.07 per share in the same quarter for FY2023, was mainly due to several one-time financial events.

Applied Digital reported $41 million of cash, cash equivalents, and restricted cash at the end of the quarter, along with $61.8 million in outstanding debt. The company also strengthened its balance sheet through $160 million in announced asset sales and financing transactions.

Is APLD a Buy, Hold, or Sell?

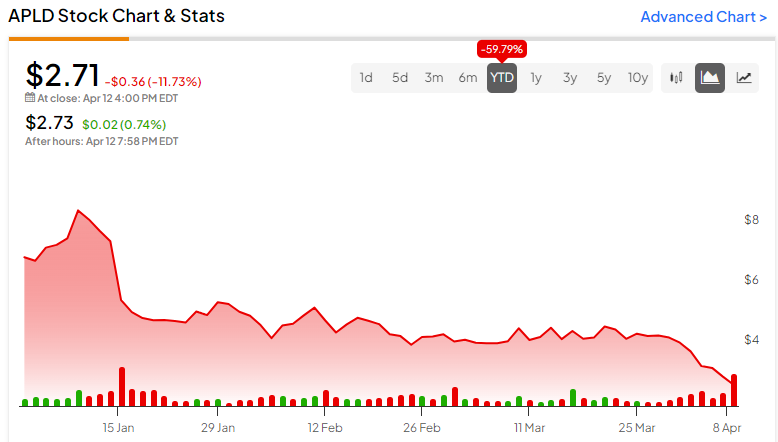

The stock has been trending downward, posting a -59% return YTD, and it continues to demonstrate negative price momentum trading below the 20-day (4.02) and 50-day (4.48) moving averages. Despite the lower price, the stock trades at a relatively fair value, with a P/S ratio of 2x in line with its listed sector (Financial Services) average of 2x and industry (Capital Markets) average of 2.2x.

The stock also has a relatively significant percentage of the shares outstanding (17.31%) sold short, indicating a bearish outlook for the company’s near-term prospects.

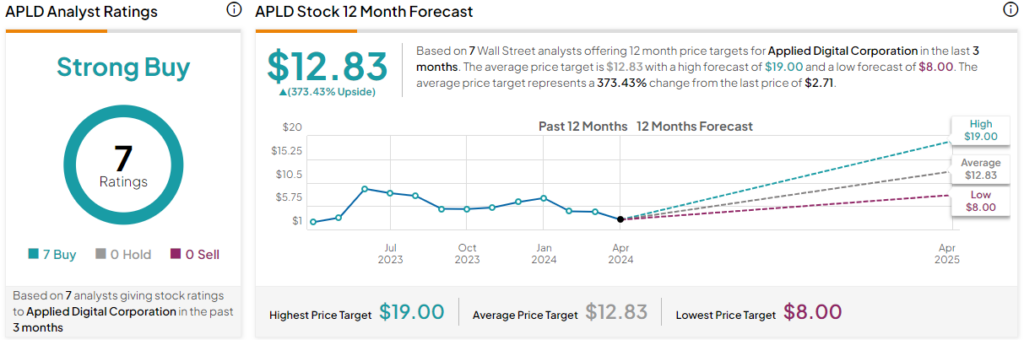

However, analysts following the company have been constructive on the stock. Based on the recommendations and 12-month price targets issued by seven Wall Street analysts in the past three months, it is currently rated a Strong Buy. The average price target for APLD stock is $12.83, which represents a 373.43% upside from current levels.

Closing Thoughts on APLD

The burgeoning demand for digital infrastructure to support high-performance computing makes Applied Digital an intriguing possibility. Though recent challenges have cast doubt on the company’s immediate outlook, there is potential for tremendous upside if the company can turn things around. Prudent investors may therefore elect to wait for signs of more positive performance before initiating a position.